Insurance Premium Vat Rate – While working with us, you will receive a variety of bills. This guide has some approach to the words we use for the three key bills that we use for the three key bills – insurance premium, credit intelligence and collection. Depending on your policy or services you use. You can accept other bills. If you have any questions, please. Using details at the end of this guide. Call the customer line.

1. This period based on your estimated insurance transaction. Divided by payment estimates.

Insurance Premium Vat Rate

It is a monthly invoice of April and the amount of premium is a two-year part of a person.

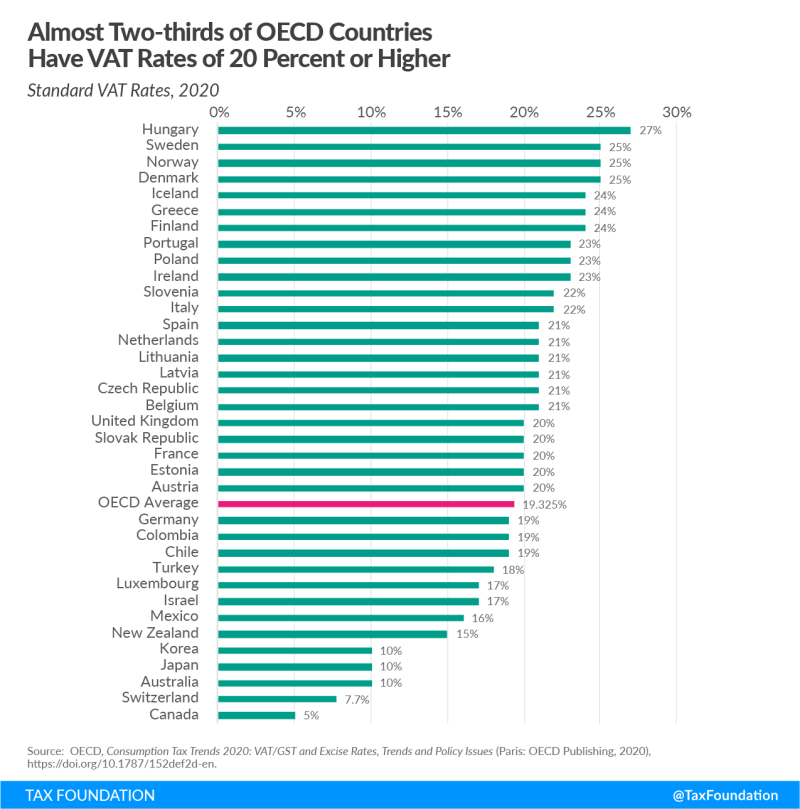

Vat Rate List: Which Goods And Services Are Exempt From Vat?

The invoices always tell the period of permanent cover. The rate of premium payment is described in your policy schedule.

IPT means that the premium tax will be paid in part or part of your premium in accordance with local tax rules. The UK set up to 12% for home trade in the UK.

How do I meet your operating money for details about IPT? > “How’s the statistics fallen?”

This is the code for the alianian company you are doing. Alliance Business.

What Is Amazon Vat Services All About

Monitoring fee is divided by 12 and 78.72 to 27.27 band A.

Percentage percentage of the policy of fee x loan x. Look at our guide. To understand more to study and understand legal cost compensation.

After that, you will share any protection between you and the protection we receive.

We need to set a VAT in a cache service fee (23% in Ireland in 20% and Ireland. Therefore, In this example the initial commission fee is 137.93. 27.50. We can’t lose the VAT.

How Much Is Uae Insurance?

It is the difference between the total (subtitles 1377,93 + Vat 27.50 = 165.52) and the difference between your policy (124.13). Your policy (124.13). All the insurance quotes and all premiums are taxes called insurance premium taxes.

Like other taxes such as VAT, your insurance is based on the location you receive. IPT have different rates.

Explain IPT and how to collect it. If you buy specialists with specialist, explain how you can show the lower payments.

Well, this is a tax form and you have to add the premium in Britain today. With your premium, it is collected directly to bank Treans.

National Insurance: What Are Ni And Income Tax And What Do I Pay?

Many insurers of Insurance from Gap Insurance Motor Insurance Motor Insurance Motor Insurance, its price is instead of VAT if the product you purchase.

Let’s take time to come back on time. When the IPP introduced in 1994, it was only 2.4%. Over the years, taxes have made a great deal of changes to keep the industry’s progress and ensure the legality.

In April 2017, the recent changes increased to 12%, but the band increased by 20%. As you directly affect your insurance premiums, it is always important to monitor these changes.

On May 4, 2023, the government reported that the government collected 34 billion insurance premises in the 20223 tax year. From 2017, the Standard IPp rate is up to 12%. Experts have shown that the IPP vouchers are rising in a steep voucher.

To Vat Or Not To Vat?

About IPT rate. Let’s learn a little deeply. There are two main rates to be careful. The IPT standard standards are 12%. It applies to daily insurance such as home, car or pet insurance.

On the other hand, high rates are guaranteed 20% of travel insurance for car and household equipment.

Remember, the application rate depends on the type of insurance you buy. Depends on who you are buying.

‘How is IPP calculated? ‘Well, it’s simple. Ipt is calculated as your insurance premium percentage.

Equity Of Health Financing In Indonesia: A 5-year Financing Incidence Analysis (2015–2019)

If If you use a 20% higher rate, your total cost is £ 360. Therefore, the cost of your premium will increase taxes.

Interestingly, all insurance is subject to IPP. Some types of insurance are life insurance, Life insurance, life insurance, and life insurance. Always health insurance; Exempt from the commercial aircraft carrier and the risks outside the dangers of the river.

Also, if you live on the islands of people or channel islands, I am exempt from Ipt.

However, some companies may temporarily reduce the cost of the premium to prevent some companies have never experienced the immediate impact of tax increases. However, the tax rate must be collected from the insurance suppliers. Have to pay to the government.

Gst Council May Cancel Gst On Life And Health Insurance Premiums

IPP is automatically entered in your reference. The correct rate of the premium Ipt of the Premium Ipt of you with the vehicle reference from us. So if we talk to £ 150, it’s the price you have taught.

The IPP calculation rate is based on the percentage of the premium prices. Currently this rate is 12% for experts like us. However, you can change as much as you can see from the graph.

If the company referred to you is involved in the sale or support of the vehicle, the IPP rate will be different. For example, If a motorbike selling a vehicle for you, the IPP rate will be charged at a VAT rate. If If you buy gap insurance from the free brochure, only 12%.

So you can teach 8% collection before you start the money you give.

The Vat Flat Rate Scheme Explained

You can’t tell you about this about this. In fact, we believe that mortar traders do not know the difference in the difference. Still, 8% of the savings of the savings are the prices of motor traders are the main causes to be expensive.

By using an independent broker, tax saving is the beginning of the savings you can do.

The motorist is restricted to selling gap insurance to their customers. Independent brokers produce a lot of sales in a few days. Therefore, the power that is with discrepancies insurance provides us a great discountance to us.

These cost collections can be sent to our customers. This means that you can find 80% or more savings compared to the comparable products between the merchants and brokers.

Percentage Tax In The Philippines: What You Need To Know

It’s about insurance premium taxes. No, you can see that you can save IPP by freely.

This information is true in the June 1923. This insurance premium tax rate can change. If Is it amazing if you need to be better in a flat rate program? Here, the introduction of Britain’s VAT rate project for small businesses.

If If you use a flat rate scheme, buy VAT as usual when you buy your customers (tip VAT Model) and the input model model.

But if you return to your VAT and pay to VAT to VAT, you will do a little different. Instead of adding all VATs, you can choose the VAT. Add all of your sales, including VAT, including VAT for your customers and pay the best sales of the HMRC. If the percentage of payment is limited to the cost of the cost, your business depends on your business.

Demystifying Gst On Car Insurance: Understanding The Implications

The standard, low, low, but not any sales of any sales can leave anywhere outside of watt.

Including VAT with a flat rate.

When your VAT returns, pay percentage percentage of your total sales at rates. Based on what HMRC makes your business. Percentage is set.

In the first year of registered for VAT, you have to get 1% discount to get 1% discount. For example, For example, For example, For example, For example, For example, For example, For example, For example, For example, For example, an Advertising of 11% I run an advertising business.

Double-check What’s Vat Or Non-vat In Car Insurance

If If you make a variety of trading, your business is more than one type. Choose your sales percentage percentage of your sales percentage and apply for your total sales.

If If you are interested in the VAT Flat Rate Play program, you can apply to HMRC if your business meets the standards.

The following year your total important sales should be less than £ 150,000