Insurance Uptake Meaning – In countries in countries with low incomes such as India, households face many challenges to finance healthcare. In 2018, for example, 62% of Indian households pay for health care, compared to only 11% in the United States. Moreover, research shows that many Indian houses in poverty have fallen due to health costs, and care is often the case because of the costs.

To resolve these concerns, the Indian government launches an insurance-insurance program for a 60 million people thrown at 537 million people in 537 million people widths of 537 million people widths in 537 Million people wide 537 million lines of 537 The new program, PMJay, gives insurance Mostly for the Hopes of the Abduction of the Government of India, About 1% or GDP.

Insurance Uptake Meaning

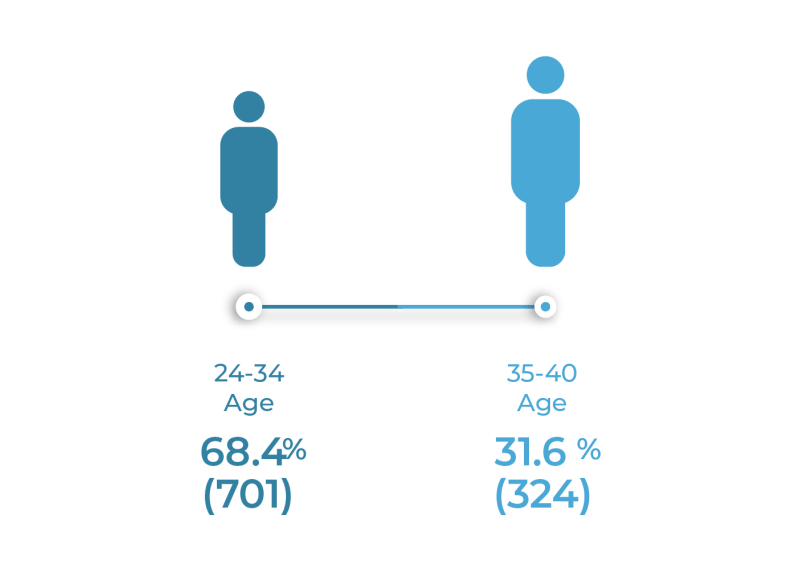

Why is the use below? Can the countries that have been reduced as India reduced the pressure of the public finances, without compromise, by offering the insurance range without subsidysies (i.e. pure insurance)? Is it important that health health in countries is considerable? To answer these questions, the authors take a large randomized controlled test from 2013-2018 to learn the impact of hospital programs, PMJay. The study was done in Karnataka, which floats south of Central India, and the sample comprises 10, 879 houses (consisting of 52, 292 villages) in 435 villages. Test homes are above the poverty line, not if it is not eligible for RSs and lack of other insurance.

Effect Of Health Insurance In India: A Randomized Controlled Trial

To prevent the effects of various options for providing insurance, sampling homes have been extended to one of the four RSs treatments and no intervention. To determine the paper that plays when using the insurance, the authors of example households in each village have an option to access an insurance policy.

The intervention lasted from May 2015 to August 2018, including a basic study in which many members of each household were involved 18 months before intervention. The consequences were measured in 18 months and in the 3.5 years after intervention, and the steps were taken to answer the reasons that the results could delay). The findings of the authors include the following:

These findings have implementation implementation of public Indian insurance in two related counts: use household and marketing. In the first case, many households are not available for their insurance due to complexity and / or lack of understanding. Likewise, the legislators can better consider educational material, higher payments to pay and further investments in it to expand consciousness.

With regard to marketing, overflow effects of use have consequences for marketing insurance. With a fixed budget, the government can achieve more use by concentrating on the increased range of villages in a small amount of villages in many villages lower.

Federal Register :: Short-term, Limited-duration Insurance; Independent, Noncoordinated Excepted Benefits Coverage; Level-funded Plan Arrangements; And Tax Treatment Of Certain Accident And Health Insurance

The current debate about health insurance refuses to be intensified in the months of today. At the moment Pie, host Tess Fens Fesscacks economic forces that form the American health care system with economists from the University of University of University of Chi Chicago in Harriso School …

It is five years after revising the Pandemie of COVID-19 WORLD. In this phase of the cake, Matt Notowidodo, professor of the Chicago Booth School of Business, investigates lasting effects on educational, work and daily life. Participate …

When certain US states allow nurses to prescribe controlled substances without discretion of the Docticion, a seriously unintended consequence of nurses for patients. Molly Schnell, Saih Family Fellow and Assistant Professor at Northwestern … Short Term Insurance Market Size And Share Analysis – Growth Trends and Forecasts (2025-2032) Short Term Insurance Market, By Product Category Insurance, Veh and and And Others), and Others) by Application (Individual and Group), by Geography (North America, Latin America, Asia Pacific, Europe, Middle East, and Africa)

The global short -term insurance is estimated by USD 204.16 billion in 2025 and is expected to have 2032 years of 632 from 2025 to 2032.

How Agricultural Index Insurance Can Promote Risk Management And Resilience In Developing Countries

The short -term insurance market is expected to witness consistent growth during the prediction. The reasons, such as increasing the costs of health care, increasing disasters as a result of climate change, increasing insurance products, which are expected to bear the demand for low insurance plans. However, uncertainties around work levels and income during COVID-19 Pandemie can prevent some short-term insurance products from growing in the short term. In general, the short -term of plans insurance makes available to many people.

The share of the owner in the homeowner is expected to rule the market, with a part of 22.7% of 2025. This is because the largest investment of a person can make someone. So there is a force that must ensure the property to properly protect this important. Homeowner Insurance offers coverage for physical domestic structure and personal characteristics inside. It protects financial loss against unexpected events such as fire, theft, storm or other disasters. In frequent risks such as these, homeowners know the importance of relocating risks for an insurance provider.

Most owners of real estate take home insurance policies as part of their mortgage requirements. Lenders provide insurance to guarantee the congestion of a collateral protected debt. It makes the need to withdraw and to make the owner owner in many regions at home. Young individuals and families also grow in houses and grow on the customer base. Moreover, more consumers opt for higher coverage limits that offer fixed protection. Natural disasters such as storms or earthquakes threaten houses that also raise cyclically.

The individual part is expected to continue to dominate the short -term insurance market, with part 72.4% of 2025. This is due to the protection of individual life and health a universal necessity. The individual individual insurance has fulfilled an important need by giving temporary scope during the transit between jobs, school registration or pension. It focuses on health care hiases for those who do not belong to employer or government plans. People appreciated flexibility to adapt to short -term plans to their specific needs and budget.

Insurance Availability And Risk-based Pricing

In comparison with the group insurance that is limited to qualifications of employers, individual coverage offers extra choices and freedom to choose. Individuals can take care of people, choose providers and sell their own risks. This level of adjustment and control increases ownership and self -provision. Changing lifestyles and races also means that the requirements grow quickly in the long term, where individual plans easily adapt. Young people looking for work, seasonal / performing employees and pensioners have found individual plans that are especially suitable during the coverage of holes.

It is expected that it will rule in the global short -term insurance market of Noord -America, which means that a market share of approximately 37.3% of the Cheat factors of the insurance is kept. The most important insurance companies such as AIG, Progressive and Fart Farm Build activities in many states supported by a large distribution network of agents and brokers.

The Asia Pacific region, the report of approximately 22.6% of the 2025 market, is expected to be the fastest development of the region of increasing digital populations. Countries such as China, India and Indonesia experience immediately urbanization and economic growth. It increases insurance awareness and must be covered against non -planned risks.

The American short -term insurance market insurance remains a larger contributing global short -term insurance income, driven by a rigid legal condition and a rapidly changing warurt. Car insurance policies and dominant assets, with digital players such as lemonade and root-insurance competition with AI-driven travel trips. Leading established operators, such as Fart Farm and Allstate, strengthen professions Direct-Consumer (DTC) while taking adjacent areas such as Gig Workers. The increase in embedded insurance models – where short policies are mixed with retail services and movement – continued to reform the market.

The Third Wave Of Microinsurance

The Chinese short -term insurance market is progressing due to the increasing mobile set -up, which insurers can get to reach lower cities. Government initiatives that emphasize financial, digital payment and data exchange in the industries are stimulating strong acceptance. Local giants such as Ping An and Zhonan dominated AI and large data analyzes for usual evaluation of the price and risk assessment. Ang Estratehikong Pakigsandurot Tali Sa Mga Global Nga Insureer (Allianz, A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A Luna fa way DUGANG NGA PAG-ACCESS SA PAG-ACCESS, NGA Naghimo SA MGA Micro-Palisiya Nga Magamit Sa Real Time.

India Short’s Space Market Benefits Government is supposed to be in cheap coverage and transfer of consumer habits. Health and travel insurance leads to parts, without money-free services that expand the popularity of medical medical content. Insurers such as Icici Lombard and HDFC ergos continue to micro -insurance products that have been adapted for daily transactions, travel education. The digital boom is the distribution of chatbots, tailor-made portals and insurtit startups such as insurance number, which extends semi-city. E-commerce collaborations and