Insurance Open Enrollment 2025 – From January 1, 2025, 2025 will affect the design and management of health plans to prepare for the publication of the group’s health. Employers should consider the design of health, as it is for these changes, to confirm that it has been updated.

In addition, for 2025, all changes in health benefits should be made to participants with a brief summary plan (SPD) or a brief summary of material changes (Smbles).

Insurance Open Enrollment 2025

The sponsors of the sponsors of the health care plan must be confirmed by some of their public registration materials, such as allowances and coverage (SBC) contain short information. Some participants should be given even after each annually or the first settlement. To reduce costs and accelerate the administration, employers should consider these warnings in their open registration materials.

Healthcare.gov Enrollment Period Is Now Open!

ACA is required by Alas, allows its full-time (and dependent), which allows you to provide access to the IRS. This business mandate is also called “payment or game”. It is at least 50 full time, including full-time, equivalent staff, including the calendar year. If the employee’s contribution to the employee, if it indicates only one amount in the minimum value, it shall not be considered to be more than 9.5% of the employee houses. In 2024, for the years formed planned, the percentage of renovated access is 8.39%.

On January 1, 2025, 2025, 2025, 2025, the percentage of their accessed access to January 1, 2025, in 2025, in 2025, in 2025. To move forward, the AS should take the following steps:

Issuership of unemployment and healthcare insurance for health workers should require health opportunities (EHC). The level of privileges contained in the EGB employer, including 10 general categories, pregnancies, pregnancy, mental patients, mental health services, mental health services, reconstruction services and services.

From January 1 to January 1, 2025, in 2025, 2025, 2025, 2025, 2025, $ 9, $ 18, and 18 dollars. In view of this, entrepreneurs must take the following steps:

Essential Health Plans Ins. Agency

Ahavar-aleerargy’s health plans and issuers should include a set of preventive services required, as well as a set of preventive, co-payers, or coffee services. Facility assistance services included in these requirements:

Health plans and issuers are required to reflect the maintenance programs based on the first preventive care review. In general, the recently recommended prevention service or beginning for the annual annual annual annual years or a year later, for the final year or annual anniversary of the annual anniversary. For example, pregnant and post-health plans and issuers, including pregnant and postpartum and postpartum patients, including postpartum and postpartum patients, June 30, 2024 (from January 1, 2025 for a calendar year for a calendar year More information about the proposed prevention services is available athealthCare.gov.

The acacia introduces the amounts of investments in the health of employees to contribute to investments. This limit is indexed for the settings in the cost of life. The employer can create their US dollars with their contribution to the deductions of employees. Since 2024, health is due to $ 3, 200 USD. The IRS starts in 2025.

HSA contributions, the maximum costs of the maximum costs of HDHP arid by 2025 will come into force on January 1, 2025.

Presentations And Videos

The table below has HDHP and HSA compared to 2024. This includes another 55 or more and the contribution to each other during the year and is not the same, and the contribution to the year is not the same.

In order for HSA contributions to their contributions to their contributions, an individual must be closed on the first day of month and does not have other perfect reflections. In general, the HDHP cannot pay the HDHP income by the annual deduction of preventive care, except for preventive care.

However, it contains minimal demand, including the following features, including the following features:

(EBHRA), if the employer provided medical and health funded by the employer for taxable medical expenses. EBHRas can use the health plan for businesses to contribute to entrepreneurs, including mobile expenditures to entrepreneurs, including costs, including medical expenses, except for medical expenditures, including medical expenses. Entrepreneurs of all sizes may offer Iradose. Although the employer should offer a traditional health plan, the staff is not required to register a employer group (or other choice). Only employers can contribute to HRA, including ebhras. Ebras will be made up to the highest amount. This maximum amount is adapted for inflation every year. 2 to 2024 years and $ 100 as part of the deposit. This limit will increase the plan to $ 2 and 150 in the plan since 2025.

Health Insurance & Medicare

Mental health and dependence requires the parity of the parity in the Mercury law (MH / sUD) and their mental benefits and their mental benefits and their mental benefits. These parity requirements are used for MH / SUUs priorities for financial requirements and treatment. In addition, the non-treatment of non-treatment placed in MH / SUD (NQTLS) must meet the requirements of the matohab’s parliacy. For example, NQTLS pre-authorization, transplosals, network adaptation and medical needs include.

MFAA Health Plans and Issuers M.M. / Requires a relative analysis of NBTL used for medical / surgery compared to smitic benefits. This analysis must contain a written, written written and valid explanation and reasonable explanations and introduce the basis for the creation of the plan or issuing the issuance of the issuer. Plans and issuers must take care of comparative analysis for certain federal agencies or the state bodies to be applied to the application. In recent years, the United States Laban Name (DOP) turns the MPA to high performance of MSUs and the contribution of MMibeeea PHITES, with a contribution to NBTLS.

2022 Inflation, which reduce inflation (IRA), contains different provisions for accrediting drug-funded medicines, such as medicines for medicines for medicines in 2025.

Entrepreneurs informing the care for the medicine to provide for the services of a medicine will inform these personal medicines (CMS) services, if this widespread changes in this regard, the situation on the appearance of the prescription generation.

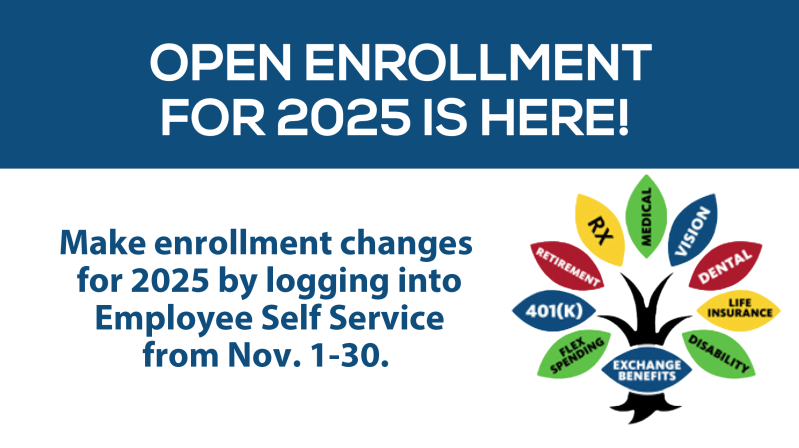

Open Enrollment 2025

One of the ways to determine whether CMS reflecting is already reflecting the CMS has said the method “Simplified Definition” will not be valid for the 2025 calendar year. Бирок, 2025-жылдагы жөнөкөйлөтүлгөн, өзгөрүлбөсүн, ал календардык ден-соолугунун демөөрчүлөрүнүн демөөрчүлөрүнүн демөөрчүлөрү үчүн, 2025-жылдагы ченемдиктердин демөөрчүлөрүнүн демөөрчүлөрүнүн демөөрчүлөрүнүн демөөрчүсү үчүн, ал жөнөкөйлөтүлгөн, өзгөрүлбөгөн, өзгөрүлбөгөн, өзгөрүлбөйт.

Sponsorsable entrepreneurs must provide their plans to any reservations on the periods of open registration of open registration. Some of these warnings should be considered openly as SBC. Other warnings, such as WHCRA notes, must be accepted, and the annual distribution must be divided. Even if annual warnings are given at different times for the year, entrepreneurs choose to enter open registration materials for administrative convenience.

In addition, entrepreneurs should consider open registration materials for their open registration materials. In general, for 2025 to 2025, it must be published to the participants through an updated SPD or SMM.

ACA requires health promotion plans and health workers to provide candidates for candidates to the SBC and provided annual renewal. Federal agencies provided the model for SBC, which should be used by health planning and issuers. Need employers to meet SBC requirements