Insurance Premium Disbursement – If you pay less than 20% of your home purchase price 20%, your lender may pay you a personal mortgage insurance (PMI).

When you start buying home, select the amount of payment and your mortgage lender makes two largest financial decisions you have to do. If you go with a normal mortgage, the loan is provided through private lender, you may pay PMI.

Insurance Premium Disbursement

The lender often needs to pay PMI if your payment is 20%. PMI keeps your lender in case you can’t pay for your debt. PMI can help you qualify for you, but it is important to note that it can increase your loan cost.

Uts Asuransi Essay

Imagine you take the house for $ 400, 000. You have a 30-year mortgage with a 5% interest rate. See how P MAMI Costs Depends on PayPal size, according to PMI PMI PMI PMI.

Normally, you will pay PMI until you reach 20% of your home equality. Equality is the current value of your home trees your mortgage of your mortgage.

Your lender can automatically reblogged PMI payments after you are equal to 20%. You can pay additional payments to access 20% and ask your lender to cancel PMI before expected date.

If you rebuild your mortgage capital, you may pay PMI. If your loan proportion (LTV) is more than 80%, so regular lender may require PMI. The lender considers high ltv ratio than high risk, so they can ask PMI to ask PMI to reduce this risk.

Pmi Vs Mip: What’s The Difference?

PMI is insurance that the lender is competing for risks. This borrower provides any protection. If you do not pay loan payments, you still suffer to risk of seizure. You are also responsible for giving host insurance.

If you can’t make 20% discount for home, you still have an option to assure Gmail with PMI and purchased the house. PMI can also help with eligible debtors for debt.

The mortgage insurance salary is given (BPMI) is a particular PMI type. With mortgage insurance, the lender will add PMI Cost to Loan Monthly Payment. The borrower will pay this extra so that they reach 20% of the equations at home.

High-mortgage insurance requires lenders to pay at the end rather than monthly payment.

Digital Payments Emerge As Competitive Opportunity For P&c Insurers

Only the lender provides this option. The borrower may contain low monthly payments without PMA costs, but some other observations are available. The lender can raise your interest rate to be deleted from your debt to cover the fresh cost because you delete how much equity.

Grewyl mortgage insurance composition of mortgage insurance salaries and single mortgage insurance factors. The borrower is responsible for this type of PMI. They will pay a payment before closing, and monthly payment. This monthly payments will be paid from your reserve account.

The Groll Mortgage Insurance provides a borrower flexibility. You can reduce the amount you need when paying the payment and make sure.

The Federal Mortgage Mortgage is supported by a private lebiler (FHA) instead of the Federal Housing Authority (FHA) is insurance insurance.

Paytm’s Loan Disbursals Stand At An Annualised Run Rate Of Rs 34,000 Cr In Q2 Fy23, Total Device Deployment Crosses 4.8 Mn

The loans supported by FHA can be accessible for the homeowners because it comes with less payments, lower closed costs and low credit points. However, lower payments and credit points may mean a higher danger for a lender.

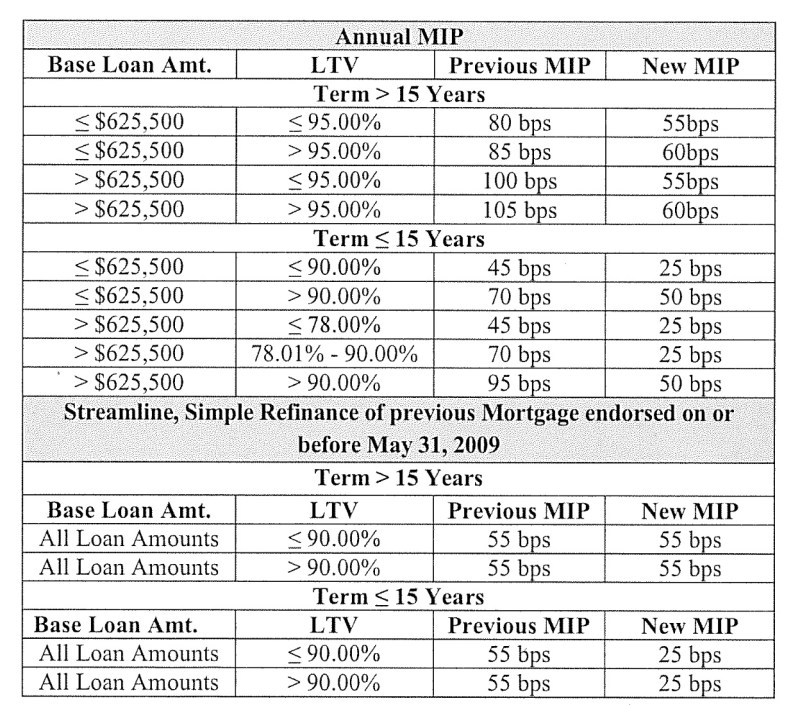

If you choose the loan supported by FHH, you should pay MIP without you do. You will pay a pre-payment to Base Loan 1.75% when closed. If you don’t have cash to give this fee, you have the option to have the option to transfer your warranty, it will increase your monthly cost.

In addition, in addition to a prepaid fee, you will pay monthly fee for MIP coverage. The annual amount is 0.15% of the amount of loan amount to 0.7575%.

The rules of the gang insurance rules from FHH loans is different from applying for ordinary loans. The ability to remove your MIP depends on your main payments and when you take the loan. If you don’t see these criteria, you can restore your FHA loan for regular loan.

What Is A Mortgage Insurance Premium & How Does It Work?

The lender is using PMI as a way to compensate for risks. The borrower has an additional payment option for PMI to exchange low-payment.

Consider different types of mortgage of mortgage, including mortgage, including a mortgage, will affect the total cost of your debt. When you reach 20% of your home equations, no longer need to pay for PMI. If you have a map, you may need to pay a loan loan.

Ask authors to use the main source to support their work. This includes white, original information, original reports and interviews. We also point to the primary research from other selected publishes when appropriate. You can learn more about standards we follow in the production of accurate and non-biased content in our integral approach.

Embroidered the cost of home insurance can it work in your society? Increases the risk of the forest fire: Your house insurance company can you leave you right before the fire season? The secret dangers in your forest fire and as they are incorrect with the dangers of flood.

Group Credit Life Insurance (group Credit Life Insurance Coverage Rider Of Cancer, Group Credit Life Insurance Living Needs Rider)

The best life insurance companies in favor of life agent: Simplified Life insurance companies for the insurance of the insurance: This payment is likely to make the insurance process, possibly conservation of possession, host insurance or other mortgage costs.

Deposits that your property and premium tax is paid on time, and protects both your lender.

When to buy or sell or sell or selling or sell, for prescription and safety transfer. Because the great amount of money is relevant, deposit as a safety network, ensures all parties meet their responsibilities before money changes.

These customers, seller and lenders protect from a thick or default capacity. No for remembering, it helps prevent precious delays and ensures that payments such as taxes and insurance are managed.

Equity Bank Group

Follow when we break the process in real estate transactions, beat the importance of deposit, so it is easy to understand.

Escrow is a legitimate meaning in which one property or money is held by the third party on behalf of other aspects who complement the transaction. It is called margin agent named the margin agent, it ensures that both sides meet their contractual responsibilities before issuing money or property.

In the money contract, customers and the seller agreed to allow a neutral group to have a fund or possession of all the terms of the sales. This assures to create trust and ensure that both sides comply with the terms of contract.

Keep the equivalent of deposit management accounts, money or safe investments. They only publish money when both sides face their responsibilities. This may be anything to complete the test to complete the test.

Marine Insurance: Meaning, Benefits, Types & Coverage

Deposits often used in real estate transactions. For example, buying house when customers pay to the reserve account. The seller can do the inspections and other conditions, knowing that funds are kept secret. When all the conditions are met, reserve agents will publish money to the seller.

The deposit is an important part of the home purchase process. It assures that everyone manages everyone and meets their promise. But how does it really work? Let it break it.

. It shows that the seller is serious about buying home. Think as a good payment. This amount has been transferred to the reservoir account managed by a third party, often called the margin agent.

The margin agent is an unbaded party, usually owner of the owner’s company or legislation. Their job is to keep your serious stock and other funds. They make sure all the following sales conditions before any money or property changes.

Atm Mandiri: Minimum Balance And Admin Fees 2025

The process of closing is when everything gets mixed. Both