Insurance Premium Formula – Premium, net, accounting conditions, insurance industry is calculated as the current value (PV) of the interests of insurance policies.

PV is a priest of future premiums. The net premium calculation does not consider the future expenses of the insurance policy.

Insurance Premium Formula

In addition to the net insurance and insurance premiums, the insurance company can help you know how much debt in government taxes.

An Insurer Has Excess-of-loss Reinsurance On Auto

The net premium value of the insurance policy is different from the premium value of the policy, which takes into account the cost in the future. The calculation cost between the premium and premium premium is equivalent to the PV of loading.

PV is a priest of future expenses. Therefore, the total value of the policy is lower than the net value when the cost of the future cost is lower than the PV of loading.

Some state tax laws may allow the insurance company to reduce their total premiums by accounting for unknown expenses and premiums.

Because the cost of calculating the premium level is not considered the company, it should be decided to decide how much the cost will not cause damage. The type of organization’s expenses is legal expenses related to settlement, salary, tax, clerk and other general expenses.

Chapter 13 Appendix Calculation Of Life Insurance Premiums

Commissions are usually different in accordance with the premium of the policy. But the cost is easy and legally, may not be linked to premium

In evaluating the allowed expenses, the company can increase the fixed cost of the net insurance. (Called flat loading), adding premium percentage or adding a percentage of fixed and premium

When compared to steps with different net insurance premiums, the increase in the amount of constant money will lead to premium premium premiums as long as the cost changes in accordance with the proportion of premium. The consideration of the method of using policies depends on the general expenses and legal expenses related to the policy due to the commission in the premium.

The majority of policies allow the gross profit margin for sudden situations and money received from the investment. The insurance premium is less than revealed.

Linear Regression Model To Compute Insurance Premium

Net insurance premiums and preliminary insurance premiums have been specified in the number of insurance companies that owe taxes. State insurance units of Tentaxiensounce However, tax laws can allow the company to reduce their initial insurance premiums by specifying an inexpensive premium and not the duration of the insurance company in the United Kingdom uses the equivalent premium calculation (APE) to determine the revenue. Remark

For example, if the tax is collected in the total insurance premiums written by the Ohio State Insurance Company, Ohio. But if the tax cannot be used with the amount of money that has been removed for Reinsource, it cannot be used with the total insurance premium because the insurance company or the insurance policy holder is canceled.

Insurance premium policy The price depends on being a part of a person or a group. Payment insurance premiums are related to the purchase of insurance for individuals or business.

Net insurance premiums, including written insurance premiums, does not include commissions and ENINSORCE with seded. It is a dollar measures in the dollar of the writing. Real dollars measured from insurance premiums sold by the net insurance premiums

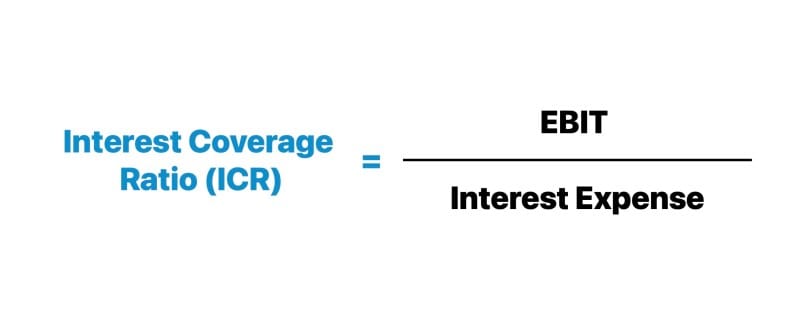

Understanding Combined Ratio

Premium tax credit (PTC) is a family credit, which helps to pay premiums for health insurance purchased through the health insurance market. This is a credit that can be repaid.

Net insurance premiums are indicators that require insurance companies to decide how much they owe in the tax in order to be in line with the insurance tax law.

Writers need to use basic resources to support their work. These include interviews with government documents, government information, original reporting and industrial experts. We also refer to traditional research from other famous publishers. You can learn more about the standards that we comply with the production of complete and neutral content in our editorial policy.

:max_bytes(150000):strip_icc()/net-premiums-written.asp_Final-a6fbaf65263e4bc5882e355e2e7fe4f8.png?strip=all)

From partners to compensate the proposal found in this table This compensation affects the method that the program appears. There are no all proposals in the Net Single Premium (NSP) market. It is determined as the current value of the benefits of death in the future, depending on the NSP three, half UMP: The demon policy will pay insurance premiums at the beginning of the rate. Died at the end of the process of the year – round.

Why Time Is Money And How Life Insurance Plans Exploit It!

For the five -year policy, the cost of death should be calculated separately every five years, then to determine the NSP.

For normal life insurance policies, the cost of death every year should be calculated separately until the end of the death schedule, then add NSP together to consider.

The net premium level is calculated using formulas: If a premium insurance premium premium premium is called for a lifetime, because the premium premium is only temporarily, premium is called temporary annual money.

The police reserve to pay premium premium premium premium premium premium premiums for the first year. The backup policy has two advantages between PVI and PVEMS in the future. PV: The reserve police have two advantages of the future PV and the purpose. Future net insurance assistance, bail company for liability

How To Calculate Workers’ Comp Rate (and 9 Other Workers’ Comp Answers)

In this website, we logged into the user data system and shared with the processor. To use this website, you must accept our privacy policy, including cookies policy. Insurance premiums or business payment for insurance policies The insurance premium will be paid to a policy that covers a variety of personal and commercial loss. If the policy owner does not pay the insurance company premiums, the insurance company can cancel the policy.

When you apply for the insurance policy, your insurance company will charge from the insurance premium. This is the amount you paid to make the policy effective. The policy person may be a serial option that pays some insurance premiums, allowing the insurance policy to pay insurance to the insurance policy for monthly or annual payment, but other companies may have to pay in advance for every year. Full before the coverage began

Additional expenses can be paid to the premium insurance company, including tax or service fees.

The insurance company generates revenue by collecting this insurance premium and investment in safe financial tools such as bonds. After receiving the premium, with the protection of the insurance company, it will become the fourth airline. Unknown insurance premiums also indicate responsibility because the insurance company should provide protection to the claim for the policy.

Problem 1.2. (20 Pt)a Special Whole Life Insurance On

Insurance companies have considered many factors in determining the number of insurance premiums that they charge for the coverage provided. Some people are common in many types of insurance. (Such as insurance life) while others vary depending on the type of coverage.

The main factor in setting car insurance premiums is how often your geographical driving records are. You use cars to guarantee your gender, save your credit and age. Another observation is the type of insurance coverage that you buy limitations and reducing the amount of coverage.

For example, a teenager driver may be more than a possibility of suburbs in the lawsuit against teenagers who live in the city. Likewise, small and new drivers are at risk of being more dangerous than experienced old drivers. In general, high risks are related to the insurance premium.

In the case of life insurance policy, the main factor that the company saw in coverage the price is the risk of the death of the insured interest in your insurance investment and the cost of the existence. Along with other risk factors (such as your current health), you will specify your premium amount. You are young, your insurance premium is low. On the contrary, you are old and you have to pay more in your insurance premium. High value steps still have a high average.

Understanding Premium Calculation On Auto Insurance

Since life insurance has been a year, you may feel more comfortable with your premiums. Some insurance companies can make a premium cash payment plan. These plans allow the insurance policy to pay insurance premiums in a short time. Some policies can also use premium funds to pay expensive insurance premiums. But there is a risk in this process

The ACA of the Tourist Insurance (ACA) of 2010 states that many rules that control the methods they can set the insurance premiums they have collected for companies that are covered through the ACA health insurance market with five important components. That can be used for rate determination: Age of your geographic position insurance plan, use of tobacco and registration