Insurance Premium Payment Offers On Credit Card – Payment of Premium Insurance via Credit Cards in India is now a standard approach to Paul owners to simplify their payment methods. New modern users enjoy many benefits when insurance payments are made through their credit cards, as this method provides fast transactions with safety measures, as well as possible reward programs. Pay insurance premium for cash flow management using a credit card, as well as avoid delayed taxes and accumulate reward points for future purchases.

Most of the insurance companies allow India’s online insurance providers to receive the bonus to pay by credit card. The business uses this payment approach in various insurance products, including life insurance, health insurance, as well as car insurance and property insurance. The payment process allows the insurance premium to set a planned installment for subscribers and update the automatic policy based on their selected billing patterns. When Paul’s owners use a credit card payment, they receive an immediate certificate to make their insurance actions and update immediately.

Insurance Premium Payment Offers On Credit Card

Owners of insurance policy need to understand all the fees when they paid a bonus on credit cards. Many insurance providers will introduce an administrative payment fee or bring an increase in tax when users pay by credit cards. Owners of credit cards must confirm that their cards have enough credit to cover premium costs, as credit lack may pay payments.

Blayzz By Premiumtrust Bank

This work explains how to pay the Indian Insurance Prize with a credit card, but also list the benefits, as well as the challenges and rules to overcome common issues during the transaction. Owners of policy who understand the insurance payment methodology as well as good practice will make reasonable decisions about the continuous experience of paying insurance.

Insurance Premium Taxes via credit cards among the owners of India as they provide convenience and flexibility, as well as the potential benefit of the reward. Most insurance companies provide credit card payment options for life and vehicles and property insurance and property coverage, thus allowing them to simply maintain insurance with modernized payment systems.

Customers who pay their premium refers to the reward and remuneration of credit cards or flight pipe based on their credit card characteristics. Regular credit card users can get the financial benefits through this award program to obtain multiple benefits that do not require a different payment method. The Swift Credit Card Payment System ensures that your policy is active without any risks associated with late payment or delay.

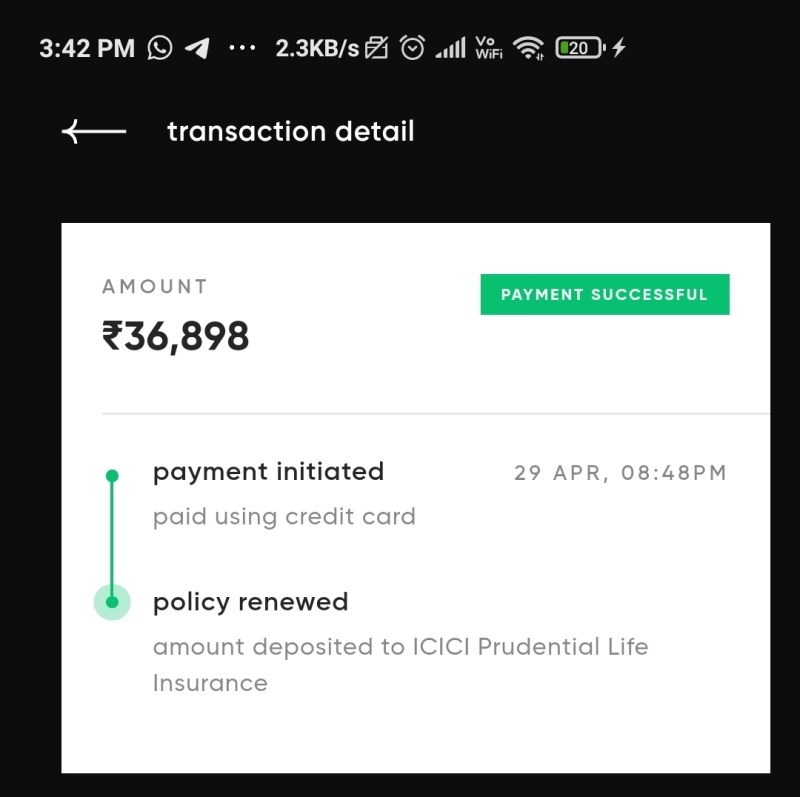

The system to pay the insurance premium with the credit card is operating smoothly. The insurers with online platforms allow their users to use the payment barrier to enter the card details for the immediate payment certificate. You can set automatic taxes on most companies that will confirm your premium payment on time for each billing period, without human help.

Cards: Prepaid Vs. Debit Vs. Credit. What’s The Difference?

When using a credit card, some points should be noted. Some insurance companies use additional costs for credit card payments, which increases the premium value. Owners of insurance policies should check their credit border rather than a bonus amount, as failure to comply with this request may lead to payment errors and penalties.

The premium payment procedure through credit cards ensures simple payment solution and financial security, but requires monitoring fees and account restrictions on the finished transaction.

New policy owners in India choose credit card payments as their preferred method to pay the premium because it gives benefits and simplicity. This payment approach provides fast premium management through safe procedures, giving users many benefits. Pioneer insurance organizations, as well as online insurance websites, provide users’ convenience with credit card premium payments that meet people who receive life and cover car health plans and property.

The main advantage of using credit cards for a bonus is its flexibility as a means of payment. The priority system based on pay, insurance policy owners allow payment dates that are in line with their graphs that keep policy coverage and miss the late payment fee. By immediate processing of credit card payments, the insurance policy is still active. Your insurance coating will remain continuous as you can end up all possible delays in the payment process.

Best Credit Cards In India With No Annual Fee| Best Credit Card For Online Shopping

Rewards programs are an important advantage that users can receive from credit cards. Premium taxes for credit cards allow users to accumulate pay on the basis of points or pipe air, from all purchases made on the card. Your credit card acts as a tool to get insurance benefits when you use it to pay a policy, which is a profitable and favorable choice in the future.

The following paragraphs should be taken into account. There is a possibility that insurance providers will impose credit card deals that continue their total value. Owners of insurance policies must check their credit border before the bonus is paid by a credit card. Transaction failures as well as possible penalties can occur if you exceed your credit limit.

Credit card premium tax receipt method provides simple transactions and adaptable payment options as well as possible benefits. Before you pay your credit card, you should check whether the extra fee is and evaluate that your card has enough money to pay the premium. Insurance payment management becomes more effective and favorable with this payment approach.

The insurance premium plays an important role in maintaining continuous policy, as well as health insurance and car insurance and property insurance. Key insurance taxes are used through standard channels, such as check payments or cash deposits, as well as bank transfers. The insurers will create technological progress to create various convenient and safe payment options that improves speed when users are processing premium payment.

What Are Life Insurance Premiums: Factors, Costs, And Tips Explained

The modern world evaluates the most common options for online payment. Policy owners can receive safe payment barriers to the insurer and third -party platforms to receive bonus taxes using different methods, including debit/credit cards and purely banking or digital wallets. Users use domestic taxes in this method, which provides automatic payment verification so that active policy remains without delay.

Policy owners can receive automatic payment through insurance providers who provide services without maintaining continuous policy without consideration of payment deadlines.

People choose more to pay a bonus using credit card payment methods. Users who pay for this method receive the benefits of bonus, both the return points and the trip. Some credit cards allow insured clients to share their premium bills with interest installments, which enhances the ability to manage finances.

Policy owners need to check whether their insurance providers will pay an additional fee for credit card payment and confirm that their credit card has many money available for bonuses.

How To Reduce Your Car Insurance Premiums In India 2025?

The premium payment process is now mainly through mobile programs that act as necessary tools for pole owners. Most insurance companies now operate on individual programs that subscribers can handle their policies and carry out bonus taxes and maintain a policy update schedule. Through mobile applications, users can quickly complete payments and receive additional features that allow them to supervise their policies and access customer services.

Users who buy insurance are enjoying a different premium payment options, have a simple approach to maintain their policy envelope.

Financial protection from late fees depends on the consistent insurance cover that protects you from additional financial loads. When you pay for your premium, the insurance policy may be outdated and bring you more expenses because of this event. The following strategies will help you make bonus taxes in a timely manner and avoid delayed taxes.

This is an easy way to create an automatic premium taxes to stop receiving a late fee. Most insurance providers allow the automatic payment methods that have been removed from the bank accounts or charge it on credit cards. Automatic death is a task to remember the payment terms and the chance to reduce the payment.

Bajaj Allianz Life Enables Auto-payment Of Policy Premium For Nri Policyholders With International Credit Cards: Check All Modes Of Premium Payment

Some people who want to have direct payment management on the phone alarm and e -mail and calendar signals can be used to remember premium dates effectively. If the period of premium is marked too early, along with the planned messages, you will prevent the loss of payment obligations. You can create graphs alert for three days and a payment time to get an adequate warning to pay for payment.

The method of paying your premiums is a useful payment strategy. Most insurance companies allow you to make a bonus in advance for different months and this gives you time efficiency and discount rate options. You can choose to pay a single amount with your budget when we recommend fixed payments as it ends with periodic stress taxes.

The final stage should include a thorough check of all payment methods when receiving payment. ბაზრის მასშტაბური დაზღვევის პროვაიდერები საშუალებას აძლევს მომხმარებლებს გადაიხადონ ციფრული სისტემების მეშვეობით გადახდა სადებეტო/საკრედიტო ბარათების საშუალებით, წმინდა საბანკო და მობილური პროგრამებით. გადახდის დამუშავება ხდება ამ მეთოდების საშუალებით სწრაფად, დაუყოვნებლივი გადახდის გატარების უზრუნველსაყოფად.

:max_bytes(150000):strip_icc()/GettyImages-1141164585-5486d44770c94a2784185a75be37a6fa.jpg?strip=all)

ხელმისაწვდომი ინსტრუმენტების ორგანიზება შესაბამის დაგეგმვასთან ერთად, საშუალებას აძლევს ინდივიდებს თავიდან აიცილონ დაგვიანებული გადასახადი და ამით შეინარჩუნონ მათი დაზღვევა უწყვეტი.

Online Insurance Premium Complete Guide To Car Insurance Ppt Sample Ppt Slide

სადაზღვევო გადასახადების მენეჯერები