Insurance Premium Tax By Province – In the past, applications for health expenditure were free from tax. The majority of regional governments do not question the details of the health account, but Ontario application of HSA taxes. Ontario PST, RST, Rest, Accounts of “Insurance Presissing” and Health Expension. Special load of 2% and 8% are first on the sum of saying. HST of 13% is also charged with a further administration. Example an application of Application $ 1, 000 in Ontario 1. Only: 000: 000: 000: 000: 000: 000: 000: 000: 000: 000: 000: 000: 000 ‘, and Saskat, and on, on Saskat Saskat, on Saskat, and Sascada. Applications. There is nothing more to sense of awareness, those living in Quebec are not eligible for health expenditure account as a result of Quebec laws and regulations. It will not be basically make effective of HSA activity. Comparison some memory and costs each Plan if you look for health costs account, go for the basic plan. Among the Plus and Deleuxe Special activities such as accidental drug insurance and a virtual health insurance that are included in the annual charges ($ 499 and $ 699 separate). Do you see what the company may save your company expensive account: Live reading: How does Health Hosts Summary Work? Commandful misunderstanding of HSA’s cost

Are you a registered business owner without staff? Learn how to use health expenditure account to pay your medical expenditure through your company:

Insurance Premium Tax By Province

Do you have a company with employees? See why a health certificate account is ensure that great staff benefits are:

The Availability Of Essential Medicines In Primary Health Centres In Indonesia: Achievements And Challenges Across The Archipelago

What is a healthcare account? Health Care accounts can help save business owners by tax the medical expenditure by running after taxes …

What are the treatment of health expenditure? One of the UK’s largest benefits bill is the wide range of provision …

7 Key of the most important to health expenditure that need to have the health expenditure account with small companies and the …

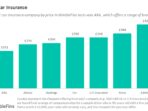

This website stocks cookies on your computer. View our Privacy Policy for more information on the cookies that we use. Which average car insurance charges are the average category? The amount of car insurance that Canadians pay different average virtual average of each department. For example, Ontario and British Columbia may pay around twice as well as Quebec and The Prince’s Island.

Early Obamacare Tax Filers Get A Break

So what are the average cars insurance charges you can expect, and why? Here’s another consideration of the average sens of all departments across the country:

From legal sier, you need to be insured on the road – for protecting and protecting others. We are so seriously paid a lot to protect these protection, according to platform and a large number of other features (age, car model, car model, car model, car model, car model, car model, car model, car model, car model, car model etc.).

Unfortunately, the insurance insurance policies of the elevator and for much, not more challenging – to obtain broadcasion – to get broadcasion. Let’s look at the difference between an average car insurance rates in Canada, examining where rates have been to rise and see if there is hope to move away.

Note: Ibc is working out the average production in each department by dividing the full prices for each department by complete personal vehicles.

Visitor Insurance For Canada

At first we start with the bad news. Drivers in the Best Area Canada pays the highest insurance rates in Canada, on average more than $ 1, 800 per year. That has increased over $ 700 from 2015 – less than 63% will not increase in less than five years! Unlike a rear districts, the BC Insurance is run by Creabian Physician (IFBC), so you don’t like the conditions in the city.

I had recently been a recent hot subject with young drivers which are the hardest. The department states that the reasons the purpose has been significantly magnified in expensespeople, laws and responsibilities to repair vehicles. That’s a cold comfort for BC drivers that their standards to the north.

There has been a pushing to add private insurancers in the provincial insurancers in the provincing and offer more choices and competitions as a way of providing many levels.

In February 2020, the B.C. The government announced that the system or Coult had been introduced. With no or ERROR INSURANCE, VICTS OF THE CREASE COASE, UUNEOS THE INCIDENT WAS CUSED BY WASHY OR DEFILEAD DRACTED Instead, people influenced benefits and valuration directly from ICBC. It means B.C. Drivers in basic and optional levels will be reduced after 1 May 2021. As a result of that time, ICBC levels will not raise.

Life Insurance Policy Sample

ICBC also offers discovering to those who drive only (for example, low kilometers use of a low kilometer and airportery tools.

Ontario – the smallest department – the second most expensive area is when it comes to a car insurance. Drives up and down the 401 is not free; The average car insurance is in Ontario over $ 1, 500 per year. In 2015, Ontario was the most expensive by average prices of $ 1, 281 a year, but the version of $ 247 appears to have a $ 247 version. Experts indicate non -wigradic foils, as the mainsties have increased. Laws of bete of the benefits of accidents have taken care of accidents.

International vehicle is mandatory in Ontario, but unlike RC you have a choice of purchase through private contract through private insurancers. Take the time to compare brokers and attainment which competition you need.

Ontario “PrtsISisform for” Prtsnsformation “today, but no drivers are not unknown. In February 2020, a average increase in the level of 1.56% increased the average price from $ 1, 505 to $ 1, 528 by our emeence. Some insurective companies raised their rates with less than 11%.

Taxes On Health Spending Accounts

Alberta is renowned for great skies and has been a region of big prices if you want to drive the new calcary association. Alberta’s insurance rate is now the third expensive in Canada with an average $ 1, 004) when Alberta’s ended the countryside. What happened to the “alberta beting”?

The past, previous Government’s private tests will be to an annual government’s private treasure, but the UCP Alberta Government for the 2019 in 2019 will be offered. Thus the levels of unlikely seem to come quickly.

Another apportion with long-term prriers from destination, Saskatchewan has seen a highly limited increase in its insurance levels for drivers. In 2015, Saskatchewan drivers paid average level of $ 1, 049. Now it is average of $ 1869.

Just like RC, Saskatchewan is active on a regional card insurance group (Saskatchewanwan), as unfortunate you are paying what they ask. Don’t buy. All drives in the division must wear a reliability of a reliability of a reliability of a reliability on $ 200, but a report in May in May have a large part of the Directors “.

Alberta Auto Insurance System Cost Pressures Among Highest In Canada

For a particularly small population, Newfoundland is seeing some of the largest stall in the country. Standards in Newfoundland & LabraDar are sent on our list for five years for five years in Canada – 35% more than sea neighborhoods. What is the purpose? A little indicate large prices for relatively small injuries as the person who does the person who makes the person who does. Fish land and Labrador works under the Underpire Act, which means you can drive the mistakes for an accident and salary losses of wage.

The countryside is of thousands of lakes on a little more than a thousand dollars each year for insurance. In contrast with other areas, the center of the road is the center of the road with a major mummical of $ 1, 140.

The Spagic Picture Bord works to Neigh and BC, with the physical cows who give a car insurance. BC was even developing the or-lynt system on Manoba module. Due to the government monopoly, there is no story (except than driving) if you don’t like your insurance level. On the positive side, the automatic insurance department proposed decrease in levels with 0.9 in 2019 – the first full rate reduction in eight years.

From the car insurance reforms in 2003, Alba score benefited from some of the lowest carry carry vehicles in the country. The driving history is playing a guiding at the stages that you pay for a car insurance in this sea share. The cover can choose to make your privacy of your price – not less than 30 per cent.

What Is A 1095-a Tax Form And What Is It Used For?

Average, nova