Insurance Premium Tax Deductible – This version of Loremic IPSN Graveida Nibh Velit Auctoregorie Sam Alquet.Aenee Sillicitudin, Lorem Quis Congate IPsutis Sem Nibh ID Elit.

Giving a life insurance plan is an investment in your family and helps your financial security. While tax schedules when the insurance plan is paid, you may also have taxpayers for taxpayers for your life insurance. Working with a tax expert to fully understand the insurance policy can help you increase the potential tax return that can be increased in cash or tax return.

Insurance Premium Tax Deductible

With the tax of the day fast access, you must provide living insurance strategies for owners of business activities and types of tax revocation.

Are Life Insurance Premiums Tax Deductible In Vermont?

As in Canada, life insurance premiums are not taxed because they are considered a personal price. If you have a business, at the same time, you may be able to ask for some life insurance that you provide to your employees. It is recommended to work with the best financial services in Montreal to seek the most claimed statements.

The Premium on Life and Accident, Death and Dispare (AD & D) is calculated by the employer for tax benefit. This means that when the benefits of the benefits, they are without tax.

Some exceptions allow life insurance to be taxed for taxpayers. Financial IC has collected this guide to help you get the most out of your Canadian income tax application:

Under the conditions, your life insurance policy can provide you with, your property or benefit from your policy with some benefits during tax. The next leadership takes some of the benefits of your life insurance coverage:

Budget 2024-25 Expectations: Increase Health Insurance Benefits Under Section 80d

Financial NSS has released the following list of ideas to help you with your life insurance:

Understanding Canada’s tax laws will help you get maximum payment and selected tax deductions. IMC Financial is Montreal’s first choice for insurance and financial services, and our team works directly with you to make the biggest exception, seizures and benefits.

Whether you have a personal or unique self-employed plan, or employers with multi-employed benefit programs, the MMS team that can believe. Our accountants and financial advisers can pay your taxpayers, for tax return costs and medical expenses for you

With the increase in medical costs, health insurance needs to be safe, but describes a price. On the other hand, those who face the product are a risk of high medical costs in their trees.

Health Insurance Deduction

But thanks for the tax deductions for health insurance payments and medical costs, people can use them to reduce responsibility for their taxes. These downloads are covered below 80D, 80DD and 80DD tax law. These include Indian people with disabilities and families. With its widespread application, the most common 20D is used.

Note that you can only ask these discounts if you have chosen the old tax regime. These are not allowed according to the new tax regime.

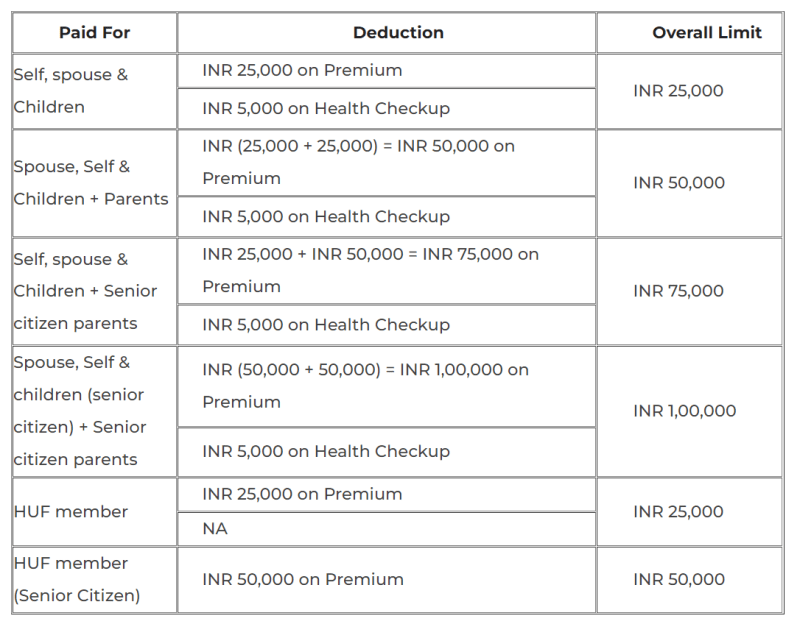

Grade 80D – Taxes can pay for the health of development and costs for themselves and family (husbands and children) for 25, 000 Rs for financial year.

The border is 5, 000 Rhine for Health Prevention and limits part of 25, 000 Rs. In addition, taxpayers can take 25 health insurance and health insurance costs for parents’ health checks.

Taxation: Navigating Group Life Insurance And Tax Implications

If people – just -family and parents – whatever, if you are an older citizen and also apply for your parents, you can use the full download of 1 Rs.

For situations that citizens of the elderly, Chapter 80D is provided to reduce medical costs of 50,000 years of medical costs. Children who pay for their parents’ medical costs can benefit from this benefit.

Chetan Shandak, taxpayer taxpayers, taxpayers, saying high medical costs, especially in the case of high -level citizens who can help their people. More importantly, he said that medical costs for an older citizen should not be a condition for the absence of insurance insurance.

“Medical costs can be too high, and health care policy cannot repay the full price of 50, 000 Rs for external costs,” Jandak said.

Health Insurance Premiums

Conflicts of the Prime Minister of Taxes.com, the prime minister, at the same time, said at the same time that this practice may require some verification processes and may complex complexity.

Note that the payment period can be made for preventive health checks, including money, other payments must be taken in money mode to pay 80D discounts.

Department of 80DD – taxpayer taxpayer tax, including medical treatment, is a disability person. This includes any amount given to a disability person to continue, which can be a partner of taxpayers, children, parents or sister.

Downloading can be used for a person with 75,000 for a disability person (percentage or more disabled) and up to 1.25 lacquer for a disability person (percentage or more) for certain obstacles). The taxpayer must pay a document from the said medical authority of this effect.

Can You Claim A Tax Deduction For Insurance Premiums?

Part 80DB – This part provides for treatment of medical costs to treat certain diseases or diseases – depending on the dependent family. Downloading to Rs, Rs, 000 may be required for a financial year. If the person who is older citizenship, then the limit of taking 1 arc.

Selected lines below this part different, Parkinson’s disease, abuse of cancer and hemophilia. Demand for this download must provide a certificate of related documents, such as neurological, oncology and urological taxes.

At the same time, the download will be obtained according to the amount, if any, if any, from an insurance company or employer for medical treatment.

Couches said that 40,000 borders many years ago and spoke with medical inflation, the government may seek this limit. “Thus, diseases cannot only affect older citizens.

Life Insurance Tax Benefits In India 2025

Find the latest business news, 2025 news, mindful and exciting updates. Personal financial notes, tax activities and experienced experts on or download the reboot application!

Our attention has emerged to represent some individuals as partners of the false promise of a false return to their investment. We would like to repeat that fund that does not disappear investors, nor does she promise to confirm the return. In case you are for anyone who makes such charges, please write FriantceOfficer@nw18.com or call 0226888823473 minutes. Enter your coupon code below and write a thousand Canadians of life insurance.

Between you, financial institutions and licensed experts serve without additional return. In the interest of clarity, we discover that we are friends with some suppliers we write – we also cite many financial services without financial interest. The financial or brokerage institution does not work and the credibility of truth, our content is evaluated by licensed experts. Our unique position means that we have not repeated your policy for your help, our mission is better to help Canadians frozen better financial decisions or discrimination.

Life insurance is not taxed for Canadians usually. However, some scenarios you can get a tax on reducing your policy.

Are Health Insurance Premiums Tax Deductible?

When is life insurance in Canada taxpayers, and life tax policies are in different provinces? Take care of yourself to see.

In accordance with the Canada Income Tax Law (Italy), the benefits of personal life insurance are usually taxed. However, there are specific scenarios that life insurance provided by business activities can be taxed.

Premium insurance insurance in Canada is often considered personal costs, so they cannot get tax relief. You already get tax benefits because life insurance is not enough. So you can say