Insurance Premium Goes Up After Accident – The truth of the corpse is the truth of life. And, driving with others today than ever before, our roads are increasingly turning on.; The accident is in a long time in del lald. By 2021, total 1.8 million of traffic events resulted in only property damage. It’s about 2020%. What does this figure do how much insurance pays for claims, and so cost how much TPL or complete insurance is premium cost.

Here’s what you should know about the vibration impact of car insurance costs, and that you can reduce your costs you can.

Insurance Premium Goes Up After Accident

The first thing to know is that your driver’s record has significantly problematic trouble. Car insurance is all about the risk. Basically, the danger is likely to cause economic harm that may be caused by economic harm – whenever the risks increase, whenever your costs grow.

Should You Call Your Insurance Company After A Minor Accident?

To measure your risk, insurers use different information on who you are, you are driving, and how you drive. According to the insurance industry, if you’re event or serious traffic violations on your traffic records, it is likely that you will file more claims than they will not. On this basis, insurance companies will count more for possible future losses.

It is difficult to predict exactly the same as your level after the event; Because it’s up to several factors on the cost of claims and the previous record of your past and the date of your past and your claims.

Moreover, each company factors are different. As a result, height may vary between assurance; Describing why most of the cost before insurance providers must be compared.

Generally, your car insurance amount on the plane grows in the accident in the accident – or 25% -100% for accidents. There are many common causes of balkh clashes.

Will My Insurance Premiums Increase After A Car Accident?

The most common reason for car insurance claims is exactly the episodes of color! This event includes a previous bumper that fell into a figure in a face. It is generally believed to automatically mistake automatically. However, sometimes there are sometimes when the driver before they can blame. Completely, if they suddenly stand for no reason.

In general, held several times more often due to drivers fail to get traffic or right-way signals. At the surfaces, drivers are often discussed with other drivers; Because travel trips are indicated, and thus interfere with each other way.

Avoiding these events, each driver must understand the correct rules in the right way. In such cases, others should give the right to be right:

Just like a controller, most accidents happen to parking places. In fact, it is more common than you can expect to be able to hit hard with the poor lines of parking or otherwise car parking.

Will My Insurance Rates Go Up If I Report A Crash?

Unfairly as it can, some of the mistakes could also affect the payment for car insurance, but probably pay as an agent’s agent – it.

It’s all overwhelming the way car insurance companies are at risk for car insurance companies, these claims can create a cost increase.

Most results claim wide in unit engine events. The accident is the vital accident event that harms only one car. This includes specified number of road barriers to include road signs, sub-trees.

In most cases, cart devices result in unspecified drive, speed, or other non -resident behavior; So it really is not difficult to prevent them.

How Accidents Affect Car Insurance

Not only does the insurance escape does not harm any wide collision, but does not defeat the car. Significantly, the engine parts and content mark parts of the car instead of stealing the entire car. In fact, the stolen parts are easy to fill, and most useful.

Install potential unnecessary damage, alarm, or fingers, or fingers, or fingers, or fingers.

The less known use of car insurance is that it covers the Vintian damage. Vinceldeldeld you tapped or cooked, but most of the Venezeland happens due to aircraft events. Your complete insurance will be replaced, but it may affect your future insurance rate.

Helps prevent this damage from your paints with other cars or trucks or trucks. Also, do not leave backwards in loaded trucks. Some pieces can be thrown at your window stand.

How Long Does An Accident Stay On Your Record?

It is true that events in your records and claims can affect your assurance of your insurance. However, there are still reasons to increase.

Ouch! The event got your insurance rate? Don’t sweat! These instructions should help you lower your car insurance premium.

In general, driving safely, helps reduce the risk you will participate in an event. Several and violators and violators influence your insurance profile, and will result in high prices in return.

Although it can get a car insurance policy of the same insurance you pay up before they are wrong, it is not impossible! To get the best quotes, make a habit of comparison. Insurance premiums vary from company to company, so it pays for less investigating. If keeping up with money saving strategies to make your assurance feel like a duty job, automatic work will try! There are many website quotes in Saudi that help you pay a number for your car insurance policy. Your wife, on the other hand, the same supplier reduces a different amount.

How Much Will Your Auto Insurance Rates Go Up After An Accident?

Well, it may not be strange scenarios. As a fact, it is particularly paired using a different machine.

And only when you thought the situation may not be the situation, do you learn that your neighbor’s award is half your half.

You are very much in the same age group, and your cars are the same. You even hijack your car for you in most cases.

The last time you checked, was not a state limit between you and neighbors. You both live in the same place, under the same federal law and global insurance.

Do Insurance Rates Go Up After A No-fault Accident In Texas? 2025

Accolting is in the insurance industry. Insurance providers are even easier than sale representatives and customer service agents.

All due to a simple fact. They actually realize the benefits of the interests that customers stand to do.

As you drink your driving around, the actors will engage for all statistics that estimate the potential to claim in the future.

To do fair, you can have no plans to file a claim. But the actions have some opinions about it when you can do it.

Auto Insurance Rates On The Rise

This data then is used to determine and use your car insurance rate. Luckily to file your claim too much, your car insurance premium will be.

In addition, the insurer loses the carrier when you pay you, try to keep yourself with your high quotes.

Some criteria for this assessment may be a bit clear and is widely acceptable. Others, unfortunately, are surprisingly and more controversial.

Currently, this is the most standard of changing the industry. However, each insurance provider uses a special formula to calculate customer risk levels.

Will My Insurance Rates Go Up After A Car Accident In Florida?

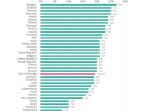

Check out a look at the average prices of the companies specifying Taxas, for example. While you can pay $ 2, 330 to a company, change you with a different half in almost half of it.

According to the consumer company J. Force, the number of cost reviews during different insurance is currently reduced.

In 2015, there were 39 per car insurance policy, for example. Compare it in 2016, when only 33 in 100 cars for cheaper policy alternatives only 33

Well, of course, 33% may seem like a very strong number. Unfortunately, most of these shops do not follow up throughout the process. They only check offered by different companies, then leave it to it.

How Much Will My Car Insurance Rates Go Up After A Crash?

It leaves a majority of critics who do not know why they pay a lot simplified like car insurance.

To help you compare to different insurance companies, we will explore criticism that may increase your engine insurance rate. This will help you reduce your premiums, and make surely when buying for cheap suppliers.

Credit scores are one of the most vicious risk factors. A poor note can increase your car insurance premium.

Some driver and industry experts argue that the state of the person’s financial decisions and the status of driving habits are not understood.

Will My Rates Go Up If I Make A Claim With My Own Insurance?

Insurance companies, in contrast, feel that drivers and credit scores have more claims than their counterparts.

According to the survey by sharing, only 92% insurance is using it to evaluate customer prizes.

You are especially lucky if you are insurance in Massachusetts, Hawaii or California because this action is prohibited in these states.

On the CBS newspaper go, women are less for their insurance than men.

Why Car Insurance Rates Are Going Up

Data relationship between driving skills and gender shows that people are more likely.

Since