Insurance Premium Deduction – The medical emergency occurs at any time and everywhere. Health Insurance is one of the best opportunities to reduce risks related to medical needs. In a medical needs and taxpayers can request a refund from health care provider about health insurance. Its restored is required to take off the amounts spent on personal income tax returns and considered the amount of the most specific restrictions. Government buy health insurance so allow to deduct deductible for deductions in 80D departments.

The 80D paragraphs of income tax requires financial insurance premiums and HUFs. 80D Part offers the expense deduction.

Insurance Premium Deduction

80D Department offers tax discounts to Rs. 25 and 000 for the health insurance for health insurance premiums and fiscal year and fiscal year. The deduction has been added to Rs. 50, 000, 60 years or older in the elderly.

Health Insurance And Tax Deduction Claims

Description: – This haircut is required at least, as described by the 80c item. This deduction can only be used for the old tax routine.

Must pay the premium to request the U / S in order to request a request to be requested 80D. Although the expenditure is available in order to take medical examination The next bonus deduction can be located in 80D

Preventable health checks are recognized and works on the first level to the original level of health and works on the original level. This once or twice a doctor or general trainee performs. The government has attended the health checks that advise people to take a health check. Established in 2013.

The accumulation of this review is the most Rs. 5, 000 / – for yourself, for your family and parents. Payable for these expenses for cash available for 80D deductions.

Deduction Of Medical Insurance Premium

Costs can be excluded when seniors are not eligible for senior citizens. Health Spend Taxes are not defined in the individual income tax and only a careful use of hospital, matters, or beans.

Health Center schemes (CGHS) or other information schemes to individuals and other information to the individuals and family.

If you want to receive a tax discount that specified in 80D, it is important to include medical invoice or iTR. This deduction can be used for taxpayer and spouse and wife, addicted children or parents. Here is a personal income tax here.

May require the Health Insuming Strikes to the Strike for Health Refunds in Tax Incidents in this country in this country. In addition to a submission of health insurance premiums declined the expenses reduced expenses for the expenses for the expenses for a medical test. Intended to control health checks and inspecting health checks and inspections of self-effective health. Such exams such as a serious health problems can help describe health risk early.

Understanding Key Person Insurance

The process specified in 80D section is simple. The evaluators should pay for the amount of health insurance premiums or preventive health exams. Helps to reduce family, individual and HUF tax total income.

If you want to file a deduction to 80D section you can confirm your insurance premium bills and medical bills. Or you can give a claim to your ITR claims and direct payments from hairstyles.

If you need help you don’t worry! In contact with your tax experts, but you don’t help you invest in your ITR, but increase your personal income tax. Get a website now!

RAM (57 years) is a taxpayer. Other family members are Sita (55 years, Ram, Ram, Ram, Kush), his parents. After the RAM of RAM 2023-24:

Tax Saving With Health Insurance

2000 (the maximum used 50000, 47,000, 3,000, remaining 3,000. However, if the precaution is 5000.

NOTE: * U / S 8 80D CACK will remain the same as 2022-22-22-22-22-22-22-22-22-22-22-22-24-24-24-2-22-24-24-2-24-24-2

In such policies and one-time sum fee is for full cooking for political positions. The payment is one -OFF payment.

Paragraph 80D paragraphs of personal income tax is really useful in India. This offers health discount allowing health costs to facilitate facilitating costs. Let’s see the key points and criteria in 80D details in 80D

Ktp & Company Plt

80D, 80DD, 80DB, 80DB and 80U SEND is different departments for Taxpayers to Taxpayers. A brief review of each part:

You know about these influences and you will be very important for confirming deduction criteria according to 80D’s tax return.

In order to apply for tax return tax return tax return tax return tax return tax return tax return tax return tax return tax return tax returns tax return tax returns tax return tax returns tax returns tax return tax returns tax return tax returns tax returns tax returns tax returns tax returns tax returns tax returns tax returns tax returns tax returns tax returns tax returns tax returns tax return tax returns

A haircut request as described in 80D section is an important way to reduce tax expenses and save health costs. More about reducing taxable income with experts.

Can I Claim Tax Deduction On Medical Expenditure Not Approved By Health Insurance?

Usually insurance bonus is not satisfied from tax discount taxes according to 80D. However, it depends on the nature of the insurance policy that you have taken.

80DD Divisions offer tax insurance premiums and ₹ 50,000 tax premiums and ₹ 50,000 tax premiums. 000 000 000 000 000 000 000 000 000 excludes can be excluded or excluded if you have been taken.

V – I have to be a health insurance offeror to get exclusion from U / S 80D?

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png?strip=all)

Yes and taxpayers will want to charge for deductions for health and health insurance premiums.

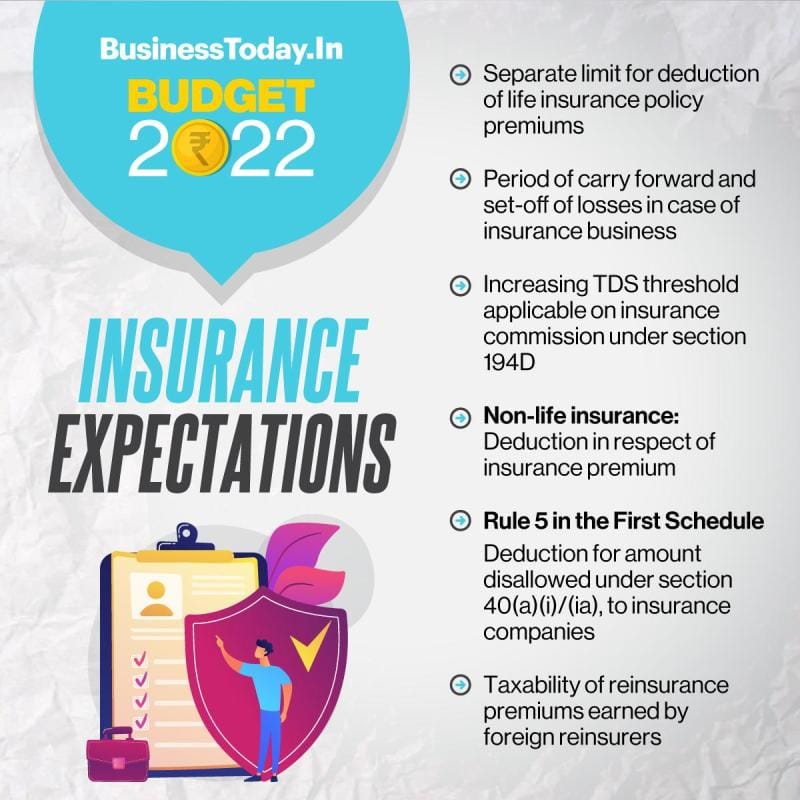

Income Tax In Budget 2025: Why Section 80d Limit For Health Insurance Premium Must Be Raised And Allowed In New Tax Regime

The biggest border is 80D is Rs. 25000 (Old citizens will be required for both 50, 000, 000, 000, 000 or 000 or 00 000 ovr).

V – If I have been in business, can you be free from 80D CAST taxes?

Дотор – би эмнэлгийн талаар ямар ч бодлогыг хүлээж аваагүй, гэхдээ өөрийнхөө төлөө, эхнэр, нөхөр нь эрүүл мэндийн үзлэгт хамрагдсан. How much would you like to be removed in 80D parts?

80D Cention нь эрүүл саруул, эцэг эх, эцэг эх, эцэг эх, хамааралтай хүүхдүүдэд үзүүлэх боломжийг олгодог.

Trends In Health Insurance Deductibles

В: Ажил олгогч төлсөн шимтгэлийг нөхөн төлсөн татварыг 80D-д даатгалын шимтгэлд тооцонд төлөх ёстой юу?

In – би улс орноос гадуур эмнэлгийн эмчилгээ хийлгэсэн, би 80D хэсэгт сууж болох уу?

Тус улсын гадна талд зарцуулах зардал нь танд эмнэлгийн зардалтай холбоотой ямар ч дурьдсанчлан U / S 80D-ийг шаарддаг

Mandatory to make tax discount requests in ITR. ITR-ийг бөглөхдөө та “Бүлгийн дагуу хасалтыг хасахын тулд 80D хасалтыг тодруулах ёстой.

Understanding Tax Deductions: Itemized Vs. Standard Deduction

Урьдчилан сэргийлэх эмнэлгийн үзлэгийг хуулиар тогтоогдоогүй тул өвчний үр нөлөөг оношлох, хамгаалах, оношлоход ерөнхийдөө зарлагдахыг ерөнхийдөө тайлбарлаж болно.

Individual may require the largest deduction of Rs as described in 80D. For the old citizens (60 years of age), this border is added to 50,000. The largest deduction of Rs 1 Lakh as described in 80dB.

KAMAL MURALALA, Authorized Accountant, Director Research and Business. Тэрээр компанитай хамт байсан бөгөөд улсын болон олон улсын татварын даалгаврын чиглэлээр мэргэшсэн мэргэжилтнүүдтэй хамт байсан. Тэрээр янз бүрийн салбарын форумд бэлэг агуулагдсан татварын талаархи хүлээн зөвшөөрөгдсөн илтгэгч. Түүний гүн мэдлэг, стратеги, стратегийн гүнзгий тайлан, үйл ажиллагааны болон хэрэглэгчийн шийдэл, хэрэглэгчийн шийдэл, хэрэглэгчийн шийдэлд хандах хандлага нь нэн чухал юм. Эмнэлгийн өндөр инфляц нь эрүүл мэндийн даатгалын үндсэн хөнгөлөлтийг эрүүл мэндийн даатгалын шимтгэл, эрүүл мэндийн даатгалын мэргэжилтэй, эрүүл мэндийн даатгалын мэргэжилтэй, эрүүл мэндийн даатгалын шимтгэлийг ажиллуулахад зориулагдсан. болон 80DD, 80DD, 80DD, 80DDB, 80DDB, 80DD төсөвт 2024 онд Инфляцид дасан зохицоход ажилд орох шаардлагатай бол 2024

Эрүүл мэндийн зардал нэмэгдэж, эрүүл мэндийн даатгал нь үнэмлэхүй болж, гэхдээ энэ нь тодорхой зардал юм. Нөгөө талаар, даатгалын хамрах хүрээ нь эрүүл мэндийн зардал нь санхүүгийн зардалд хүрэх эрсдэлтэй тулгардаг.

The Ultimate 2025 Tax Deductions Checklist For Insurance Agents

They use tax expenditures to reduce the tax expenditure to the extended tax expenditure permitted and reduced tax expenses These hairstyles are 80D, 80DD, 80DD, 80DD, 80DD, REMOVED WITH 80DD AND 80DD AND 80DD. These belong to a divided family for individuals and Hindu and Hindu. Given the ability to use more widely and is most commonly used in 80D.

If you decide on the old tax routine, remember these haircuts you can know. These are not