Irs Refund By Mail – Snow air in the West Washington to see the weather in Washington, rest with snow and snowing opportunities in the region.

Check the treasury this unexpected recent months after the taxpayer was returned. Photo: Como

Irs Refund By Mail

Seattle (Como) – among all domestic income services (IRS), the newly charged code is not recently taken.

Irs Notice Cp32a

When he replied the tax return in April, he said he said he was more than $ 2,000. Acceptance of a refund test with doubles in the middle mid-mid-mid-rid of red flag.

Lourenses knows the IRS fraud to block threats if you listen to tax immediately, the stupid tax. He also heard of the back of the scam through theft of the individual. So when the treasurer are u.S. The letter box appears, he was surprised and cared for. The test is real, but it’s for 4,653.35.

“He said,” Keep it it. Cash it. “” Lourenses said, “He said,” “said:

The IRS website informs about the return of fraud, including a refund of a refine back. But all about the checks taken by Legenia is genuine. She said she had even a black light test by the US Department of Finance to determine the security of ultravrases. He appointed the IRS number for a detailed explanation.

Where’s My Tax Refund?

“You can’t get anyone in this number” said the case. “They tell you a lot of calls or gets their last day of work and I understand this for 3 days until I know exactly for 3 days until I know exactly for 3 days.”

Among the consideration of taxpayers and the taxpayer’s information review is currently known for the taxpayer to people who are mistakes. IRS often says but not always, correct mathematical errors.

Each time you get the u.sserine check for unexpected tax returns, you should explain once or more IRS per week or more of the IRS for the return of money.

Appointed the IRS’s IRS email after our visit, confirmed that the test was a refund. The IRS said the IRD to enter the amount paid for 2018. But he didn’t believe.

The Fastest Way To Get Your Tax Refund

“I don’t know what it will be different. I haven’t paid my money. I’m insisting it.

Even if the check returns to be a legal refund, you will stop. If the IRS IRS is incorrectly to send you no chance after the errors found. That happened.

If you get a refund of the refund or savings to answer and answer the phone and you can’t answer you to spend money. If you return it, there is a high opportunity that the IRS hasn’t even seen it. It is estimated that about 6.8 million people are not processed.

Greensborough, N.C. – November 20 approved, agency agency returns about 162,000 people from 168.6 million, which was obtained this year.

2025 Irs Tax Refund Schedule: When To Expect Your Tax Refund

The agency was due to national residence at the beginning of this year, which began by Panjember, the afternoon the national residence was at home.

There is a high text box on the IRS website on my return page:

To process the sent posts, we need to be a longer to refund paper and the appearance related to any tax. Do not offer the second tax games or the IRS contact.

The IRS leaders know that people want to call, so there is other boxes at the bottom of the page.

Irs Refund Tracker: How To Track Your Refund Online

Wait if you have a paper back or refer to the IRS investigation.

This is a good news if you get a refund, you will also take a percentage if you offer a percentage after 15 April 15 and the new tax day.

Interest rates are from 3% and 5% per year. Matlip is performing mathematics. Say you are not for the return of average, $ 2, 881. You can add $ 34. You will be in the way of income. Yes, the IRS will take part next year. Waiting for your tax return may seem to see fresh flowers that are sitting by a baking in a large state on the back of the name. They are very close, but you can’t just jump on the table and take one – you should wait until it’s treasurer. This is a sticky combination that is a pleasure of pleasure, impatient and frustration.

Although you can speed up to speed up the tax return of what you can accelerate it, you can accelerate it if you want.

How To Turn The Average $2,827 Tax Refund Into More Than $100,000

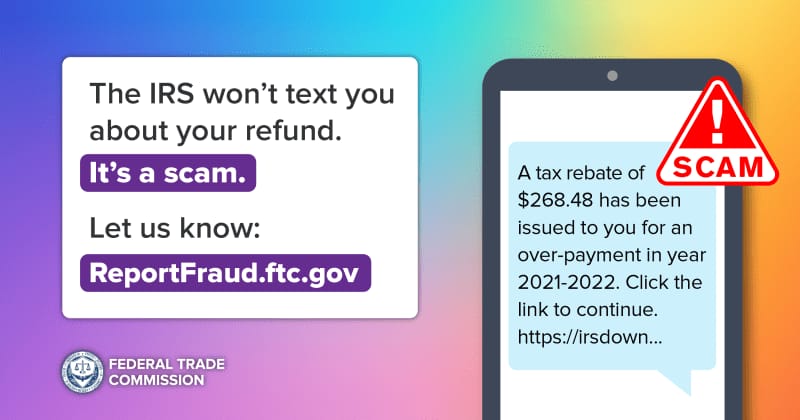

Submit the tax return after the possibility of your account; Of course, you will get your money faster, but it can also reduce the probability of criminals for your return. Tax returns is usually started when someone stole personal information, then start it to submit a fake and refund of a fake taxation. So when the actual tax returns, they try to get out of the software or letter from the IRS, which would be asked to say or requested. Result: probably waiting for a tax paying when the IRS is leaving everything.

Do not submit the paper tax return; They must be processed six to eight weeks. Electronic files and the IRS will be returned within 21 days. There are several ways of your Federal Return:

Most countries also offer free e-options for the return of the country. The Federation of the Sax Secretary of the Sax Administration retains a list of public archives.

Specify direct savings for savings when submitting directly registered deposits after registration. So money goes directly to your bank account. Ask for a check and you get yourself to the mercy of POS POS.

Militant Angeleno On X: “the Militant Was About To Throw Away Some Junk Mail But It Turned Out To Be His Ca Middle Class Tax Refund. He Usually Gets His Ca Income

By direct deposit, you can also distribute up to three accounts. Use this option by submitting a 8888 of the IRS form.

Follow your returning you back with the IRS and your state. Although tracking your backs are not really faster, at least give you a better picture to wait for your money. If you forgive your Federal Return, you can usually return your tax return after permission IRS. However, if you send a tax return, you must wait for four weeks. You have to say when the IRS will accept your return when you are sending and when sending you back. Every year, you spend your hours for your taxes. You assure that each number is correct and tries to maximize your return. The anxious process is the annual task that everyone should be saved for some effects, even if you have tax tax. The process can feel strongly; However, often, in the end, it was possible. Finally, you get back and wait, when your return is unexpected – Liber! Once you send you, you will see what your return and is what you are expected, or don’t you be free. This value may be spending in your mind before taking a check. It’s your money to spend like you, but now you have to play the waiting game and expect to visit the waiting game.

The time is lost and you don’t get back. Then you will receive the IRS CP32A’s IRS cp32a – but you can panic before you. This notification is not involved, you must pay SRS and does not require even an audit process. Then: You have no IRS from IRS; They owe you!

The IRS CP32A warning the IRS CP32A says your return tests are not claimed. To complete this notice, you have to call a new refund request. After calling IRS, you must take a refund test within 30 days. If you have a refund investigation, please solve it because it is not valid.

Stolen Refund Checks

If you pay taxes or debt to the IRS, they pay them using this amount of unpredictable return. If the IRS do this, they send you other notice to break the distribution and testing if there is a redundant payment balance.

Apply for your tax, can not prevent you in the mistakes and to take a loan that you don’t know about it. Other