IndoBeritaTerkini.site – Show Tiles Login / Signs on US Career Press News News

August 25, 2022, 2022, New Delhi: Do you have to include a Government healthcare plan? If not, live without health insurance or you need to pay a high premium than last year, and your family’s health insurance should be hunting. In their savings, a waiting dream is the “insurance, which is a waiting dream, which is not considered paying for a medical cost / accidents.

Insurance Premium Increase

After thousands of jobs and opinions relating to a significant increase in health insurance premiums, it has decided to conduct a national survey on the rise in citizens and understand the increase in health insurance premiums at the whole level of health insurance premiums. The study collected in India was asked 2022 Aug 12, 2022 in 287 areas in 287 areas of India, 287 citizens in 287 areas of India.

Wondering Why Health Premiums Are Higher? 🤔 Here’s Why Your Premiums May Increase: ✓ Age: Premiums Rise As You Grow Older. ✓ Lifestyle Choices: Smoking, Drinking, Or Unhealthy Habits Impact Costs. ✓

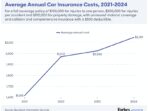

38% of their health insurance premium rose 50% or more in the past year. 24% of citizens rose 25% -50%

38% of the question of the size of your annual insurance increased in the last 12 months, 24% of citizens gave up to 25% -50% higher premiums, and another given 9% -10% premium. Either 18% should be more shell out of more than 18% or Jind SeaP could not be the insurance premium or the employer did not know.

It clearly does not know the size of the premium progress from the response to the response to the response to the response to the survey 202. Last year, at least 25% of the health insurance premium was 34%, this year, the year was 62 per cent. Overall, the average Indian increased by 10% in 2021, and increased by 25% 10%. When all the costs of most products, most products, essentials arise, their retirement reports harmful policies.

Increases health insurance premiums in 2021, most Indian Indians rose 25% or more in 2022

62% Health Insurance Holders Saw At Least 25% Increase In Premiums

All external estimate, Pandemic and Covid Health Insurance premiums increased to 10-25% for many experienced reasons in the last two years. In the case of elderly, according to the policybursor.com, the Indian insurance agorator, “health insurance premiums increased to 100%”. Feedback from citizens is doubled for the last 2 years for those over 65 years. For example, if two people are in 2019 – Rs. 28, 000, then it Rs. 55 and 000 to Rs. 60, 000 this year. ”

Another reason for high premiums this year, the insurance regulation, the WDA (IRDA) and expanding the price is to expand the price. The Idai introduced the Graterle of excuses under insurance in September 2019.

Accordingly, insurance providers do not qualify to avoid certain diseases. Idai is mandatory to provide attention for some modern treatments.

In short, at 3222 in 3222, at 3222 in 3, a health insurance premium in India increased by 25% in 2022. 38% of their premium rose to 50%. Such an increase in home budgets is a squeeze in domestic budgets, especially elderly facing the largest increase. Using a small part of Single-June 2022, it has found the reduction in reducing the roads to adjust the premiums, and increasing any increase in 2023.

Brand Name Rx: Why Insurance Premiums Continue To Rise

In 287 areas of India, there have been more than 20 responses from citizens. Men were 67%, 33% women. 47% of citizens came from metro or tier 1 areas, 35% of Tier 2 areas of 35%, Tier 3, 4 and rural areas. The survey was conducted through a platform, the citizens for registering to attend this survey.

The government is enabling the government to improve the problems of India’s primary community policy and implement the play politics -Play and Citizen. India is # 1 Paulstar India in the subjects of the system, public, consumer interest. See more than https: //

All content in this report is a copyright. Any reproduction or redistribution of graphics is required to perform any logo with the logo. Any fracture monitors the right to take legal action according to the observation.

Note: E -mail is never transferred to the spam folder, so the offer will be sent to your mobile projects if they needed the evacemes during these indefinite times. As a pandemic causes more hospitals, people face the financial loss. Furthermore, at the end of a pandemic, health insurance is not required in 2020. Health insurance premiums, health insurance premiums, health insurance premiums, health insurance premiums of 30%, and their premiums have increased by 30%, and in some cases , in some cases. What are possible reasons for the prosperity in health insurance premiums? Let’s explore –

Why Health Insurance Premiums Increase Every Year

Health insurance companies register high claim volumes due to a pandemic. Of 20-October 30, according to the public insurance companies in the public insurance companies, according to their health insurance policies Cova recorded a total claim Bill of Rs 7700 Crore. Pandemim increased 15.8 percent by October 2020 by October 2020. (Source: Indian Express)

Due to high claims, healthy insurers are forced to increase premium rates to achieve profits and problems.

Medical inflation increases when using inflation and medical treatment as the cost of medicine and treatment increases. Healthcare inflation was 4.39 per cent in the financial year 2017-18, up to 7.14 per cent in 2018-19. Inflation rose to 9.4% in hospital and nursing in hospital and financial. It was 6.5 percent in 2017-18.

Increased inflation has led to major claims for health insurance companies, which enhance premium rates.

Govt Notifies Increase In Motor Third Party Insurance Premium From June 1

Irdai (Insurance regulation and India development) forced health insurance companies to increase scope. Mental disorders, modern treatments, modern treatments and treaty treatment, and treatments. Now in regular coverage of health insurance plans. The insurers are exposed to the possibility of high claims as the scope of the policies increases. Therefore, to compensate for the broad coverage offered, the insurers raised their premiums.

Knowing diabetes, hyperians and other colleagues associated with a serious agreement, the insurers have a high risk. That is why the premium progress focuses on policy holders in at high health risk against work.

Many insurance companies charge similar premiums about individuals within a certain age bracket. This age bracket is usually for 5 years, up to 30 years, 31-13 to 35, as long as you are in the same bracket, you may not change your premium. However, the insurers may need to configure their premium depending on their claiming experience, and its arrangement is usually implemented. So when you go to the next age, you may cause the experience to change the premium of the insurer’s claim experience.

When the premium of the health insurance companies, the elements mentioned above are maintained in premium rates. Do not know the reasons why your health insurance plan and pay is to charge your health insurance and charge scheme next time.

Health Insurance Premiums Doubled Since Last Year

Browse blogs to read cool posts related to health insurance, car insurance, bike insurance and life insurance. you can. (*)