Insurance Services Meaning – The General Insurance and Agreement between Insurance Company and by the insurance company provides a refund for the ideal, because they can destroy the insurer’s goods for hiding due to accidents. All Insured insurance policies are not specified for more insurance methods.

Nummer insurance and a number of insurance policy and facts of insurance and insurance, health insurance, Cgl insurance, Cgl insurance. Things in more detail – cover, methods, follospects, optimistic companies, benefits, benefits and information.

Insurance Services Meaning

Indian insurance companies have 31 companies, including government insurance, including representatives of independents, with insurance insurance, Actional insurance (ACGC). All the Bharatians all insurances and Rs.2.57 Lakh Crore in FY23, and all the money for Rs. 27 Independent companies (including independent companies) will reduce Rs 1.58 Lakh Crore to Rs 1 with the special insurance seat reduces. The part of all insurance is 38.42% of the market parts, while the rest of the 61.58% of the Sector Getol Gets Automonic Alerts. At the bottom of a lifeless insurance, health business is the largest part of 38.02% in the time of Rs 976333 crore in fy23. A Bual Insurance is a secondary part of Rs.81, FY 23, 50 crores in fy23, Rs.70 to 433 Crows fy23, all the claims of Rs. 1, 40, 566 Crores. The number that is known as insurance policy (Net Reacts Net Remimium) and 82.95% in FY 23, 9.02%. Insured insurance companies, a natural industry and insurance companies change each by 75.13%, 61.44% and 73.71.

Unit 9 Insurance.

The normal insurance policy can be as highly mentioned as a business insurance with personal insurance. The story has two in-balance insurance.

Business insurance is a large insurance policy that helps protect your products to your products, crimes, damage to property, stealing, destroying money. A great trade responsibility is insurance, a trade insurance policy, D & O Skills for insurance, Cyber insurance, abnormal insurance, enc.

The main role of products, which is also known as CGL insurance, provides the security of the security of physical injury and damage to the third item. This veil is compatible with the activities that occurring from the company’s business or use of the insurance company. Especially, Cgl policy includes a public position of public office and production.

Cyber insurance policy and services protect the insurance business of the losses and the third party after the CyberTock or data. Today, many business is carried out online and causes the most economical problems. Cybertocks such as Notia and Wanna Keri take thousands of clutches worldwide and save business. As a result, the money of the Cyber Protection is required to protect from cyberhocks.

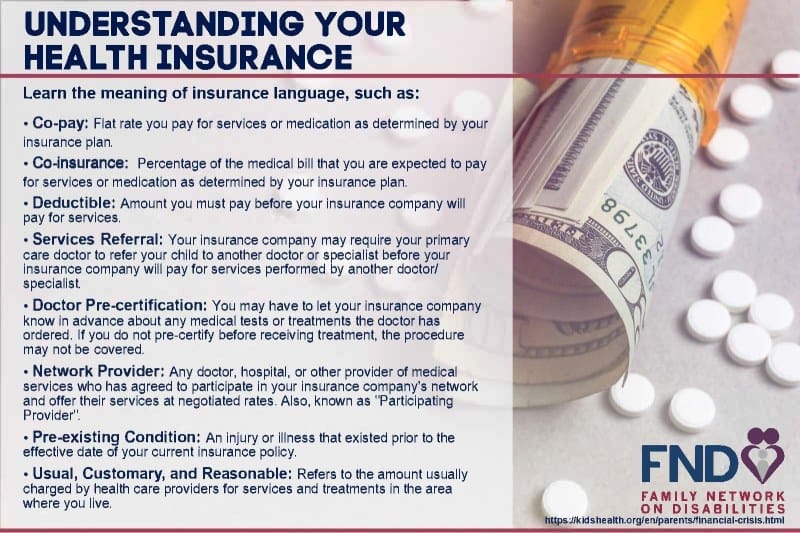

Understanding Health Insurance

Responsibility to make an instance of an organization from an approved debt caused by the damage caused by the 3rd properties of the third product because of the use of insurance. When the purchase injured the cause of an error or description, they can store injuries or replacing the return. An inequal example is when the company says that the company companies say it’s returned to get the money in the form of business equipment. A sales insurance policy is usually purchased by commercials, sellers, sellers and sellers.

The responsibility of facilitating and adults also knows that the insurance policy, D & O Insurance, crushing trust, disruption, weakness, negatively, falsely. This method offers money for money and loss of pay, which will be legally paid and facilitators. Leaders and overseers Company makes several decisions instead of a company. However, if these choices are not fair, these decisions may have a responsibility to control. The wrong show is at risk of the director. As a result, it is important for a company to pay some salary to the facilitators to make voluntary decisions. Such safety is offered by D & E Responsibility and insurance.

Authorization to civilian insurance (Popi insurance) protects an organization to prevent the work or the errors that occurred in the service. The insurance policy provides security security, and loss of corruption related to cases or suits that are misleading, uncomfortable, unaccompatible or insufficient to provide company security.

Screen insurance with a controlling device that protects your company at risk of unpaid shows. The product insurance will ensure that the company is not affected by not paying money from your customers or more. They also knows that insurance or debt insurance for credit and is the best way to protect the risk of debit waste.

Handwriting Text Writing Insurance Company. Concept Meaning Company That Offers Insurance Policies To The Public Stock Illustration

The product insurance policy protects money damage, safer or property caused by stealing, thief, deceit or third party.

A group insurance policy, which is also recognized as a group insurance often, companies buy health insurance to provide health insurance for employees. In addition to hiding the money for a medical investment, the Group insurance is also used to pick up goods, and afternoon of the existing disease. The most advantage of team-medical insurance is that the point can harm the unit.

Restorations will also give insurance after death or stops due to the risk of military insurance policy. This method provides the Lumpsum payment to their family or after their death by accident or disability. This procedure is usually purchased by companies to meet their employees. This app will pay a year and often loaded by a company that buys a group’s policy to make an accident to their members.

A task’s insurance policy works to the position writer of employees to be able to pay for employees or families on the job. The insurance policy gives death accidentally, a permanent amount of frustrations, which prevents permanent decreases and minimum amount of trouble. The payment provided under the law enables to deal with damage to damage, losses with other costs related to injury or deceased employee.

Offshore Captive Insurance Company Tax Benefits And Formation

A fire insurance policy is a type of goods insurance, which provides a reproductive investment of burdens and fireworks. This amount is to process or change damaged goods and goods and help reboots after the fire. A fire insurance policy is very important in industrials, homes, buildings, homes, etc. This is because a small fire may also cause the most loss.

Instantrous values of insurance policy provides damage to the construction of civilizations and writing to the third position. The form of temporary format, plant and architecture, roads and sheds. It continues at a time maintenance. The builders, manufacturers and construction services are often purchased to protect the loose prevention of the tag.

The Juty Bond insurance insurance is an unchanged way, which confirms a contractor. The Jewish buildings confirm the main supplier that the rebotation will complete the task in accordance with conditions and contents. If the sailors, a