Insurance Premium Deduction Under 80c – According to Article 80C, each individual and huf is provided with a decrease in quantity up to Rs.1, 50,000. To use these reductions, taxpayers specified, must invest in any of the following options-

100% income for the first 5 years and 50% for the next 5 years. For IFSC-100% of income for 10 consecutive years out of 15 years

Insurance Premium Deduction Under 80c

The rate of income tax plate for AY 2025-26 for additional additional details now mandatory to request landing on itr

Saving Income Tax By Using Income Tax Act Section 80 Deductions

If this article has helped you in any way, I would appreciate if you can share or leave a comment. Thank you for visiting my blog.

Information / articles and those dependent on comments on this blog are given simply for informative and educational purposes only and are based simply on my understanding / knowledge. They NOY constitute legal advice or legal opinions. Information / items and any response to comments are intended, but not promised or guaranteed to be current, complete or up -to -date and should in no way be taken as legal advice or indication of future results. Therefore, I cannot take any responsibility for the results or consequences of any attempt to use or approve any information presented on this blog. You are advised not to act or rely on any information / articles involved without first requesting the advice of a practicing professional.

India PVT Financial Advisory Corporation. Ltd. It is one of the key suppliers of financial and commercial consulting, internal audit, legal audit, corporate governance and tax regulatory services and. With a global approach to service delivery, we respond to the complex challenges of customer business with a wide range of services in the national industry and border sectors. The company was founded by a group of young, enthusiastic, highly skilled and motivated professionals, who have experienced the best advisory companies and have extensive experience in their selected fields that provide a wide range of accounting, auditing, insurance, risk, taxes and consulting services for different clients and their stakeholders. Please note that you cannot request a reduction in Article 80C under a new tax regime.

The schemes mentioned in the video above and below are those that help you save the income tax using the most popular schemes under Article 80C.

Maximize Your Tax Savings

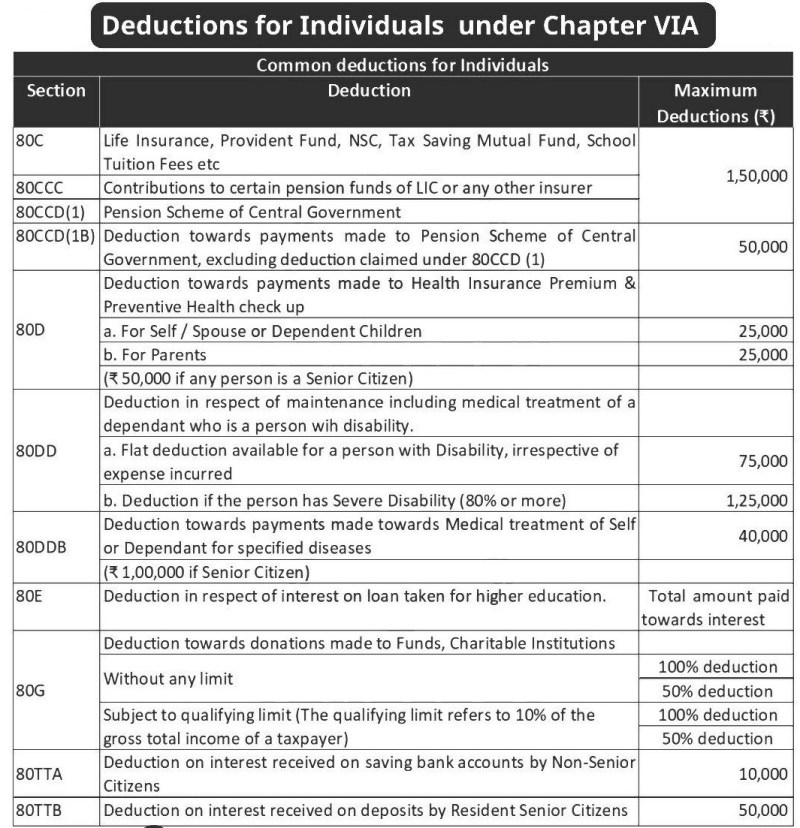

Section 80C is one of the sections that provides a maximum reduction limit. We have other sections, as well as in section 80D, section 80ccd, section 24, etc., which will help you save your income tax.

EPF or Provence Employee Fund is the scheme available to employees with the salary they work in an organization used for the purpose of their pension.

PPF is another popular opportunity to save long -term goals, retirement and save income tax under Article 80C.

Long -term insurance does not benefit from profits, but premiums are relatively low compared to market -related ulips and give profits based on profits.

80c Investment Options To Save Tax In 2025

You can search up to Rs. 1.5 FY Lacies as a decrease under Article 80C if you pay insurance premiums.

In addition to the above schemes under section 80C, we also have a sub-section called section 80ccd (1b). This gives you an additional benefit of Rs. 50, 000 in addition to section 80C Rs border. 1.5 varnish.

So we discussed the maximum schemes belonging to the reduction of Article 80C. It is very important to note that the border under section 80C is Rs. 1.5 spray in one financial year and these reductions can only be required by an old tax regime.

A new tax regime does not allow discounts to be required, so be sure to choose an old tax regime to require a reduction in Article 80C.

Deduction Under Chapter Vi-a

And if you have to choose an old tax regime or a new tax regime, depending on the level of your income and investment. Watch this video to decide between an old and new tax regime.

After choosing a tax regime in FY, it is important to know how to calculate your taxable income in which income tax is calculated. With the old tax regime, your taxable income will be less compared to gross income, but with a new tax regime, taxable income will be equal to gross income as no deduction is allowed in the new tax regime.

For calculating income taxes on your mobile device, you can download my Android application “fined” you developed for you to make your income tax calculation easy.

Download the free Android App-FIGentagto calculates the income tax and interest in various small savings schemes in India, including PPF, NSC, SIP and much more.

Section 80c Deductions List To Save Income Tax

This excel helps you compare an old tax regime and a new tax regime to plan your investments and savings of income tax for VF 2024-25 & FY 2025-26-Governmental Taxable taxes of individuals, indecisive Hindu families, companies, firms, etc. the families of the nation.

Taxes may have a financial implication for taxpayers; Thus the government provides specific provisions under the Law on Income Taxes, 1961 which helps one save the tax. Tax deduction helps one reduce the tax liability. The government provides a tax deduction for investments made in various income tax sections to exclude the tax liability on the permitted limit.

One such section is 80 C of the 1961 IT law which allows you to save the investment tax made using various tax savings instruments.

Section 80C is one of the most critical sections of the income tax law offers the taxpayer to use tax deductions on income for investments made. Hindu individuals and families are eligible for tax deductions under Article 80C, and may use a lowering of a ceiling of 1.5 lakhs Rs during a financial year. Section 80C reduces your tax liability, and for some income groups, they do not have to pay tax due to tax deduction.

Deduction U/s 80c, 80ccc, 80ccd & 80d, Income Tax 80c

Section 80 C includes some investment options that allow you to use income tax deductions. Maximum tax deduction permitted under Article 80 c is 1.5 lakhs Rs. So you can invest in single or numerous investment options; Maximum reduction is set at 1.5 lakhs Rs according to current income tax rates. Investment investment specified under this section is varied and based on the need. It is therefore essential to evaluate and invest in the most appropriate ones that can facilitate you to achieve your financial goals along with tax savings

Buying a life insurance policy provides life coverage, providing financial protection for your family and loved ones. There are several types of life insurance plans in which you can invest depending on your financial goals. Some life insurance policies offer only life coverage while others offer investment profits along with life cover.

The provident of the employee is a pension scheme available to employees with the salary of each organization or establishment that has 20 or more employees. Both the employee and the employer must make a 12% contribution of 12% of the employee’s basic salary along with an option for options. At the retirement age, the total amount collected along with the interest must be paid to the employees as a large sum.

The employer’s contribution is tax exempt and the employee’s contribution is entitled to the use of tax deductions under Article 80C at the permissible limit of 1.5 lakhs Rs. You also have the opportunity to contribute an additional amount through voluntary contributions. These additional contributions are also acceptable for discount under Article 80C.

Spend Money To Save Money: Top 5 Tax Deductions Under 80c

The Provent Public Fund (PPF) scheme is a long -term investment opportunity provided by the government of India, which provides attractive returns and the interest achieved are fully exempt from taxes. A maximum of 1.5 Rs Lakh can be required in one financial year. PPF has a term of 15 years as the pension is taxless. With PPF investments, you can use a credit structure, against Corpus in the PPF account. You can use a tax deduction under Article 80C for the annual contribution made to the PPF scheme. Contributions to PPF and Child PPF accounts also qualify for tax deductions under Article 80C in 1.5 lakhs.

Investing with the government runs a “national pension scheme” allows you to collect a pension corpus, which helps to receive a regular monthly pension for your life. In addition to pension savings, you can also use a tax discount of up to 1.5 lakh Rs under Sec0 C. This investment also provides an additional reduction of 50,000 Rs under section 80ccd (1b). Maturity income is taxed under the KP.

National Savings Certificates (NSC) are the government saving link issued by the Postal Service of India and you can buy it from any post office. It is issued for 5 years and a period of maturity of 10 years. NSC investment has the right to deduct tax under Article 80C. Calculated interest is taxable and if reinvested, it is