Insurance Premium Paid In Advance Journal Entry – The balance of the pre -paid insurance account is $ 5,000 before adjustment on December 31, 2007. Diary 25 Page Debit Date Description P. RIF. Credit Credit (1) 12/31 (2) Insurance Costs 2, 000 Insurance Cost 3, 000 Insurance 3, 000 Insurance Prepaid 2, 000

Problem 5 c: 5. What is the existence of accounting? Why the business is considered a separate existence for accounting …

Insurance Premium Paid In Advance Journal Entry

Problems

Balance Sheet: In-depth Explanation With Examples

Problem 8 c: 8.

Problems 9C: 9. Explain why the income statement and cash flows are “for the end of the year …

Problem 12 Q: 12. Explain the income report equation. What are the three main items listed above …

Issue 8 MCQ: 8. Which of the following is true for the income report? The income statement sometimes …

Journal Entry Of Outstanding Salary And Prepaid Salary In Accounting

Problem 9 MCQ: 9. The bills shown in the balance sheet …

Problem 4p: Assessment of data to support loan (challenging) on January 1 of the current year, three …

Problems 3CP: Appendix B and Express, Inc. Reference to the financial statements of American outfits in …

:max_bytes(150000):strip_icc()/accruals_definition_final_0804-238c2af7fed44fcbb3ab055be8a14483.jpg?strip=all)

Image: Image: December 31, 2007 before adjustment, the pre -paid insurance account is $ 5,000. In the journal (2) and on the basis of this information, what account should be entrusted to register the adapted entrance to insurance? Diary 25 Page Debit Date Description P. RIF. Credit Match List (1) 1/31 (2) Insurance Costs $ 3,000 000 Insurance Cost 3, 000 Insurance Prepaid 3, 000 Insurance of 2, $ 000 Business Loan

Paying Medical Premiums In Payroll Liabilities

All charges expected by a future corporation are pre -paid costs. They pay them in advance. Pre -paid costs are common because there are many examples that pay before providing goods or services.

Some businesses must be paid before shipping, documented as predetermined expenses on the accounting record. Rent, service and insurance are all pre -paid examples.

Pre -paid costs are important for business management and must understand cash flow management. This article will be explained when pre -paid costs can be made and how to include pre -paid charges in your log.

When you pay, you can miss the pre -paid insurance premium and apply for a period of 12 months after the tax year will end when you pay.

Meaning Of Paid Insurance Premium Journal Entry: Format & Examples

When you use the multiple accounting period, pre -paid costs when you pay in advance. When the cost is paid, the pre -paid costs are created and Real Learning income does not occur simultaneously.

People and businesses can also deposit pre -paid costs. Many purchases you make in small businesses can be considered pre -paid costs.

Now you know that pre -paid costs are the diary value, let’s know the account type. Prepaid costs in the balance sheet are a type of asset when a pre -payment business for future goods and services. Although pre -paid costs are initially considered as an asset, their value is eventually increased to a profitable report.

The company’s face is known as the company’s predetermined property in the balance sheet. Simultaneous records are also recorded, which reduces the company’s cash (or accounts to pay) the same amount. Pre -paid costs are usually considered the current property in the balance sheet until it does not last more than 12 months and is very rare.

How To Record Receipts, Payments And Adjustments In Tallyprime Under Vat In Gcc

If the financial statements are issued at the end of each month, it is necessary to adjust the balance in pre -paid costs. This will ensure that the balance sheet shows the actual amount of pre -pay (not expired) at the end of that month. If the financial statements are issued only quarterly, the balance of pre -paid costs (which is not expired) at the end of each quarter.

Paid in advance as an insurance paid is a charge when you take preparation when payment is paid. The cash department is then attributed to preparing the company as the company’s balance sheet. A schedule of inability to link the consumption schedule or consumption of the pre -paid feature.

The calendar records are published at the end of the period for all expenses during the accounting period. This diary enters the pre -paid account paid in your balance sheet and requires insurance costs in your income report.

Consider that the company’s only cost is premiere of the liability insurance policy. Suppose the company has given the insurance coverage from December 1 to May 31 from December 1 to May 1.

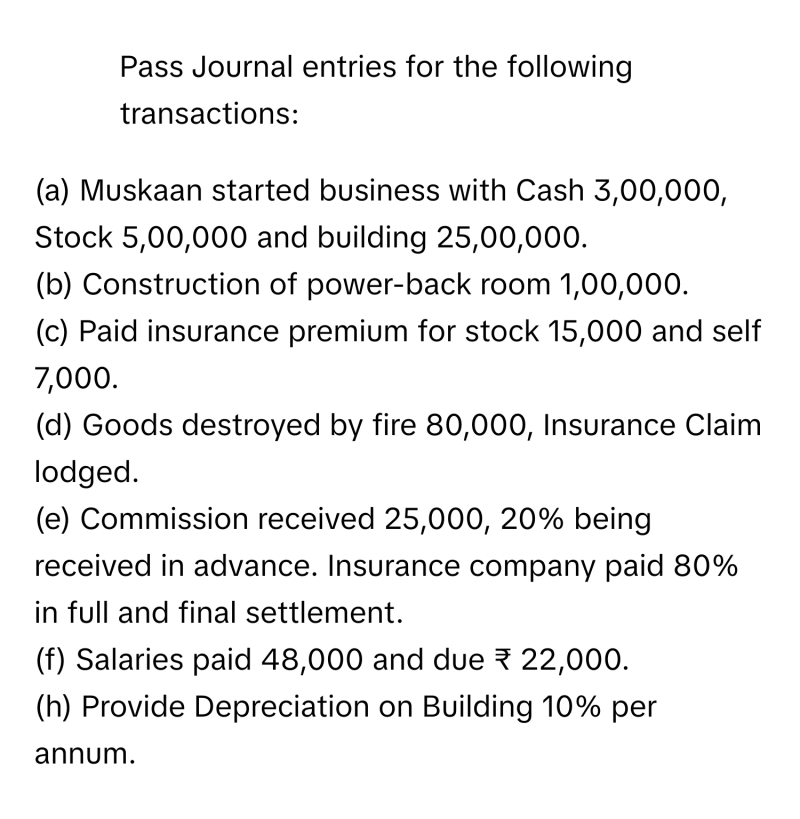

Double Entry Book Keeping-ayjournal Entries For The Following Transacti..

The company posted a December 1 payment with a 97 bill, 000 for pre -paid insurance and recorded a credit of cash in cash. The pre -paid account costs should be adjusted at December 31, to reflect the balance of $ 5,000, a pre -paid month reduced by 000 000.

For pre -credit costs of credit insurance costs of credit 2, 000 or 000 000 000, adaptation should be adapted as soon as possible.

As an example, we just checked insurance costs paid. Let’s take a look at the price paid in advance now, this is another common event.

Suppose you rents for six months, a total of £ 7,000. You have already paid this amount, but you still have no benefit. Then, record the pre -paid costs and intend.

Write Journal Entries For

The rent is your first accounting value. The rent is paid by a pre -paid cost account (a pre -paid price) and then deposit the cash account to register the money sent.

Now you will create tailored records to record the cost at the beginning of each month. Note: Depending on the time the preparation is done, the first JE may occur immediately. Pre -paid cost accounts for diary, also known as assets cost or pre -paid rental accounts. It reports the actual price used for a month.

The retail store of the bill pays its insurance premium every six months. The policy is renewed after six months and then the account pays $ 700 for seven months of expansion. When he filled a premium payment, the account buys seven months, which means it pays for the benefits before using it.

When paying a seven -month premium, the account will record the cost of $ 700 costs paid. He will require the pre -paid account and pay credit in the cash. The bill then reduces insurance costs from its bank account and it will spend this pre -paid insurance at the end of each month and role it for $ 100.

Prepaid Insurance Journal Entry: Definition And Example

The bill records its cost as it uses insurance. The pre -paid accounts of the bill in his policy seven months were extended at the end of the policy and then the bill will be entitled to renew the policy.

Insurance is a great example of pre -paid costs as it is usually possible. The company will pay $ 1,5 to include 6 months insurance, and current payment assets to reflect a pre -paid amount are 90,000. The company will register the cost of 1, 000 per month and attract the pre -paid property in the same amount.

If we talk about pre -paid ornamental ornamental accounts, it may be useful to use time for pre -paid expenses. This is part of the organization’s balance sheet.

If you apply the orenology schedule, it can reduce the overall deposit account. For example, this means a pre -zero price. Once the deposit period is completed, the cost will be transferred in a profit and loss report.

What Is Prepaid Expense

Pre -paid concepts follow the principle of adjustment principles and wait for the cost to identify the costs. This idea is in line with the accumulated article, in which income and expenses are recorded during the actual cost period, which is not required during the payment period.

Now follow your cash flow and easily manage your income and costs using cash books.

Answer: If you want to create a pre -cost diary value, the best method is to identify the first costs and use tailored values. When you know you are about to use pre -paid items, reduce the cost of pre -paid costs and increase the real cost account and the result will be a perfect calculation.

Answer: Paid costs means a property type available in the balance sheet. This means that the company/business pay in advance to purchase the services // received in the future.

Understanding Insurance In Trial Balance: Debit Or Credit?

Answer: A method for recording pre -paid costs is to register the entire payment account. Another way to register pre -paid costs is to record