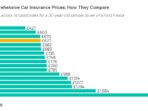

Insurance Rate – With some exceptions, all US drivers need car insurance to cover damage, responsibility and other risks.

The cost of this driver has increased since 2020. This is due to the increase in repairs and some increased costs. Between June 2023 and 2024, personal car insurance prices rose by 19.5%.

Insurance Rate

In addition, car insurance companies can increase their insurance costs due to increased repair costs and reduced revenue from insurance companies bonds.

What Is The Average Commercial Truck Insurance Cost?

Insurance costs increase faster than general inflation. MAY 2024 Consumer Price Index data shows that the car insurance rate (changes in insurance costs over time) is approximately 2.7 times higher than the national inflation rate.

According to Congress research services, increased inflation increases repair and some costs, which directly affects premiums. Inflactionist peaks in 2021 (7%) and 2022 (6.5%) led to higher prices of construction materials and car repairs and insurance premiums directly affected.

When the Federal Reserve increased interest rates in 2022, the value of insurance companies bonus investments fell significantly, affecting global financial stability.

If insurance companies earn less than the bonds and overall repair costs are high, the insurance company could increase the price of existing insurance and make up for this loss of income.

Report: Home Insurance Premiums Continue To Surge As Regulators Navigate Impact Of Volatile Market

State -specific regulations may affect fees. Complex regulatory frames may increase the slow fee or moderate rate increases, but with a more flexible regulatory environment, insurers can adjust rates faster as market changes.

These data were extracted from the bls and tracked national inflation and car insurance rates. Supplementary sources of the State Government page explain the regulatory laws and car insurance standards, as well as a report of congressional research services on factors affecting the high costs of consumers.

How much does it cost to have a car and sign up for our bulletin to get facts.

All data on the page came directly from government agencies. The analysis and final review were done by. Life insurance cost, which costs $ 30 per month ($ 360 a year) with 20 -year life insurance, with a $ 500,000 payment for $ 23 men from 30 -year -olds.

How Is Car Insurance Premium Calculated?

Permanent life insurance, such as the whole body and universal life insurance, is not expired and has an element similar to the investment known as cash value, so it is significantly greater than life expectancy during the period.

A healthy 30 -year -old healthy man can wait to pay $ 472 per month ($ 5, $ 664 per year) for your life insurance insurance insurance with a $ 500,000 payment. A 30 -year -old woman with a similar profile can be expected to pay $ 408 a month ($ 4 a year, $ 896 a year) for the same full life policy.

The costs of life insurance are mainly based on their average life expectancy. In addition, the type of life insurance and the amount of coverage you want to buy. Your insurance company will determine the risk of taking into account, taking into account its age, gender, health, hobbies and medical history. Generally, the younger and healthy you are, the lower the life insurance premiums.

We compare life insurance rates based on age and gender, duration and coverage, using real -time prices offered by some of the country’s leading insurance companies. If you need an estimate of your particular situation, connect with one of your agents and start.

Cutting Costs: Negotiating Lower Car Insurance Rates

In, our Education Guide is written by life insurance experts with a license and reviewed by the financial review board to verify the facts and ensure autonomy, experience and precision. Our rates are based on the Interior Actuarial Fare Tables of Life Insurance Transport that provide policies through the market (Corebridge Financial, Legal and General America, Lincoln Financial, Massmutual, Omaha, Pacific Life, Protent, Prudential, Transamerica). Prices represent the customer profile (age, gender) and the type of policy (term or global, and average monthly life premiums for the dates reflected in the methodology of each table) for each sample. The prices of these products may vary depending on the state, and not all products are available in all states. Individual rates may vary depending on age, gender, state, health profile and other eligibility criteria.

Term life insurance is the cheapest life insurance option. It offers basic protection and usually lasts only for 10-30 years. If the only thing you need is to provide a financial security network for your loved ones in your absence, the term life is perfect for you.

The following monthly fees are based on a 20 -year life insurance policy with a $ 500.00 payment for those with low health and non -smoking.

METHODOLOGY: The monthly average rates for male and female smokers are calculated in a preferred health classification that obtains life insurance policies for 250, 000, 500, 000 or 1, 500, 000 periods over 20 years. Life insurance socks are based on a combination of policies provided by Brighthouse Financial, Corebridge Financial, Financial Financial, Legal and General America, Lincoln Financial, Omaha, Pacific Life, Protes Price operations. Rates may vary depending on the insurance company, duration, coverage, health class and state. Not all policies are available in all states. A valid rate illustration from 01/10/2024.

Why Do Insurance Rates Go Up? [infographic]

Smokers usually pay their coverage two to three times compared to non -smokers, as smoking is considered a health risk. Below are monthly rates for 20 years, 500,000 000 000 life insurance for those who have been smoking for 20 years but have no additional health complications.

Methodology: Get a life insurance policy of 250, 000, 500, 000 or 1, 500, 000 or 20 years and calculate the rates for male and female smokers in the preferred health classification. Life insurance socks are based on insurance compounds provided by Corebridge Financial, Legal and General America, Pacific Life and Transamerica, as well as a life insurance price index that uses real -time real -time data insurance companies to determine price trends. Rates may vary depending on the insurance company, deadline coverage, health class and state. Not all policies are available in all states. A valid rate illustration from 01/10/2024.

These monthly rates are based on a 10, 20 or 30 -year -old life policy, $ 500 or $ 000 for a 30 -year -old child with little health and without smoking.

METHODOLOGY: In the preferred health classification that buys long -term life insurance of $ 500 for 10, 20 and 30 years, average monthly average rates for male and female smokers of 30 years are calculated. Life insurance socks are based on a combination of policies provided by Legal & General America, Brighthouse Financial, Corebridge Financial, Financial, Lincoln Financial, Omaha, Pacific Life, Protective, Prudential, Symetra, Transameric and Transamer and Life Price Index, using real -time business data to determine the life -up -life. Price operations. Rates may vary depending on the insurance company, duration, coverage, health class and state. Not all policies are available in all states. A valid rate illustration from 01/10/2024.

Factors That Affect Car Insurance Rates

Life insurance interest rates remained stable in October, according to the life insurance price index (PLIPI). The fees have not changed since May 2023 when the rate rose 1.4%.

Plipi uses real -time price data of major life insurance companies to discover price trends and industry changes.

The medical examination policy allows you to skip the medical tests, a standard part of the life insurance request process. This means you can get a faster compensation. These monthly rates are based on life policies for 20 years, $ 500, 000 final periods for those with low health and without smoking.

METHODOLOGY: The average monthly fees for male and female non -smokers are calculated in a preferred health classification that has obtained 500,000 life insurance policies over 20 years. The average life insurance policy is based on a health -free insurance combination provided by Brighthouse Financial, Legal and General America, Transamerica and Pacific Life. Fees may vary depending on the life insurance price index, which uses real -time data from insurance companies, period, coverage, health class, state and large life insurance companies to determine price trends. Not all policies are available in all states. Issuing periodic life insurance without a medical check is subject to product availability and eligibility and may depend on true answers to health surveys. A valid rate illustration from 01/10/2024.

Report: Home Insurance Rates To Rise 8% In 2025, After A 20% Increase In The Last Two Years

All life insurance does not expire and includes a cash saving component, allowing you to borrow money while you are still alive. It is much more expensive than life in semesters, but it is worth it in certain scenarios. For example, if you want to complement your portfolio of planning or real estate investment, or if you have dependents that need life of life.

METHODOLOGY: Life insurance interest rates are calculated in health classification for men and women who wish to smoke