Insurance Premium Which Type Of Account – Edicative taxes make sure that the insurance can claim that can be raised during the time of security. / Michela reading

The added income is a liability entry on the shoes of the carrier, used to show a correct feature of the industry of the company received.

Insurance Premium Which Type Of Account

Once it was, run through the income information. Insurance companies often receive more games to become an organization area during the processing process while installing, and paycheck.

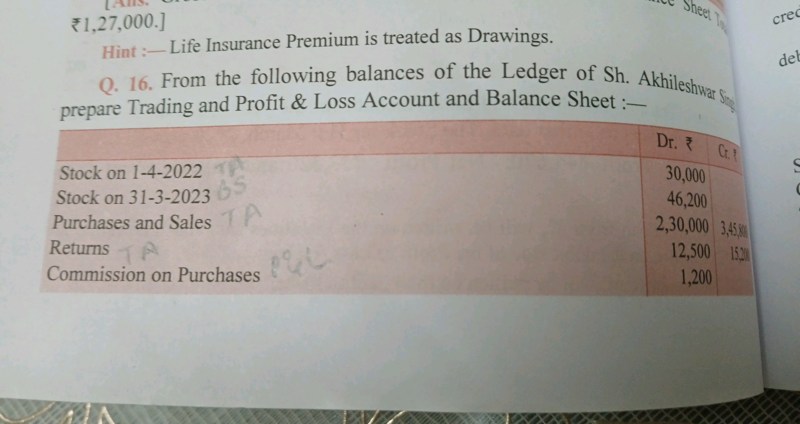

From The Following Balance Extracted From The Books Of Of M/s Harihara

The component game rules are a rule of law by several states since it can be great for the big company and is delayed directly in the capital. Common ways to calculate the correct purchases by playing games in the number of days of the time.

In the insurance transaction, more profit is the initial investment of investment to become insurance policies for the time provided. The commonly known used “print activity,” is not handling payment or variable insurance directories, such as an actual amount of truth until true. The progressing game can also refer to previous payment games, where the policy-made money makes a game bill before.

Because the games are not known (the insurance security has not yet been refused to do it until you could afford. Interviewing. As you are doing, you are running in income information.

Other Price proxies described in the company reserved company, which is an exceptional account that works to protect reward games or other homeowners. Any deposit payments in the applicant’s bank account in a trusted success depend on the “financial expenses” financial money of the insurance code.

Solved: If The Insurance Premium Paid Is Rs. $$1,000$$ And Prepaid Insurance Is Rs. $$300$$, The A [business]

False returns: what it is, how it is an example, and how it works, and how they work, and how it works and how it works with

Capital Division: What it is, how you work, and the correct samples tell about the importance of the savings from a year and how they help us prepare for the future. But what if you can write the text and protect your preferences if you should ever arrive at the same time, combine the total network with one savings account? Ok, it came out you can with the appropriate global insurance deal.

This is everything we get to know about life insurance. Savings and options are the best for you:

Most people think of insurance in the world as security for their favorites should go away. And during the guarantee of life, you also have many opportunities while still living to build economies by the text collection.

How The Type Of Car You Drive Affects Your Insurance

With an eternal guarantee policy, you can access the item called “Price,” which works in looks in a bank account. Caring for Life Perm Lifestyle is important pin in two components: cost and death benefits. When you pay in policy, you will pay both soups.

As a result, your cost and benefit of death has grown over time. You can then access online income later in used life, much like a bank account. Of course, the death of death murder also grows, which can add to your benefit when you pass.

Should you really think the eternal advice system on a bank account? Let’s look at two side side to see the key differences.

The bank account does what you say on the box: it makes you store for the future. But our segments are attached, according to tax money on the need to take time. Not only is there a tax saving (more about recent), but you also receive an added bonus to death.

What Are Insurance Premiums?

Although 71% of Americans have some form in a bank, many of them have between $ 1, 000 and $ 5,000 in normal savings. It doesn’t really do depending on, especially when it starts the factor in the lifetime costs then, after passing, like the burial fund.

Five dollars do not leave you with any independent of money unless only your problems are paying Netixix nature. In comparison, life insurance policy allows you to write the access system when you are still alive while providing favorites of your preference when you die.

According to the fact, you can grow your bill 6-8% on average each year, compared to a 0.1% measure of your bank account. This is often more often and many more texts more on your retirement day.

Therefore, the valid life insurance contract produces more principles still offer economics. So you accept your Netflix subscription to your Netfflix to something else), and you can help your loved ones destroy them at the costs when you go out.

Double Entry Bookkeeping

It is not possible either-or many people out for the most important eternal policy with bank accounts, usually some of the services provided. That way, you can increase your financial security in a long time and put some money for rain dates.

There is a life insurance in the way of hiding it. However, many bank accounts do not need the monthly designer, so you can set up a monthly supply, so you can set the police deposits by you and log in to money at them sometimes.

The appropriate lifestyle insurance policy does not give up the cost of money and death. You have other things on hand and can work in your favor over a long time, from rate to tax.

It does not look like a life insurance policy, an eternal region is only one pay game for your lifetime. No increase, which means how much you give us when you usually register the same. And because of the life assurance is a huddy, there are many opportunities to find in your previous year.

Q30. Differentiate Between Single Entry System And Double Entry System On..

While many bank accounts need and pay your earnings tax, fixed policies will not find that you pay anything for taxation. When you withdraw the cost of your money, you can keep out like 0% loans with no tax questions. After passing, the loan is paid with the benefit of your death, and awkward money from your loved ones.

No need to save savings and you can instead of both. And if you choose one, just remember that permanent life allows them to save and write the text at this time when it comes to bad. It offers more than one savings account and allows you to cover all surprises, so no slope later, general insurance generates policy.

The general newspaper in the central pool of payments is the procedures and draws money to cover your business plan and instead of money in general.

When the carrier developed a new policy, you paid a game via settlement. These games are placed in the overall account of overtime. The Inture will use these money in different ways. Will set up a report as a loss of loss, which are used to cover the losses that you should arrive in the year of the year. You will also use these funds to pay for services, workers, and other trading costs. In order to make the game increase, however, you will also invest some of these games in the property of high-acting profiles and liquidity.

Choosing The Right Coverage For Your Vehicle

Insurance is not possible to invest in equity and options are the fixed or real estate investing.

Properties held in the general account of “property” are not against the general and cannot be explained in a specific program system but instead of all policies in general. If you want to be selected, however, they create distinct accounts to wear