Insurance Reimbursement Meaning – Out-of-pocket expenses are fees that individuals are responsible for payments and may or may not be reimbursed in the future. This term is often used to describe the work-related expenses of employees that the company later reimburses. It also indicates a insufficient share of health insurance company holders’ medical expenses (such as deductibles, copays and co-insurance).

Employees often spend their money on business-related expenses, especially when they travel on behalf of the company. These out-of-pocket expenses are usually reimbursed by employers using a company-approved process. Common examples of out-of-pocket expenses related to work include air tickets, car rentals, taxi or ride fares, gasoline, tolls, parking, accommodation and meals, as well as work-related supplies and tools.

Insurance Reimbursement Meaning

The term is also used in health insurance policies to refer to the portion of medical expenses that an insurer does not bear. Out-of-pocket medical expenses include deductibles, copayments and co-insurance.

Dax Presentation Template

Health insurance plans have out-of-pocket expenses set under federal law. These are the upper limit of the money policy holders must spend on health care costs each year. The Affordable Care Act (ACA) requires all groups and individual programs to comply with the annual updated maximum out-of-pocket cost guidelines.

In 2024, out-of-pocket expenses are $9, individual coverage is $450, and family insurance for market insurance plans is $900. For 2025, out-of-pocket fees are limits to individuals at $9,200, for one family at $18 and for one family at $400. Market healthcare plans cannot have out-of-pocket maximums that exceed these limits, but many offer lower maximums.

In health insurance, the deduction is the amount of insurance you pay annually. Fees to be paid before insurance coverage begins. When deductions are deducted, the policyholder “shares” the expenses with the insurance plan through co-insurance. For example, with the 80/20 plan, policy holders pay 20% of the fee, while the plan gets the remaining 80%.

The co-insurance fees you pay, as well as your co-payment and deductibles, are all counted as the highest out-of-pocket expenses of the year. When you reach out to out of pocket, the plan will pay 100% of the coverage for the rest of the year.

Pdf) Discussing Patients’ Insurance And Out-of-pocket Expenses During Gps’ Consultations

Some plans are higher than others. Generally, the lower the premium you pay, the higher the deductible, the higher the premium you pay, and the lower the deductible.

A high deduction health plan (HDHP) can save you money in the form of a lower monthly premium. You may also be able to earn tax loss medical expenses through a Health Savings Account (HSA).

HDHP is a health insurance plan for the 2024 tax year, under the Internal Revenue Service (IRS) rules, with deductions for a single plan of at least $1, $600, or at least $3, $200 for a family plan. For 2025, the number of individual plans rose to $650, the number of family plans rose to $300, and the number of household plans rose to $300.

:max_bytes(150000):strip_icc()/accountableplan_recirc-resized-7da256a7f76046059b822ecebd90d58d.jpg?strip=all)

For 2024, out-of-pocket expenses may not exceed $8, individual out-of-pocket expenses may not exceed $8, households are $16 and households are $100. For 2025, the number for individuals is $8,300, for one family is $16 and for households is $600.

Tenant Liability Insurance Coverage Vs. Renters Insurance Blog Image

For those who expect medical expenses in the coming year, it makes sense to minimize premiums and choose HDHP, as you may not need enough health care to outweigh the high deductions. If you expect huge medical expenses, plans with lower deductions but higher premiums will be desirable, so insurance reimbursement will start earlier.

HDHP allows holders to contribute to HSA. 24% of policyholders within the federal tax range can use the HSA to pay $3,000 in medical expenses with pre-tax money.

In the 2024 tax year, the maximum allowable contributions for individual programs are $4,150 and the households are $8,300. The “Catch-up” rule still applies. These contribution limits rise to a maximum of $4,300, with a single plan limit of $8,550 and $550 in 2025.

When deciding whether to choose a plan with high or low deductions, estimate your medical expenses for the year and look at the premiums, deductibles and out-of-pocket expenses of available plans.

Definitions And Meanings Of Health Care And Health Insurance Terms

Here is an example of out-of-pocket expenses related to the job. Suppose an employee has a meeting with potential clients. The employee spent $250 on air tickets, $50 on Uber rides, $100 on hotels and $100 on meals, all of which charged their own credit cards. After the trip, the employee submitted a fee report for $500 to cover his out-of-pocket expenses. The employer then issues a $500 reimbursement check to the employee.

An example of out-of-pocket health expenses is prescription medication. Many health insurance plans cover prescriptions, but the amount you pay depends on your deductible liability. If you have not paid the amount of deductible, you must pay any prescription medication from your pocket until you have it.

However, some health insurance plans allow the purchase of general medicine at a discounted price, regardless of whether the annual deductible has been met. Some medical plans and prescriptions are deductible.

Lisa has a $2,500 combined deductible. She has paid $2 out of pocket, $350 out of pocket, and now needs to buy a prescription drug worth $150. Lisa’s out-of-pocket fee is $150. However, her total deduction can now be met this year.

Expense Management & Reimbursement Software

When you meet the deductible, you may still have to pay a certain amount for each prescription. For example, a plan might say you have to pay $10 for each general medication or prescription supplement, which means your out-of-pocket fee is $10 per prescription.

Some out-of-pocket expenses can be deducted from your personal income tax. For example, expenses associated with charitable contributions and unpaid medical expenses still receive income tax relief.

Since the adoption of the Tax Cuts and Employment Act (TCJA) of 2017, individuals no longer deduct outstanding business expenses.

Although tax relief does not mean direct reimbursement, there are auxiliary benefits for them because claiming that these expenses as deductions can reduce your tax burden.

Life Insurer Hi-res Stock Photography And Images

In the real estate industry, out-of-pocket expenses refer to any expenses other than the mortgage itself that the buyer incurs during the sale. These fees depend on local property and real estate, but usually include the expenses of a home inspection, appraisal fees and escrow account deposits, and closing costs, which may include loan initiation fees, attorney fees and property taxes.

The IRS believes that the movement costs are expenses incurred by taxpayers incurred by relocating new jobs or transferring to new locations. However, Thetcja canceled moving fees for the 2018-2025 tax year, except for active-duty military members who ordered them.

Members of the armed forces can use the IRS 3903 form to use the relocation fee as a federal income tax relief.

Active members of the U.S. military can deduct moving fees to deal with military orders that require permanent changes to Taiwan. Eligible fees include packaging, slats, hauling, shipping storage and insurance.

Veteran Travel 101: Applying For Travel Reimbursement

If the government provides and pays any moving or storage fees, these fees should not be required as tax deductions.

Out-of-pocket expenses are payments you earn on your own, whether or not you pay them back. This could be a business expense, such as paying for flights your employer reimbursement, or health expenses before your total expense reaches the insurance deduction.

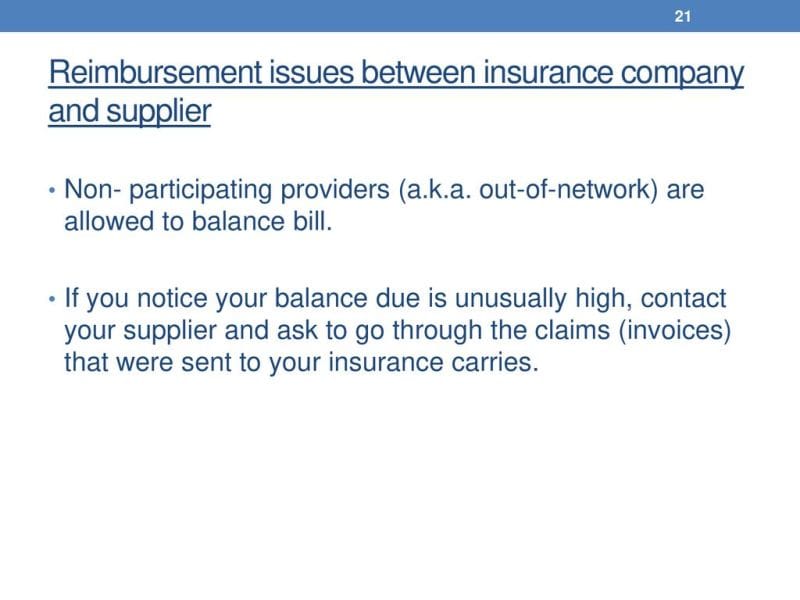

The deductions of a health insurance plan and its out-of-pocket limits represent the point where the insurer pays for all or certain subsequent health expenses. However, they are two things:

The deductible is the insurance medical expenses you have to pay for yourself every year, and your insurance company starts collecting the bill.

Have Two Health Insurance Policies? You Can File Claims Under Both

The out-of-pocket limit is the maximum amount you have for all insurance healthcare during the year.

Out-of-pocket expense limit is your total expenses in the year, including deductible payments, your co-insurance and your shared expenses (if your plan has), the maximum amount reaches the total amount.

The out-of-pocket limit is set by federal law. For the 2024 tax year, your expenses must not exceed $8, individual expenses must not exceed $050, family expenses must not exceed $16, and family expenses must not exceed $16. For 2025, the number for individuals rose to $8,300, for one family, for $16 and for households, for $600.

The attractive plan is to get a high deduction plan, choosing to pay out of pocket for regular health care in exchange for a lower monthly premium.

The Future Of Subrogation And Its Impact On Insurance Companies

If you don’t have a lot of medical expenses, that can work. If you accidentally need a lot of medical care, it can become expensive.

When choosing a healthcare plan, it is wise to estimate what you might be each year before you can determine a low deduction premium or high deduction premium plan.

Plus, your healthcare needs change as you age, family, and as your income changes. All of these factors will affect the coverage you need and the level of out-of-pocket expenses