Insurance Premium Offers – Insurance companies are exaggerating as they offer attractive exceptions and skirts for your attention.

Waiver – a word that is like music on the ears. This is a word that always brings a smile for our face. Nowadays, inflation burns a hole in a common person’s pocket, exemption and speed allows for relief. They want to buy a brand dress, but they can’t afford shoes that predict shoes that proclaim a store discount. They all eagerly store the product in eager shops and eager shops in eager stores to disappear this product before disappearing from the shelves. Health insurance plans also offer customers to loosen them to create a plan. However, the health insurance plan has actually increased that people still need extra pressure to actually invest in a good plan. The places presented by the insurance company, which offers gentle noms that include a person or their family members in the assessment of coverage because it provides a percentage of premium levels.

Insurance Premium Offers

The discounts offered by health insurance companies are many forms and are presented in different types. Let’s take a look at all kinds of discounts provided by their plans form.

Bangkok Insurance Offers Special Premium Discounts At The 25th Bangkok Money Expo

1. Family discounts – a discount given by companies if any family member is covered by the proposal. However, it should be noted that the discount is a flat price and does not increase by the number of members. Sign up once once when adding a member and does not apply to another member. For example, Easy Munich from Apollo Munich offers a 5% discount to cover each plan and 10% for 3 or more members. If more than 3 members are covered, the discount rate will not increase to 15%but will remain stable at 10%. Similar to manipatungs prof. The health plan offers a family discount of 10% of the family discount, and the number of members does not increase the number of members.

2. A cumulative discount for premium – insurance companies offer premium discounts if clients are willing to pay for two years of premiums at a time. It is useful for insurance companies as they collect at least 2 years old premiums on the customer plan and provide at least 2 years of premise. The discounted price is usually 5% – the annual premium is 15%. Apollos offers a 7.5 % discount for a two-year premium premium at the same time. The second plan is that such a discount is offered by Bupa’s Health partner family who buys a second -year policy.

3. No conflict bonus – each insurance company in its health schemes has a bonus function for requirements that did not have last year. There is a nature of nature of the year after any sales year. The increase continues at the progressive speed at progressive speed until the buyer’s maximum approved limit reaches the context of the amount. For example, the medical team of the Bajaj Assistant health team offers a calicular claim rate of 10%up to 50%. Therefore, the sum insured after each year is increased by 10%until it reaches the original value that is not increased. Some plans are high as a highest level of 100%, which increases the sum secured by 200% of the original amount. Such a plan, a family of health partners is the first plan.

4. Discounts for discounts – companies can pay a voucher to customers who can be treated against medicines or fixed stores. Vouchers of such a discount are part of a preaching work. According to its schemes, the BUPA has offered 10% of the payment price that can be used to buy lifestyle and health products and services on the insurance company.

Youset Vs Co-operators Insurance (in 2024)

5. Fitness Rewards – A new trend of insurance companies has a customer award if they maintain a healthy lifestyle. Many insurance companies come with different forms for clients that maintain good health.

Apollos, energy plans for diabetes, which means that during the political year people performed two medical tests and a 25 % discount in the recovery premium.

The famous manipal plans are fitness and the party complements online premiums or health premiums or health premiums or health premiums or health premiums or health premiums or health premiums or health premiums or health related

6. Free medical examination – although this function is not a currency, it is not a currency implementation, but a deep period if they take advantage of the company’s coverage. Typically, such medical examinations are made in the star block, such as a plan for the drug plan, while my medical examination offers medical examinations. Each step is just every year that offers medical examinations within a safe medical plan.

The Best Auto Insurance Picks For Beginners

7. Discounts for girls – in order to support the health needs of women of healthcare, the common policy of the entire Reliance policy will propose the whole policy of a woman if the plan is proposed by a woman and covers the whole family. The discount can also be obtained if the girl who is involved in the family health insurance plan.

Filled with many attractive coverage features, including discounts, they are like icing on cakes. You have no options, but spoil it for the option and the correct discount only and if you do not enjoy these benefits?

I authorize to talk to me about the number that was given for my insurance needs. I know the right will ignore my register under NDNC.

It remains outside TV shows, movies, unwanted food, comics and sarcastic. When he doesn’t work as friends of other creatures like him, he is. To secure Premium Premium Premium Premium insurance, it is paid on payment shelves covering various personal and commercial risks. If the insurance company does not pay the policy premium, the insurance company may cancel the shelves.

Sanima Reliance Life Insurance Offers 100% Late Fee Waiver To Renew Lapsed Policies

When you sign up for an insurance policy, the insurance company will charge you a premium. This is the amount you pay to maintain the policy. The claimant has sophisticated options to pay premiums paying premiums. Some insurance companies allow the insurance company to pay the insurance premium for payment of the insurance premium-but per month or annual year-Hirs, perhaps the entire April payment for the whole year.

The insurance company may be paid to the insurance company at the top of the insurance company, including taxes or services for services.

Insurance companies collect premiums and earn safe financial instruments in safe financial instruments such as bonds. When the insurance company takes the premiums by ensuring security, that carrier becomes a victim of fate. Unwanted premiums also represent responsibility, since the insurance company should ensure coverage for claims to be accepted compared to politics.

Insurance companies are different work to do the various works that they will pay for payment in the Crossing Group. While some factors are the most common factors in so many types (such as the age of insurance), the second cover differs depending on the type

24. An Insurance Companyy Offers Its Policyholders A Number Of Different ..

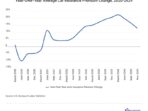

The main factors of determining vehicle insurance premiums, how often do you use your car, car type and car type. Another idea you buy is the type of insurance coverage that adds restrictions for covering blanket and haircuts.

For example, a claim that was filed against a teenage driver living in an urban area can be more than teenage drivers. Similarly, small and new drivers bring more risks to join an accident than old, more experienced drivers. Typically, the highest risk is more expensive insurance premium.

In the case of a life insurance policy, key factors in this coverage with prices that risk the death of insurance are and expects to file your premium. The age you start at the cover will determine your premium amount, other risk factors (such as your current health). You are small, your premiums are normal. In contrast to that, old