Insurance Us – 25 of the largest life insurance companies in the US- According to the National Association of Commissioner Insurance (NAIC) in 2024, there are 25 of the largest life insurance companies in the US. These companies have developed billions of direct premiums.

Many people in the US still believe in life insurance and still use insurance products. According to Investia, life insurance is a contract between life insurance companies and policies owned by the policy. A life insurance policy guarantees that the insurance company pays a sum of money to one or more beneficiaries mentioned when a person who is guaranteed dies with a premium in return paid by the policy owned by the policy. Finally, this functions as a financial safety, offering protection and providing peace of thought by ensuring that people are financially safe in the event of a policy.

Insurance Us

All data obtained from the 2023 Life/Fraternal Market Report issued by the National Association of Insurance (NAIC), a non-profit organization with the aim of protecting consumers of insurance by promoting the similarity of the laws and regulations of the US State Insurance. Structural, the National Association of Insurance Commissioners (NAIC) is the regulation of the United States standard, which is managed by the Head of Insurance Regulators from 50 states, Columbia District, and five regions of the United States to regulate multistat insurance company regulations. Historically, Naic was established in 1871. The following is the ranking of 25 largest life insurance companies in 2023. Data ratings are regulated based on direct premiums generated by insurance companies in 2023.

25 Largest Health Insurance Companies In The Usa

Life only began with financial and insurance business in 1845. At the same time business development, New York Life is still one of the largest life insurance companies in the US with a total of USD 231 billion. Operationally, New York Life still has a head office in New York Life Building, New York, USA.

Finance, in 2023, according to the annual report balance, the total ownership of New York life insurance reached USD 231 billion with a total responsibility of around USD 206 billion. Based on business performance in 2023, the company earned a total revenue of USD 23 billion with a net profit of around USD 0.027 billion. In addition, according to the Naic Market distribution data report in 2023, New York Life Insurance received USD 13, 287, 777, 787 Premium on US Life Insurance.

Northwestern Mutual was founded in 1857 and grew up in one of the largest insurance companies in the world in the life insurance industry. Northwestern has become one of the most trusted companies in the life insurance industry with several large rankings from several financial institutions. Until 2023, Northwestern Mutual received AA+ from S&P Global, AAA from Moody’s, AAA from Fitch Ratings, and A ++ from A.M.

Finance, according to an annual report in 2023, Northwestern Mutual has a total property of USD 358 billion with a total accountability of USD 320 billion. In addition, in 2023, based on business performance in 2023, Northwestern Mutual earned a total revenue of USD 36.1 billion with a net profit of 0.71 billion USD. In addition, according to the Naic Market Division Data report in 2023, Northwestern Mutual acquired USD 13, 061, 706, 856 and still the 2 biggest direct premiums than other US insurance companies.

Major Health Insurance Companies Nearing Too Big To Fail Status

Metlife Inc. is one of the oldest and largest insurance companies in the world. Historically, the company was founded on March 24, 1868. In terms of operating conditions, the company has a head office at Metlife Building, New York City, USA. Through 153 years of experience and has 40 markets worldwide, Metlife has become one of the leading financial services in the world in the world, providing insurance, annuity, employee allowances, and ownership management. Until 2023, in finance in 2023, the company had a total property of around USD 687 billion and total responsibilities of around USD 657 billion. Based on its business performance in 2023, the company positively earned an income of around USD 66.9 billion and a net profit of around USD 1.6 billion. According to Naic’s sharing data report in 2023, Metlife managed to collect USD 12, 284, 718, 024 from the premium directly on the US Market Life Insurance.

Prudential Financial, Inc. is an American insurance company founded in 1875. In connection with business development, Prudential Financial serves 50 million customers to more than 50 countries in the United States, Asia, Europe and Latin America. In the financial aspect 2023 according to his annual report, the total Prudential property of around USD 721 billion with a total responsibility of USD 691 billion. In terms of business performance in 2023, the company has a total revenue of USD 53.9 billion and managed to get a net profit of USD 2.5 billion. In addition, according to the NAIC report, Prudential Financial received USD 10, 923, 713, 601 live life insurance premiums in the United States (US).

Massachusetts Mutual Life Insurance Company, known as Massmutual, is an insurance company founded in 1851. Operationally, Massmutual still has a head office in Springfield, Massachusetts, USA. As an insurance company, Massmutual has several financial ratings from several institutions including A ++ from A.M. The best company, AA+ from Fitch Ratings, AA3 from Moody’s Investors Service, and AA+ from Standard & Poor’s. Finance, according to an annual report in 2023, the total massmutual ownership reached USD 335 billion with a total responsibility of USD 306 billion. Based on direct premiums, according to the NAIC 2023 report, Massmutual obtained USD 9, 204, 566, 734 premiums in the US life insurance market.

Lincoln National Corporation or Lincoln Financial Group is an insurance and asset management company founded in 1905 by Perry Randall. In the life insurance industry, Lincoln Financial has two products including temporary age and permanent age. Based on financial ratings, Lincoln National captures the best (A), Fitch (A+), Moody’s (A1), and S&P (A+). Based on business performance, Lincoln National suffered net losses of around USD -2.2 billion. Data from the National Association of Insurance Commissioners (NAIC) in 2023 shows that Lincoln Financial received $ 8, 322, 502, 167 from the direct premium written about the United States Life Insurance (US).

How Much Does Healthcare Cost In Your State? Find Out Here.

National Mutual Insurance Company is one of the largest life insurance companies in the United States (US). Historically, all countries were founded in the 1920s as mutual agricultural bureaus and then in 1955, the name was changed to national insurance. Operationally, the company has a central office in the National Plaza, Columbus, Ohio, U.S. In addition, all countries have several financial ratings from various financial institutions including A+ from AM Best, A1 from Moody’s, and A+ Standard & Poor’s.

Finance, according to the annual report of 2023, the national reciprocity insurance company was formed by USD 60.3 billion total revenue with a total net profit of USD 1.3 billion. According to reports by the National Association of Insurance Commissioners (NAIC), all countries have obtained direct premiums written around USD 5, 802, 222, 162 in the US life industry.

State Farm Insurance is one of the largest life insurance companies based in Bloomington, Illinois, USA. Historically, George J. Mecherle began the corporate foundation in June 1922. George was a retired farmer who was widely considered as one of the strongest insurance business numbers. In developing its business, state agriculture uses more than 57,000 people. In terms of financial ratings from financial intuition in the US, state agricultural insurance has a financial rating of ++ from A.M. Best®, AA1 from Moody’s®, and AA from Standard & Poor’s. In other financial aspects, according to the 2023 annual report, state agricultural insurance has a total ownership of USD 220 billion but unfortunately suffering a net loss of USD 4.7 billion. According to reports by the National Association of Insurance Commissioners (NAIC) in 2023, state agricultural insurance obtained USD 5, 754, 456, 473 premiums in the US life industry.

AEGON N.V. is an insurance company founded in 1844. The company still has a head office in the Hague, the Netherlands. Until 2023, Aegon served 23.9 million customers worldwide. In 2023, based on the company’s financial structure, Aegon had a total property of around EUR 301 billion or USD 313 billion with a total responsibility of around EUR 292 billion or equivalent to USD 303 billion. In terms of business performance in 2023, the company managed to earn revenues of around EUR 10.3 billion or USD equivalent to 10.7 billion but suffered net losses around (EUR -0.199 billion) or equivalent to (USD -0.20 billion). According to reports by the National Association of Insurance Commissioners (NAIC), geography in the US market, Aegon received a direct premium written around USD 5, 103, 997, 736 in the life insurance industry.

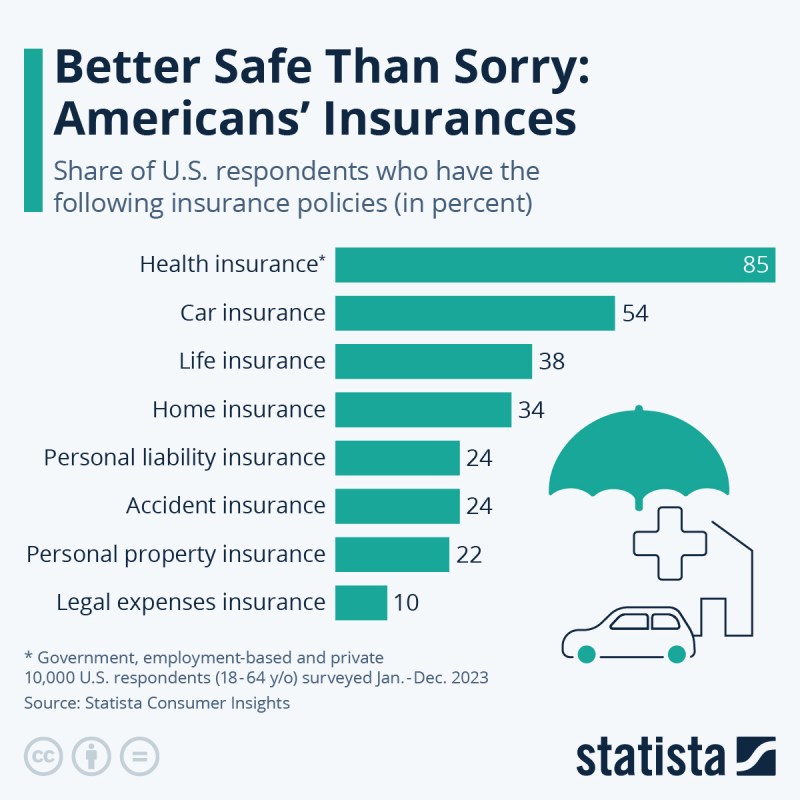

Health Insurance Coverage In The United States

Minnesota Life Insurance Company is a subsidiary of Securian Financial, one of the largest insurance groups in the United States. Minnesota Life has a financial rating from the independent A+ independent agency of A.M. Best, AA from Fitch Ratings, AA3 from Moody’s, and AA-Standard & Poor’s. Finance, in 2020, the company’s total equity reached $ 6.8 billion and property under management reached $ 97.8 billion.