Insurance Premium Paid In Advance – This page is digested. This is a combination of different blogs that discuss this. Each title is linked to the main blog.

+ Free support and discount faster! Convert help with the support for: Choice option (200kg – $ 1b) Project Founder / CTO Growth Growth Researching Services and Creating Business Analysis with more than 155 pounds and 50k VCS worldwide. We use our artificial intelligence system and present investors through warm entry! Send 10% discounts $ 50k $ 5m $ 5m $ 5m $ 500 $ 50k $ 100k $ $ $ 5M $$$$ $ $$$ $ 200K How much invest in your company? * How much is your monthly burn rate? If so how much are you looking for in the next 3 years? * What ways did you try to approach investors? Cold or hot? What is the result you won? * Do you find only investors or are there any external parts that helps do this? We cover 50% of each stock costs. Send here $ 35 allows you to get a free business package. Development estimate: $ 500K $ 500k $ 500k $ 500K $ 500k $ 50K $ 500K $ 500 $ 500 $ 500 $ 500? Yes No, Declaration, Review, Review, Business Plan, Financial Model, White and / or Other! What kind of material do you need: Choosing the financial model of the Earth’s deck financial model is what kind of services you are looking for: To review the review, we help large projects around the world to achieve financing. We work with real estate projects, construction, cinema production and other industries that require a lot of money and help the right lender, VCs and the right funding resources to close the budget to quickly! Have you invested $ 2b $ 5m $ 100 billion $ 100 $ 100 $ 500 $ 1B $ 1B $ 500 MILLION Do you invest $$$$? * How much is your monthly burn rate? * Plan to increase how many turns? If so how much are you looking for in the next 3 years? * What ways did you try to approach investors? Cold or hot? What is the result you won? * Do you only find investors or if there is an external side that makes it outside? The area I need in the market selection study must protect the swot feasibility analysis. Competitive analysis of all other budgets examined – $ 4000 – $ 4000 – $ 6000 – $ 8000 – We cover the entire group of $ 8000 sales and cover 50% of costs. Get a free list of 10 potential customers your name, email and phone number. What services do you need? Choose sales as sales service services, increase sales. Other budgets to improve sales $ 500k $ 500k $ 500.5 million $ 500 billion. What services do you need? Digital Marketing Marketing Social Media SEO Services Marketing Strategies Your Marketing Activities: 30k-50k $ 500k $ 500k $ 500k $ 500k. Watsap e-country e-country business plans send business plans to business letters 1 or 2 businesses. Post Post PER mail mail will be longer

Insurance Premium Paid In Advance

The importance of reinsurance in prepaid insurance preparation has 98 sectors. Limit search keyword using search and select one of the keywords:

Pdf) Reserves And Investments

It is not sustainable for the importance of reciprocal insurance preparation. Reliance insurance provides an additional layer of protection for catastrophic damage insurance, financially destruction without proper coverage. In this blog post, we will pay the reinsurance and its mission in the Premium Insurance Insurance.

Reliance Insurance is a key tool in insurance risk management. By transferring a part of the risk to an insurer, insurers can reduce the exposure of catastrophic losses, which may be economically paralyzed without proper coverage. Relaxing insurance allow insurance to cover greater politics and without being in danger of expanding business. Therefore, insurance acts as an important aspect of risk management for insurers.

Relaxation insurance insurance not only the benefits of insurer, but also policy assets are also beneficial. With more support to insurance, the reinsurance guarantees that policyholders will receive their coverage in the case of catastrophic loss. For example, if an insurer covers a large claim because it has enough reservations, the insurer can pause the policy holder to ensure that the policy is not left without a cover. This protected layer can calm down the policy and help the insurance coverage feel greater security.

There are two main types of reinsurance: urban planning and treaty. Relaxation insurance is usually used for large individual risks, while the reinsurance covers the risk portfolio. In these two categories, there are several types of reinsurance, including appropriate and non -properthsal reinsurance. Understand different types of reinsurance and understand applications for insurers looking for an effective way to manage their risk.

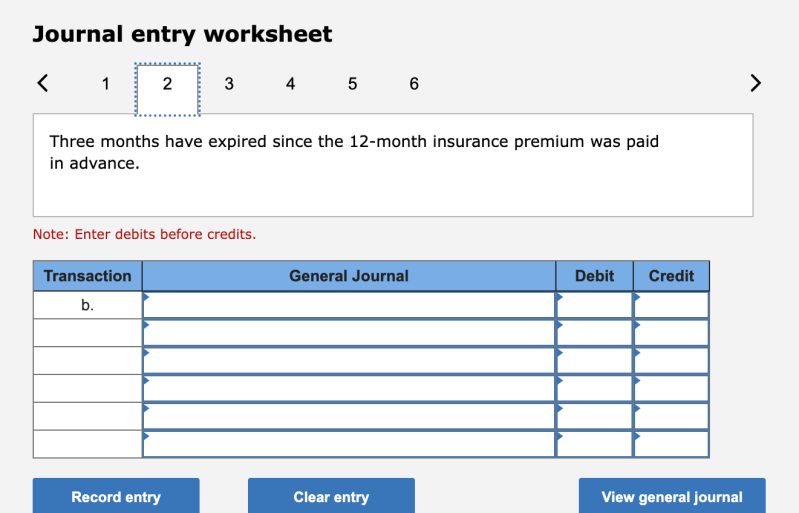

Solved 26 On September 1, 20×1, A Firm Purchased A 1-year

A refund insurance transmits a part of the risk in front of another insurance. While you are returning, it can be a useful tool for insurance to manage risk management, separated from the traditional reinsurance. The insurers must carefully examine the reinsurance and retirement when choosing, each of the possibilities with its advantages and shapes.

To manage risk through the re-management, insurers make the usual risk assessment, choosing the right insurance, and maintaining enough reservations. The insurers should also ensure that their reinsurance contracts and the conditions and conditions provided and conditions provided. Following the best ways, the insurers may take advantage of the benefits of the reinsurance.

Reliance Insurance is one of the critical components of mutual insurance progress insurance. By providing a complementary layer of catastrophic damage, insurance helps insurers manage the risk and expand their business while making sure that politicians receive the cover they need. Insurers must carefully examine their opportunities to choose between the reinsurance and retirement and follow the best ways to effectively manage their risk.

Relationship Insurance Importance in Mutual Insurance Insurance – Connect religious Insurance Insurance Insurance Premium Insurance Insurance

Pdf) Determination Of The Disability Premium There Is Life Insurance With Annual Payment For Type Benefit Waiver Of Premium

Reliance insurance has an important role in the insurance world. It is a technique that insurance companies use economic uses, if natural disasters, terrorists or catastrophic events like epidemics. Reliance insurance is a complex process that involves transferring risk to other insurance companies. In the world of the world in advance, the reinsurance are essential to ensure profitability with each other and cover members. In this section, we will examine the role of premium reinsurance insurance in advance.

A relaxation insurance company that uses an insurance company to transfer another insurance company called insurance company. Insurance agrees to pay a part of the insurance company that may suffer from the exchange of premiums. Infigural insurance allows insurance companies to protect from catastrophic losses and maintain financial stability.

Default Mutual Insurance companies work in a different model compared to traditional insurance companies. Mutual payment premiums are already and have the right to cover for a specified period. Mutual reciprocity uses premium claims and costs, but if claims are more than premium, it can address mutual economic problems. Recovery insurance allows reciprocity to transfer risk to an insurer and reduce the possibility of economic losses.

The Premium Insurance earlier purchases a mutual intelligence. The insurance agrees to pay part of any damage that may be mutual mutual. Reciprocional reciprocity for this coverage to insure insurance. The number of reinsurance purchased reinsurance depends on the risk and its financial potency risk.

How Will The One Big Beautiful Bill Act Affect The Aca, Medicaid, And The Uninsured Rate?

There are two main types of reinsurance: covenant and factor. alliance