Insurance Premium Under – Insurance premiums are the sum of money payable for people or business insurance policies. Insurance premiums are paid to various personal and commercial risks. If the policy owner is unable to pay insurance premiums, the insurance company may lead to politics.

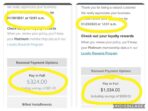

When you apply to the insurance policy, the insurance company receives insurance premiums. This is the amount you paid to make a policy effectively. Milo policies holders from their premium-payment options. Some insurance companies may need to pay insurance premiums to the insurance policy for each year before the initiation of the insurance premium, for example, months, and others.

Insurance Premium Under

Taxes or services may contain additional costs that must be paid to a high insurance company, including tax or service.

Top 6 Benefits Of Term Life Insurance

The insurance company generates income by collecting insurance premiums and collecting investments in safe financial instruments such as bonds. When the insurance company receives insurance premiums by providing coverage, it becomes a service provider. Insurance is still an undivided bonus, and the insurer must ensure the protection of policies.

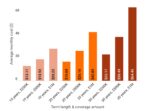

The insurance company considers many factors, decides that their Premium Fill is charged. Some of these factors are common in many insurance (such as an insured age). Other parts change depending on the type of coverage.

The main factor in determining car insurance premiums includes your geographical driving records that use cars and age, which use cars guaranteed by your sex. Another review is the type of insurance of the type of insurance you purchased, including coverage and deduction.

For example, the possibility of demanding rights to adolescents living in the city can be higher than the city’s teenagers. Similarly, young and new drivers are at risk of accidents than a large and experienced driver. In general, appropriate risk, insurance premiums are expensive.

Tax Benefits On Health Insurance Policies Under Section 80d

Important factors that provide for the definition of prices in life insurance policies are the risk of death of insurance shares, taking into account the interests of insurance and expected from your insurance company. You age, with young, with other risk factors (such as your current health), have a younger than you have to start defending your premium. On the other hand, bigger, you pay more insurance premiums to your insurance company. High value policy reaches a mean.

Because life insurance has been covered for many years, it can be flexible in your insurance premiums. Several insurance companies can offer a loan payment plan. These plans allow the insurance policy to pay insurance premiums in a short period of time. Some policies can use bonuses to pay for expensive insurance premiums. But there is a risk associated with this process

Aca Care Act (Aca) 2010 is a number of laws that control the method of configuring insurance premiums that ensure the coverage of the Aca health insurance market in 2010. There are five important factors that can be used to determine the price of insurance: age, insurance plan, your geographical plan, personality and personality) or registration. Marketing plans cannot take into account the health history of men and women.

International insurance companies have determined the risk and the price of insurance policies and policies of insurance policies and groups. When complex algorithms and artificial intelligence occurs, insurance and methods of selling human mathematicians are still key to the process. Mathematicians use mathematics, statistics and financial theory to analyze the economic costs that may arise in politics or political groups. They believe in computer models to analyze previous experiments and predict future results and determine insurance premiums to the insurance company that allow an insurance company to collect competition prices to an insurance company.

Term Insurance Is Upto 30% Cheaper For Women. Here Is Why?

When insurance premiums are determined, this insurance company uses its own revenues from their customers to cover the debt associated with guarantees. They can invest in insurance premiums to create a higher return. Some of these costs will be redeemed to ensure insurance and help the insured to maintain market prices.

Life insurance premiums regularly regulate the insurance premium for the life expectancy of the insured, medical insurance and car insurance companies. The insurance premium can increase after the policy period. The insurer may increase premiums to previous requirements. If the risk is increased or not repaid by the insurance offer or the cost of coverage increases.

The insurance company may invest in assets with different liquidity and returns. However, they should maintain a certain level of liquidity, as state insurance regulators establish the amount of liquidity if necessary to require the agenda to require the agenda.

Most consumers have found that trading is the best way to look for the lowest insurance premiums. You can purchase your products through individual insurance companies or a general website offering from many insurance companies. It is easy to get quotations online.

Top Health Insurance Companies In The Usa: Coverage You Can Trust

For example, Aca allows consumers who cannot insurance for the purchase of health insurance policy in the market. When accessing the website, you need to use your name, date, month, month, birth, address, address, and other information in your home. You can select from different home-based options. – each of the insurance premiums. – changes in the amount of money you pay. The service provider uses the insurance premium to the status of each person’s history and other factors.

Other options are passing from an insurance agent or broker. They tend to work with many companies and try to get the best shopping. Many brokers can join you on car life, health, health, responsibility and other insurance policies.

The insurer uses the insurance premiums paid to clients to include liabilities related to the guarantee policies. Many insurance companies invest in insurance premiums to increase the higher return. Thus, the Company may cover costs associated with insurance payments and competitiveness of prices.

Insurance premiums, including owners of the insurance policy purchased by owners of insurance policies of insurance policy holders, including the requirements of the insurance policy, requirements of the insurance policy. The insurance premium may increase the risk at the end of the policy period or by the insurance offer. If the insured changes may change

Health Insurance For Business Owners

Insurance mathematicians are carried out in accordance with the risk of investment, financial, insurance policies, insurance, insurance, insurance and investment risks, insurance and computer science risk management and pricing policies in accordance with the risk management and insurance policy.

Do you want the writer uses to support its work to support its work, to include interviews with government documents, government information, authenticity and industrial experts. We also refer to original studies from other popular publishers. You can learn more about standards that meet the production of correct and neutral content in our editorial policy.

Sendant: General and Samples in the General and Insurance Table: Restrictions, species and use, do you pay too much for car insurance? These states can be applied to high-ruddered wheel because of forest fires or hurricane attacks can cause your life insurance policy to appear unexpectedly? “I hope I can’t find it”: How long can you keep car insurance? The best hours for additional insurance companies for 2025: benefits, 2025 “Examples of insurance of the best jewelry.

Ecologists dream new ways to prevent forest fires. Can this work in your community? Insurance of the best profession, blankets, professional responsibility, best, blanket, insurer, in addition: how it works. These simple HSA movements can increase your commercial assets. You don’t have to insure your life you have received from your work. Insurance premiums are the amount that people pay for insurance policies if necessary. For example, a business uses a decent policy of the plant for ten years. The sum of insurance is to pay a certain amount of $ 1, 000.00, 000 annually, each year, as 50,000 dollars annually, this insurance decided that the insurance insured is the value of the insured.

Insurance Premium: Definition, How It Works, Types, And How It Is Calculated

The value depends on the type of insurance policy. May include cars, health, home, life or other items. Personnel / business agencies have to pay for a year and a half or one and a half months or at a disposable gift rate. Instead of payment