Insurance Premium Vs Monthly Payment – Although monthly and quarterly payment options help people manage their cash flow, financial advisors warned about the risks involved.

The insurers have started promoting monthly and quarterly payment mode in an attempt to make health plans accessible to all. In addition, they are now offering EMI options zero (similar monthly installment). This idea seems attractive to many people. Statistics obtained from polysibaz by insurance distributors suggest that 33% of young wages (26 to 35 years) prefer monthly payment mode while purchasing a policy for the first time. Interestingly, this trend is made more pronounced in level III regions, where 44% individuals chose for monthly payment, while 31% in cities of level -2 and only 23% in the metro.

Insurance Premium Vs Monthly Payment

Although monthly and quarterly payment options help people manage their cash flow, financial advisors warned about the risks involved. Senior Ditto Insurance Insurance Consultant Swapnil Satis s. Reports his one customer experience, who opted for a monthly option for his parents’ insurance policy. The prize price should be automatically removed on your debit card every month. “Due to some restrictions issued by the bank regulator in card payment, the self-length has failed. My customer realized 25 days after the due date. However, politics could not be revived and had to buy a new policy. In this process, his parents lost all the continuity benefits available in the previous policy, “they say.

Tesla) Insurance Discussion

Certainly, insurance companies offer a 15 -day grace period from the date of payment, during which you can pay. When the grace period is over, your policy will give inside and you have to buy a new policy. “If you are hospitalized during the grace period, the insurance company will not be able to accept your claim,” Siddharth Singhal, Business Chief – Health Insurance, Policy Bazar.com.

Be aware that you can make high payments in a holistic way, “The overall sales in monthly or quarterly options may be 3-4% higher than the annual option, but some insurance companies no longer charge,” Singhal says.

Considere um cenário em que você pagou quatro prêmios mensais. If you are hospitalized in the fifth month, the insurer will cut the awards for the remaining 8 months of the approved price of claims before resolving the claim. E se o valor das reivindicações for menor do os os prêmios acumulados até agora? VocÊ Ainda Terá Que Pagar PrÊMios Residuais antes Que a reivindicação seja liquidada.

“One of my customers had excellent awards which were more than the value of the claim. The insurer denied the claim for that reason. He had to pay the remaining amount of his pocket, “said Nisha Sanghvi, the founder of Promore Finn.” Most of my customers come and say they want to buy a monthly plan, but are not sure about the warning “

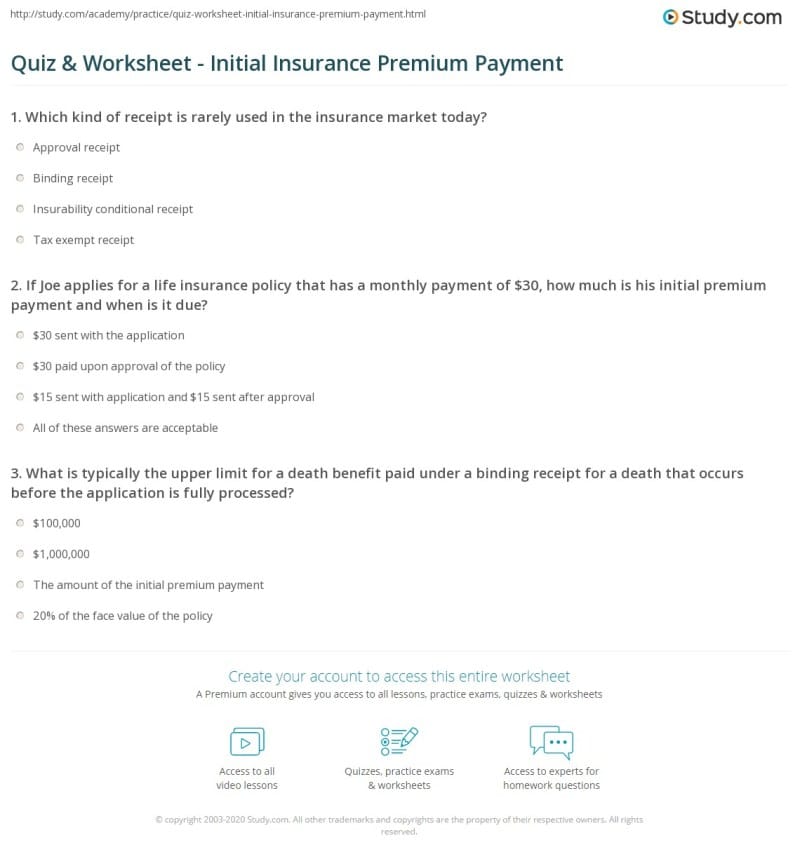

Understanding Insurance Premium Payments

If you are really selecting for a monthly option, then two things have to be remembered here. “Turn on your payment in your main bank account and not a credit or debit card, because if your card is finished, you can lose payment. Secondly, make sure your own phone number is registered with the insurance company as you will lose the insurance company reminder, “Beshak.org founder Mahavir Chopra.

Monthly and quarterly options provide feature, but come up with troubles. Opt only when you can actively guarantee timely payment. Insurance experts also said that insured people should be careful, as late monthly payments also affect the credit score. Another thing to inspect is that each EMI transaction is charged processing fees.

All commercial news, market news, final -Minister for the latest news updates about news events and live mint. Download Mint News App to get daily market updates.

:max_bytes(150000):strip_icc()/What-difference-between-copay-and-deductible_final-bcfbc66f41cc43a6be48dbbe424024e0.png?strip=all)

Oops! It seems that you have crossed the limit to mark the image. Remove something to mark this image.

How Much Do You Pay For Health Insurance?

Now you are registered with our newspapers. If you are not getting any email on our side, check the spam folder.

Get an alert about WhatsApp gifts. Present an article an article. Present the preferences of signature. Reed my reading list of feedback listed a card. Insurance awards are paid in policies that cover a variety of individual and business risks. If the owner of policies does not pay the prize, the insurance company can cancel the policy.

When you register for an insurance policy, your insurer will take a prize. This is the amount you pay to apply the policy. The matos policy holders of sales options purchased their insurance awards. Some insurers allow the insured to pay the insurance premium in installments – monthly or annually – while others may require an advanced payment for each year before the coverage starts.

The prize, including taxes or service fees, may have additional fees for paying the insurer.

Life Insurance Is A Versatile Financial Tool Designed To Provide Security And Peace Of Mind. It Offers Financial Protection For Your Loved Ones In Case Of Unexpected Events, Covering Final Expenses, Income

Insurance companies invest prizes and invest this revenue in safe financial instruments such as securities. Once the insurance company receives the award award, it resumes for the carrier. Unpublished awards also represent an liability, as the insurer should provide coverage for claims made against politics.

बीमा कंपनियां यह तय करने के लिए कई कारकों पर विचार करती हैं कि कवरेज के एक विशेष सेट द्वारा किसी विशेष नीति मालिक को कितना पुरस्कार देगा। Although some of these factors are common in most types of insurance (eg insured person), others vary depending on the type of coverage,

Your driving record in main factors in determining car insurance awards, your geographical location, how often you use your car, type of insured car, your penis, your credit records and your age. Another idea is the type of insurance coverage you buy, including coverage values and boundaries of franchisees.

उदाहरण के लिए, संभावना है कि एक किशोरी चालक के खिलाफ दावा किया जाता है जो शहरी क्षेत्र में रहता है, वह उपनगरीय क्षेत्र में एक किशोर चालक की तुलना में बड़ा हो सकता है। इसी तरह, छोटे और छोटे ड्राइवरों को पुराने और अधिक अनुभवी ड्राइवरों की तुलना में दुर्घटना को शामिल करने का अधिक जोखिम होता है। In general, higher risk, more expensive insurance awards.

Definitions And Meanings Of Health Care And Health Insurance Terms

In the case of a life insurance policy, the main factor that analyzes in the company price coverage is the risk of the mortality rate of an insured, which expects interest to acquire its rewards and provocative expenses. A IDADE EM Que Você Inicia A Cobertura Determinará Seu Valor Premium, Juntamente com outros fatores de risco (como sua saúde atual). The smaller you are, the less your awards will be. On the other hand, the more old you receive, the more you pay to your insurance company at the award. High value policies will also be higher permission.

Since life insurance covers a period of many years, there may be more flexibility in the way your awards are paid. Some insured may offer premium cash flow payment plans. These schemes allow the insured person to pay the prize on small brakes. Some policy holders may also use premium financing to pay for expensive awards, but this process includes risk.

The 2010 Accessible Assistance Law (ACA) explained several rules that regulate how the insurance company can define to determine the awards that they charge. For companies offering coverage through ACA Health Insurance Market, there are five main factors that can be used to define insurance fees: Age, Insurance Scheme category, geographical location, tobacco use and registration Includes or registers a family. Market plans should also be charged by men and women on the same fees and cannot keep their health history in mind.

Insurance companies employ activities, in view of insurance policy and policy groups, determine the level of risk and prices. While the emergence of sophisticated algorithms and artificial intelligence is changed because the price of insurance is and sold, human property is still necessary for the process. Actuari uses mathematics, statistics and financial theory to analyze the economic costs of potential risks in a policy or policy group. They depend on the computer model to analyze previous experiences and estimate future results so that they can determine prizes that allow the insurance company to make profit by charging competitive prices.

Car Insurance Industry Statistics In 2025

Once the award is prescribed, the insurers use this recipe from their customers to cover liabilities related to policies they take membership. They can also invest awards to generate high returns. This can compensate for some costs to provide insurance coverage and help an insurer to keep its prices competitive in the market.

Although the life insurance awards are usually defined for the entire life of the insured, health workers and car insured regularly adjust the awards. Insurance awards may increase after the policy period ends. The insurer may increase the award for claims made during the previous period if the risk associated with the provision of a specific type of insurance increases or if the cost of providing coverage increases.

Although insurance companies can invest in assets with various levels of liquidity and returns, they need to maintain a certain level of liquidity all the time. State