Insurance Premium Simple Definition – Usually speaking, a fee is a price giving some money outside the basic or natural value. IEene, losses, accidents or destruction of destruction (eg insurance or option contracts). The word “premium” derives from Latin

The price of some basic values is called a rewards, it is said to trade such funds or objects with a reward. The need to trade in the future can be traded in the asset premium due to increased and limited distribution or observations.

Insurance Premium Simple Definition

Premium bond is a trade in the upper or another words; Pay more than the name of a bond name. A bond can be traded with a premium because it is higher than the current interest in the market.

Sum Insured In Health Insurance Policies: Compare Personal And Group Health Insurance

The concept of bond price fee is associated with principle, watching a bond loan and monitor interest rates; If the current interest rate is purchased with a reward, the current interest rate is less than the interest rate of the Bond’s coupon’s interest rate. Thus, investment gives a fee for an investment, which gives a larger amount than the current interest.

The risk includes an income of the risk of fee and hope it exceeds the return rate. Asset’s risk fee is compensation to investors. This represents a fee for additional risk for a particular risk for a particular investment in the Aristics Free District.

Similarly, the fee of the shareholder points indicate an additional setback that invests in the testock market. Investors with these additional rocks increases the risk of investing equity. The size of the reward varies and trusts a certain portfolio’s risk management. This changes over time when the market is vary.

The rewards of the options is the cost of buying an alternative. Provide the options to the owner (owner) of the owner, but not a liability to buy or sell inherent financial instruments to a particular board. The problem fee reflect changes to the interest or risk profile from the problem. For a period of time over a period of time a particular board is not liable to sell (call) or to sell (call) or to sell (call) or to sell.

Definition Of Insurance

The reward is its natural value, its intention of its purpose; A long-mature option is always worth more than short mature structure. The market on the market and strike price is payable and the market will affect the fees.

Slow investors sometimes sell an option (known as an option) and use a fee that cover the cost of purchasing the inherent device or other option. Buying multiple options can increase or reduce the location risk profile depending on how it is made of it.

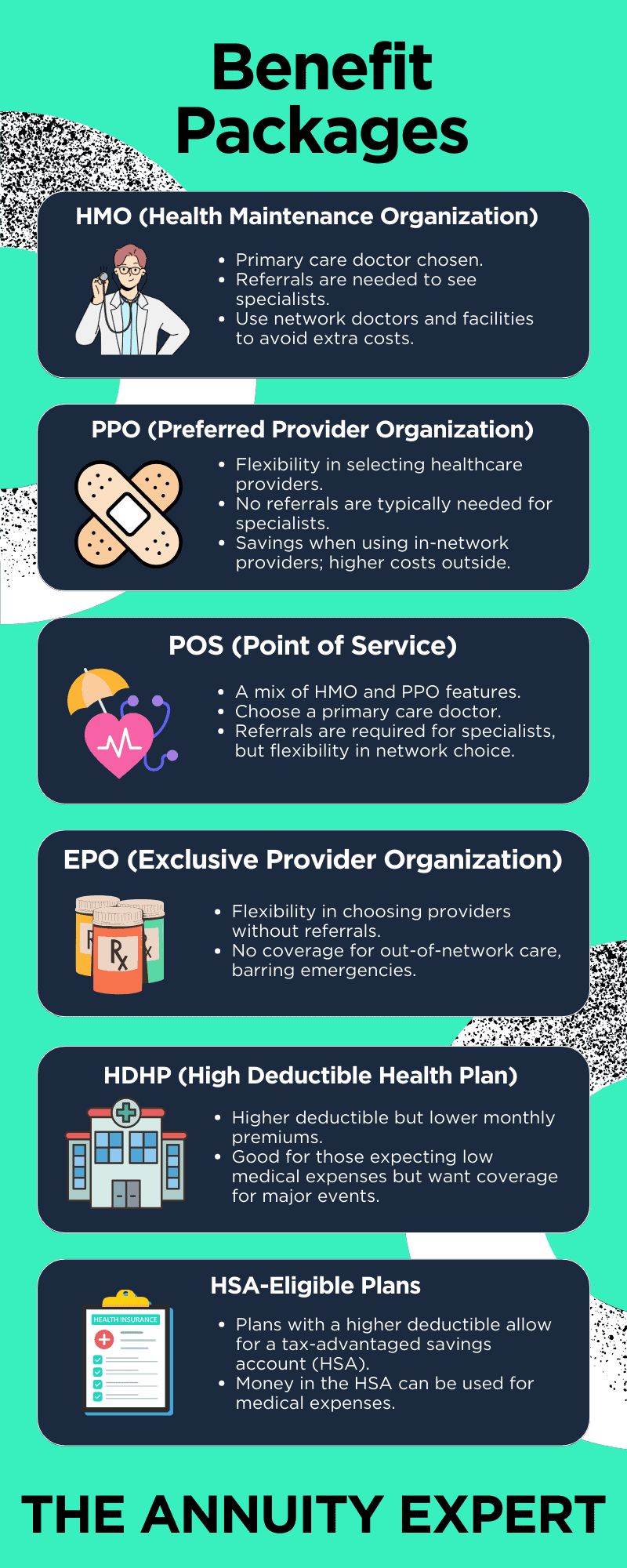

If the events produce coverage occurs involved, the insurer involves receiving the risk of taking risk of risk. The reward may include a Sales agent or broker’s fee. The most common insurance is the car, health and employee insurance.

Insurance premiums will be given to many types of insurance, including health, employees and rental insurance. These fee practice should be submitted in a normal condition or schedule to continue. The general example of the premium is from car insurance. The owner of his vehicle will ensure the value of his vehicle on accidents, theft, fire and any other issues.

Unearned Premium Vs: Earned Premium: Understanding The Difference

The owner usually gives a fixed fee in exchange for the insurance company’s warranty, and it consists of economic loss across the agreement. Premiums are based on the risks associated with insured and measure of coverage.

Some means some extent to some extent to some extent due to a cost or distribution and imbalance. Fee payment Insurance may indicate more than the payment of the option of the agreement.

Includes “Premium” synonyms, a gift, payment, dividend or bonuses. In an insurance and option store, it may be synonymous with “price”.

Premium pricing is a marketing strategy that contains a strategic high price than the basic version of that product and comparisons to competitive. The aim of premium pricing is to save the quality or aspiration and other options.

Understanding Partially Self-funded Insurance Plans

Writers need to use primary resources to support their work. These include the white papers, state information, real reporting and industrial experts. If necessary, we refer to the true study of other popular publishers. The exact, impartial content of our editorial insurance you can learn more about the criteria you follow. Automatic insurance fee in 2025 (in the explanation of the–Dip of—DIX) is a monthly or semi-hire charges. This guide crushes how insurance premiums are calculated and which factors affects and practical tips to reduce insurance costs.

Benjamin car worked as a licensed insurance agent in the State Fam. He sold various coverage lines, he informed his clients about their lives, healthy and life insurance needs of health and real estate / life insurance needs. Assessment is assessed and his passion is to find people in the best coverage for their needs. Insurance is designed to protect people, especially when it is …

Joel is the CEO of the Enterprise Center company. He is a certified financial planner, a writer, a writer, an angel investment, a serial entrepreneur, books or companies. He was working before the founder of the National Insurance Office, Company and Resident CFP. He was a MBA South Florida University from the University of MBA Joe …

The advertiser reveals: we try to tell confident car insurance decisions. Compare shopping should be easy. We have not linked any car insurance provider, and we cannot guarantee a single provider offers. Participation does not affect our content. Our comments are ours. Let’s compare quotes from several different companies, this page can be written postal code to use this page free offer device. Additional quotes you compare, more opportunities you save.

Buying Insurance Direct Vs. Through An Agent In 2025 (side-by-side Analysis)

Editorial suggestions: We want to learn more about car insurance we’re a free online resource. Our aim is to be the goal of the car insurance, third-dead source. We regularly update our site regularly, car insurance experts check all content.

The contribution of car insurance is indicating the repeated amount of payment, maintaining the repetitive amount of payment.

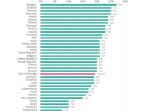

For the best auto insurance companies, many elements of your insurance premiums are influenced by your car, this is the cover of your coverage options. You can receive a premium period of a statue.

Any premium is how they calculate them, the difference between the average cost and premiums. To start reducing the postal code for free.

Insurance Proposal Form

Car Insurance Premium is a monthly or semi-listed payment for insurance. It is important to understand that the insurers use many factors to calculate the risk of each driver.

The possibility of compensation, the higher, high insurance company will set your insurance premium. These are the main components of calculating insurance premiums:

The estimated understanding of car insurance contributions is crucial to manage overall insurance costs and achieve the best value.

You should follow your insurance and take care at the time you need to update. If you have a fall, you can provide 12% more than 12% of the insurance premiums. For more information on the practical follow-up: https://t.co/pjpwidav8c Pic.twether.com Pic.Twtter.com/adi57pqdm – (@) August 20, 2024, 2024

Pdf) Insurance Concepts

By looking at components such as car details, history and location, you can make conscious decisions to reduce the reward. Always compare offers to find the best price to suit your situation. More information about what to do if your car insurance contribution is unable to close your car insurance contribution.

Unfortunately, insurance prices will always last the same. The most common things that make car accidents and traffic tickets to your insurance prices.

When you usually leave your claim to get your claim quickly, you will notice that the prices will be rise soon when you visit your claim. However, using tickets like tickets, tickets like your insurance company can only rise when you check your driving information only when you check your driving information.

You see that your driving information and insurance profile is the same but prices will rise slightly. Sometimes the company decreases to compensate the company’s compensation requirements or if your area increases risk.

Auto Insurance Deductibles In 2025 (what It Means For Your Coverage)

If the price rises, you should shop if other insurance companies offer low interest rates. For example, if you rise quickly and price rise, get offers from the best car