Irs Refund Backlog – Levitown, Pennsylvania (WLOPVI) -When people take their seeds, a large backpack of IRS affects. The government agency says it only made significant progress last month, but the background is still great.

Living in Levtown, Baks Sir says he is doing e-film for family members in February. However, Sam is still about $ 7, 000 of their grandchildren.

Irs Refund Backlog

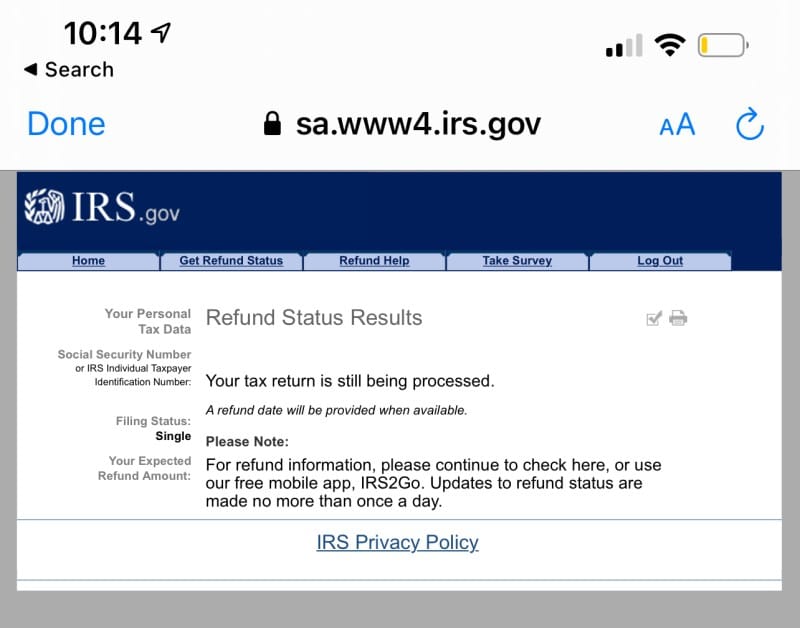

He said, “If you click ‘where’ my AY pays’, he still says that his adspire is under process,” he said. “You can’t even talk to anyone. You can’t go to you you can’t get the answer.”

The Irs Backlog Is Insane #taxtok #taxnews #taxes #tax #dukelovestaxes

The survival said that the process was disappointing because he and his granddaughter were out of work and just a child was born for their family on April 15, they were 3 years old.

US representative Lisa Blunt Rochester and other 13 members, especially on paper income, have called for investigations.

A letter indicates: “The IRS currently has a previous schedule of 1.5 million paper profits received in 2021, as well as 1.7 million paper profits received by the IRS this year.”

“We ask the questions about what they are going to do, not just Covid, not only Covid, but in general and what they are going to do, we are moving forward and received their necessary assistance and assistance for the people,” Rochester -Frey says -Lwyn -Dafod.

How Long Will It Take To Get Your Irs Tax Refund?

The IRS says that most of 2019 earnings are now processed and are currently processing the earnings during the summer and 2020’s fall. He also said that the earning order is being processed.

“I will encourage them to reach their Congressional offices,” Rochester says. “We must make sure they are accessible to everyone.” Many clients still have two questions: “Where is my federal advance?” Following quickly, “Well, why didn’t they process my return?”

“I have informed my clients from the backpack with the tax agencies. So my clients know that the processing time is going to take longer than usual, “CPA Robert Seltzer of Celtzer Business Management in Los Angeles said.” What we can do is to test every few months to get status updates. “

“Many of our clients have been waiting a long time for their tax seeds, especially those who had to file the modified earning and/or paper,” said CPA Gayle Rosen in Martinsville, New Jersey.

Where Is My Tax Refund? 2024 Taxes Irs Status Update

Registered agent of MN Tax and Business Services and Harris Nadig, Michigan’s Canton, Manasa Nadig said that some of his clients were waiting for his federal return process.

“One of them has been waiting since February. I called the IRS, [practicing priority service] Waiting for the line is extremely long and most of the time you get kicked from rows. Clients have reported the same problem, “Nadig said. “I’m not sure whether the taxpayer’s advocate service will help it, but it is worth shooting.”

The National Taxpayer Advocate has created the Congress, although he praised internal revenue service for most earning timely and announced most economic impacts despite last season’s challenges: a background of them waiting for millions of paper processing.

At the end of the 2021 filing season, more than 35 million personal and business tax returns of the IRS still needed manual processing, for which the participation of employees was generally needed before the return could make the next step in the pipeline processing process, the taxpayer added. Crude paper forms account as about half of manual processing; Return to the processing account for the other half.

How To Avoid Delays In Receiving Your Tax Refund

“Under December 2 December, 2021, IRS did not have the time to adjust its systems for the filing season of 2021, which allowed the 2019 earnings to be examined regularly,” the taxpayer advocate in his report. “The IRS had to do those earns manually testing where the taxpayer selected to use 2019 had earned an income to claim Iv or Act. Not the same as the previous years, the IRS had to deal with a lot of earnings for which manual reviews needed. “

“According to the IRS website, on July 5th, about 1.5 million unchanged individual income tax returns. It has dropped from July 1 July 1..6 million, so the background has been gradually engraved, but of course, “Philadelphia Dracker and Skcketti CPA and shareholder James McGriry said.

“The first background was forced to close during the IRS epidemic. The IRS then had to implement a new tax initiative with a three -point stimulus check distribution, “Rosen said.” The good news is that IRS will have to pay interest on those who delay the seeds of their taxes. “

Celtzer added, “A revised earnings took our client about a year and a half to pay their AY.”

Irs Path Act Tax Refund Status 2023

Clients certainly have adspoints delay with it sometimes unfamiliar with: an incomplete or wrong return error; A banner of stolen ID or fraud; Presence 8379; Or even claim EITC or AOTC. Nevertheless, the makers have been left in the front line to calm the taxpayers.

A problem for clients in these situations is the IRS that starts computer-exposed notifications that do not seem to be related to what is happening to the backlog. “We were with the IRS in recent conversations,” we learned that a system was not removed in the computer IRS for some clients that we learned [and] not to remove the notification for this effect, “McGriry said.” By “

CPA Brian Stonar in California Barbank says that his clients are not caught in the processing, but those clients are waiting for the recipients.

“I explained that the adventures were delayed because they had a stimulus and the recovery advertising credit was applied and the IRS took us forever to confirm the credit credit against us,” Stonar said. “Or delay because we had to file a paper return and it extends the processing time – perhaps until the next millennia.”

Stimulus Update 2021

According to the NTA report, about 1.5 million earnings were postponed by the IRS in their processing and further reviews were needed when the NTA reports that when 2.7 million revised income is awaiting processing processing, the IRS facilities limit the access to employees. As a result of the order of removing the epidemic.

The IRS has processed 66 million independent income tax returns and re -released the $ 1 billion account in the filing season of 2021 – re -published a 1 million million accounts in the account – the last general filing season in 20, the NTA said.

However, the Congress also gave the IRS to announce a three -point stimulus and paid about $ 475 million to alleviate the influence of the epidemic on US families and businessmen.

(Taxpayers advocate recommended that their clients have access to accounts in favor of the clients and the IRS priority provides practitioners this national service))

Your Tax Refund Will Likely Be Smaller This Year. Here Are More Things To Know

According to the NTA, another crush: Most qualified taxpayers quickly adopt their EIPs, about 8 million taxpayers could not qualify who could qualify. Taxpayers who have not received the first round or the second first first round or second round EIP, or a ratio of the amount obtained and lost funds claimed to be lost for their form in 2021. If the amount claimed as opposed to the RRC records is opposed, federal profits were snatched away for authentication.

Whatever the snatch, the economy is slowly improving on their seed -money, slowly improving for them, the best suggestion seems to be erupting in two words.

“Even though the IRS is called, the process seems to be a way to speed up,” said McGriry. “The best advice we can give to clients is to respond instant to any notifications of IRS – and be patient.”