Insurance Premium Subsidy – When I sit with clients to discuss their healthcare capabilities, the first problem is almost always related to costs. And I understand – how much health insurance per month is an important part of your financial puzzle. Although there is no answer, which is suitable for everyone, I can provide you with useful reference points to start planning:

If you are buying ACA market plan without subsidies, 2024 per person, the national average costs about USD 477 per month. This may look suddenly, but here is good news: after premium tax relief, about 80% of Americans can find insurance for $ 10 or less per month. Yes, you read it well – five dollars!

Insurance Premium Subsidy

Many people I work with initially focus only on the monthly budget. I always encourage them to delay and look at the whole photo. Your true health care costs include several moving parts that affect what comes out of your pocket.

Health Term Explanation: Subsidies

The reality is that with time health insurance has become much more expensive. Since 2014, individual contributions have increased by 68%. Looking at the perspective, the plan costs USD 271 per month, and then costs a person around USD 456 per month. This is quite a jump in just a decade.

I am Les Perlson and for over 40 years, under the leadership of customers through the health insurance market, I helped many people to manage a difficult question how much health insurance costs a month for finding solutions that balance good insurance with real budgets.

If you want to immerse yourself in healthcare costs, especially for companies and employers, I recommend checking the following resources:

Throughout this guide, we will examine all factors affecting your monthly contributions and sharing strategies that will help you find insurance that meet your health needs and wallet. Because understanding your possibilities is the first step in making intellectual health care decisions.

Compliance Incentives Under The 2014 Farm Act Would Be Lower Without Link To Crop Insurance Premium Subsidy

If you bought health insurance 2025, you will probably start with one big question: how many health insurance costs per month? Let’s look at important numbers of the budget.

The average national award for the reference silver plan for the 40th anniversary is USD 539 a month before all subsidies. This number increased from the previous year, reflecting what we all experienced – healthcare is becoming more and more expensive.

But here is the good news: that’s only average. Your actual costs may be completely different, depending on where you call your home, age, how many people you will cover and a selected type of insurance.

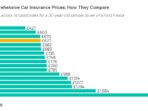

How much health insurance costs to you to you per month can be a reduction of jaw. The inhabitants of Virginia enjoy the lowest contribution in the country up to the month of the 40-year-old to a silver plan every month.

North Carolina Approved For 24 Percent Average Health Insurance Premium Hikes

Meanwhile, if you are in western Virginia, have fun – on average 864 USD per month. It is more than twice than he pays for Virginia for the same range!

The changes tell a different story over the years. Although the national average increased by about 4% from 2023 to 2024, the inhabitants of Oregon were confronted with a stunning 17% jump. Meanwhile, in some happy states, the minimum growth or even a slight decrease was reduced.

What explains these huge differences? It is a complex combination of factors: how many insurance companies compete for your company in your area, local health care costs, state regulations, how healthy residents are generally and whether you are in a rural or urban environment. All these elements are combined together to create a bonus.

As for the size of the family, mathematics is quite simple – more people mean more bonuses. Although one 40-year-old pays around USD 539 per month for a silver plan, the addition of family members increases expenses:

If The Incoming Administration Lets Aca Health Insurance Premium Subsidies Expire Next Year, I Think Millions Of People Will Drop Their Coverage And Just Be Uninsured. Without The Subsidy, This Would Be

The couple (both 40) will pay around USD 1077 per month – basically twice as much as the individual rate. Add a child to create three family and you observe about USD 1398 per month. Five families? Get ready for the menstrual period 2, 040 USD.

Remember, however, that this is “prices of stickers” before starting any financial assistance. For many families, the actual costs expire much lower.

I recently talked to Sarah and Michael, a few of 40 years with two children in Texas. When they saw almost $ 1,800 for the first time, Sarah told me: “I almost left the chair!” However, applying for tax reliefs, taking into account their income, their actual payment dropped to USD 340 per month. “The difference was to change the budget,” she said with obvious relief.

Your monthly installment is only one part of the puzzle. You also need to understand the maximum financial exhibition-it is maximum in your pocket. 2024. ACA plans to cover the following amounts:

A Public Option For Health Insurance In The Nongroup Marketplaces: Key Design Considerations And Implications

These numbers reflect your absolutely the worst scenario services per year (not counting the contribution). After reaching this limit, the insurance covers 100% additional costs for the rest of the year.

These maxima provide decisive protection against medical accounts that cause bankruptcy. However, with time, they grew basically – in 2014, when ACA plans began for the first time, the individual maximum was only USD 6,350.

Understanding both the monthly costs of the premium and potential costs in your pocket, you can in detail how much health insurance costs for a month. The advantages of the NPA, which we specialize in finding plans that balance the price accessibility with you, really needs insurance.

Have you ever wondered why your neighbor pays a completely different rate for health insurance than you? When it comes to understanding the costs of health insurance per month, not just buying the best offer. Your premium is calculated using several key factors that can significantly increase the costs every month.

Pdf) Comparison Study Of Agricultural Insurance Government Subsidy And Farmers’ Self-subsistent Premium In Indonesia

Your age plays a huge role in determining the bonus. According to ACA guidelines, insurers may burden older adults up to three times more than younger people than a uniform range. Think about how the sliding scale, which begins at the base of the 21 -year -old -Cold base and gradually increases higher.

For example, if the 21-year-old pays USD 300 for a silver plan, a 40-year-old may pay around USD 405 for the same insurance. At the age of 64, this prize can ballon up to USD 900 per month. Mathematics is quite simple – the older, the more likely it is to pay.

However, several states are this trend. New York and Vermont have completely banned changes in the highest level based on centuries, while Massachusetts, Minnesota and Rhodes use modified age curves that relieve the shock of older adults.

Then there is a budget budget of tobacco for smokers. Tobacco users can overcome up to 50% more insurers, which can mean hundreds of additional dollars each month.

Federal Subsidies: Harnessing Federal Subsidies Through Form 1095a

James, a graphic designer from Denver, shared his experience: “Smoking has retained my lungs and wallet. My bonus has fallen by 175 USD per month – it is over $ 2,000 a year, now I put it in my HSA instead of the burning.”

Your postal code has a surprisingly large impact on the costs of health insurance per month. Life right next to the line of county can mean a significant difference in what you pay.

Local health care prices in regions differ dramatically. An ordinary procedure in San Francisco can cost twice as much as in the village of Ajova.

Insurers’ competition also has a huge difference. The counties with only one market insurer usually see about 10% of higher contributions than areas in which several companies compete for your company.

For 2024, 80% Of Aca Enrollees Can Get Health Insurance For $10 A Month, Cms Says

Insurance costs are real divisions of the city and rural. Rural areas are often encountered with double Whammy – less competitors of suppliers and lower competition of insurers – which leads to a higher contribution to the population.

Regional health trends are also important. States whose chronic diseases or unhealthy behavior more often have higher insurance premiums to reimburse the increased costs of maintaining the entire population.

The type and level of coverage of the selected plan significantly affects your monthly account. Think about this as the choice of economic, business or first-class options-the prime-class has various privileges and price points.

As for the types of plans, you basically decide how much freedom you want to choose doctors and professionals:

Crop Insurance As A Payment Program

HMO (healthcare organizations) offers lower contributions (on average $ 512/month), but is limited to network suppliers and requires initial doctor’s instructions to see professionals. They are great if you have nothing against these restrictions and you choose simplicity.

The WTO (preferred suppliers’ organizations) ensures greater flexibility to visit doctors outside the network without commands, but you will pay for this freedom up to USD 613 per month for this freedom.

Epos (exclusive suppliers’ organizations) is at an average price, without their network, except for critical situations, but usually there are no shipping requirements.

HDHP (high deduction of health plans) is characterized by lower menstrual contributions, but higher deductions. They are often paired with savings accounts (HSA) that offer tax benefits.

Medishield Life Premiums To Increase As Government Expands National Health Insurance Scheme

Bronze plans include the lowest monthly contributions (on average 417 USD/month), but the highest costs of pockets when you need maintenance and insurers cover 60%and 40%.

Catastrophic plans are available to people under 30 or difficulties, on average USD 335 per month with very high deductions.

“I learned this lesson,” says Marcus, an independent photographer. “I chose the cheapest brown plan to save