Insurance Premium On Loan – If you acquire a house with a refund of less than 20% of the price for your home, you must pay private mortgage insurance (PMI) if you have a conventional loan or a mortgage insurance premium (MIP) if your loan is supported by the Federal Housing Authority. In both cases, the insurance protects the lenders if they take the loan in standard.

Private MortGage Insurance (PMI) is an insurance used in conventional mortgage loans that protect the hypores from the risk of mortgage. In this way, PMI buyers who cannot make a deposit of 20% are to receive mortgage financing for affordable interest rates.

Insurance Premium On Loan

If you buy a house and take less than 20%, your lender minimizes its risk by being sure that you will take out insurance from a PMI company before registering for the loan.

Private Mortgage Insurance (pmi) Faq

The cost of PMI varies depending on credit rating, loan type and size of the payment and the loan. As a rule, PMI costs 0.5% to 1% of the loan amount, but can be up to 6%.

Where you pay the mortgage insurance premium in advance in a single flat -amount, either completely to close or be financed in mortgage or in PMI (lenders paid PMI)), whereby the cost of PMI is included in the mortgage line for the life of the loan.

Possible and failure are the two events against which the lender must be protected. I add a third event that you usually want insurance: the borrower’s death.

Banks do not want to chase grief or widow to chase money if your spouse dies. You often want you to withdraw life insurance so that the surviving spouse can pay off the loan. It is usually not mandatory, but is encouraged.

What Is An Automatic Premium Loan Provision?

Many banks are in the life insurance industry and employ people to sell this product. The policy is often a conceptual insurance that reflects the result of the loan. The facial quantity decreases when they pay.

This seems to be an excellent concept. However, in 25 years of sales of life insurance, I still have no declining term that is cheaper than a level of level.

From the Federal Housing Administration (FHA) Hypothek loan, insured borrowers offer more to qualified conditions, including a deposit of only 3.5% compared to traditional 20%. Private lenders who issue loans supported by FHA are protected from FHA from the risk of failure.

However, the borrower must pay a mortgage insurance premium (MIP) if they make a payment of less than 20%. This premium is similar to PMI in the fact that it is an insurance that protects the lender, but the cost structure for the borrower differs from PMI. You also have to pay a preliminary fee when the loan is closed.

What Is The Fha Mortgage Insurance Premium?

Fha also evaluates a “in advance” mortgage insurance premium (UFMIP) of 1.75% of the loan credit paid for closure. For example, a $ 200,000 credit balance would cost $ 3, $ 500 in advance ($ 200,000 * 0.0175).

The annual MIP interest rate may depend on the size of the payment, the credit balance and the LTV ratio (credit-to-value). MIP interest rates are higher for loans with more than $ 726, 200 US dollars.

For example, let’s assume that after a payment of 10%, you will register a $ 200,000 loan. Their annual MIP would cost 1,000 $ 200,000 * 0.005) or $ 83.33 per month (1,000/12 months).

For loans with FHA cases awarded before June 3, 2013, FHA requires monthly MIP payments to make a full five years before MIP can be reduced for credit terms for more than 15 years. The premium can only be dropped if the credit balance reaches 78% of the home’s original price – the purchase price specified in their mortgage documents.

Pdf) Penentuan Cash Surrender Value, Premium Loan, Paid Up Insurance Dan Extended Term Pada Kontrak Asuransi Jiwa

But if your FHA loan was created after June 2013, new rules apply. If your original LTV is 90% or less you pay MIP for 11 years. If your LTV is greater than 90%, you pay throughout the loan life.

Private loan insurance (PMI) protects the lender if a borrower pays a payment of less than 20% when you buy a home. The monthly insurance premium is a percentage of the credit credit paid by the borrower.

For loans supported by the Federal Housing Administration (FHA), borrowers must pay a mortgage insurance bonus (MIP) annually based on a percentage of the credit balance. In addition, borrowers must pay 1.75% of the credit balance in advance when closed.

As soon as you have equity of 20% in your house, you can request PMI from your mortgage. But your lender automatically cancel PMI as soon as your loan amount has been paid by 22%.

What Is A Car Insurance Premium?

If you have made a deposit of less than 10%, you have to pay MIP for the loan life. If your deposit was 10% or more, MIP expires in 11 years. Otherwise, you can either pay the loan or refinancing of the FHA loan to a conventional mortgage to remove MIP before it expires.

If you buy a house with a payout of less than 20%, mortgage will require insurance to protect it if you are excluded. Private mortgage insurance (PMI) protects the lender; The borrower must pay PMI every month and is calculated as a percentage of the loan. If you buy a home secured by the Federal Housing Administration (FHA), you must pay a Mortgage Insurance Bonus (MIP) annually or in monthly installments, plus a preliminary fee of 1.75% of the loan.

Requires that writers use primary sources to support their work. This includes white books, government data, original reporting and interviews with industry experts. We can also refer to original investigations of other known publishers. You can learn more about the standards we create in our editorial directive when you generate more accurate, impartial content.

The hidden costs of skipping house insurance: “You can lose your home” environmental activists have come up with a new way to protect against forest fires. Could it work in your community? Waldfeuer Risk increase: Can your home insurance company release you just before the fire season? Best Jewelry Insurance for 2025 Best Guard Insurance Company for 2025 Best -Dame -Dame -Insurance Company in July 2025 Best commercial property insurance The hidden risks in your wildlife insurance and how you can be repaired

Life Insurance Policies As A Security For A Loan

The costly mistake that homeowners redo their flood risk – how to control the vehicle insurance it pays back? That’s one thing – here’s what you should know if your life insurance can fail before you do. Here you can find out how you can close the gap. This trick can save hundreds of dollars for house insurance. 5 Best universal life insurance companies in July 2025 will increase this summer. TrenderViewsisture can protect your holiday fund for best life insurance with life benefits for the best dental insurance companies for July 2025 Premium financing of life insurance. As a rule, the annual premiums are between $ 100 and $ 5 for several million dollars in advanced.

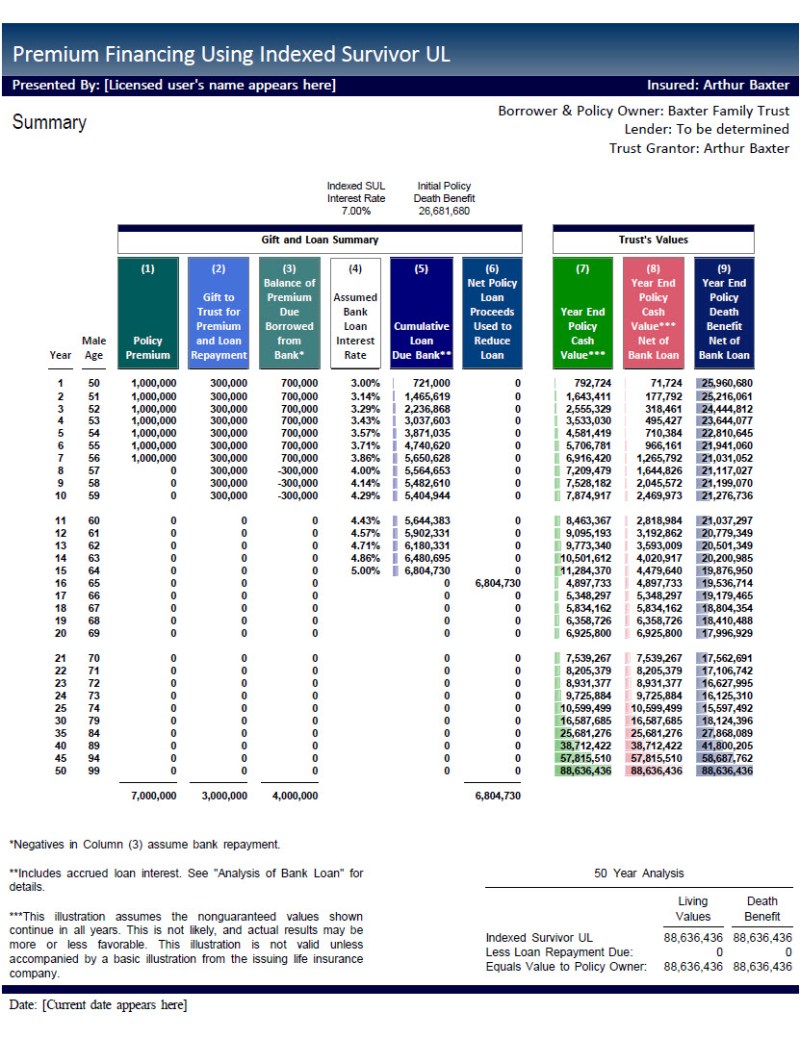

The financing of life insurance premiums for real estate planning is usually used if life insurance is in possession of an irrevocable life insurance insurance (ILIT).

The insurance owner protects a loan from a lender of third -party suppliers. The lender for third -party suppliers is usually a bank with a department that specializes in loans for financing life insurance. Not all banks can achieve life insurance loans for financing.

The information in this article serves to provide an overview of how premium financing works. When evaluating the financing of life insurance, there are a number of different programs, patterns, political alternatives and considerations.

Insurance Premium Defined, How It’s Calculated, And Types

Some premium financing structures can be an advantage. Other structures can be too aggressive, leading to a negative result for the customer. We encourage everyone to complete their own due diligence with their tax, legal and investment team before we implement a priority financing agreement.

Ideal candidates for financing life insurance are rich individuals and families who, based on one (or more), have the following interest in lending life insurance premiums:

Premium -financed life insurance offers a number of benefits for individuals and families with a high network. Life insurance price financing offers the opportunity:

As soon as a need for life insurance protection is determined, the question of how it is the best way to finance the policy is. There are a number of ways to finance the need. Life insurance price financing is one of several options.

All You Need To Know About Home Loan Insurance

When using life insurance price financing for real estate planning purposes, it is common to establish irrevocable trust and to be the recipient of life insurance. The irrevocable Life Insurance Insurance Trust (ILIT) will be the borrower and make premium payments to the life insurance institution.

In this scenario, the insured will be granted by Ilit. The granter calls the Ilit loan. The trustee should not be the contributor.

The trustee requests the loan on behalf of ILIT for the political premiums. Scholarships/insured is usually provided