Irs Refund Covid – “Where is my money?”: The IRS has frustrated the Americans waiting for stimuli as the IRS sends funds to the wrong account in the Covid-19 pandemic.

Those who used tax readers and received regular refunds were very likely to pay the IRS economic impact on the wrong or sleeping account.

Irs Refund Covid

This week San Lindro, California, inspected. Millions of Americans. However, thousands of people reported that they landed on an account they never heard about their money. If everything ends with an infectious disease, you can’t get an answer.

Stimulus Checks: Irs $1,400 Payments Coming. Check Status, Eligibility

The San Francisco de ABC affiliate was heard from Consumers of Texas, Io and South Carolina.

When the IRS began stimulating millions of Americans this week, Sharon Brach’s San Leandro felt the weak of hope.

“I was waiting because they said goodbye to work, and this was an opportunity to get financial support,” he said.

So it went to the IRS website and found that the stimulus check was deposited but not deposited by the bank.

Hedge Funds Cash In On Covid-era Tax Credit Amid Irs Backlog

Your payment was to the temporary account of the H&R block. It is loaded on a pre -tax refund, a debit card. But this card expired last year.

Broussard was able to make money stimulating because the H&R block wanted to renew the card, but all the H&R block offices were closed.

“When I went down there, no one replied to the door. Then I took the key and hit the window. My key hit the door for someone to hear me.”

Someone finally went out and gave you a free phone number to call. Brousard said the agent “found his stimulation of $ 1 and 200”. But $ 35 will be used to load the new card.

First Round Of Coronavirus Stimulus Checks Arrive

“They will take $ 35 from the stimuli and it’s a lot of money. I can use $ 35 to buy food and pay for electricity and pay for electricity.”

Asking for an opinion, H&R Block said he would not claim that rate and, in fact, the bank returned Broussard’s money to the IRS.

Tina Williams isn’t sure of your payment. She contacted us from South Carolina. “What should I do if I go to another person’s account and get it?” Williams said.

“This consumer will get money at some point. Almost everyone will get money. It’s a matter of delay. I know it’s very disappointing. I need to buy an edible.”

Covid Relief: Where’s My Check? Answers To Common Stimulus Payment Questions

Like BrousSard, many people received tax refund loans last year, and IRS accidentally sent money to closed accounts.

Wu said, “There was a defect and the defects affected hundreds of thousands. … often people who need the most money.

There are several sophisticated systems related to federal stimulus funds that can be obtained earlier this week.

The IRS said the bank should make mistakes the stimulus sent to the sleeping bank account and return the funds to the IRS. The IRS writes paper checks on consumers. But it still deals with defects. And 160 million stimuli will soon be paid.

Covid-19 Response: Tax Update

Many consumers report that the closed account payment has returned to the IRS. However, according to the IRS website, these payments will be transmitted to the closed account on April 24. Frustrated consumers say they have a loop that does not end.

IRS and tax preparation companies say they are changing the defects that seem to exchange between the closed account and the IRS.

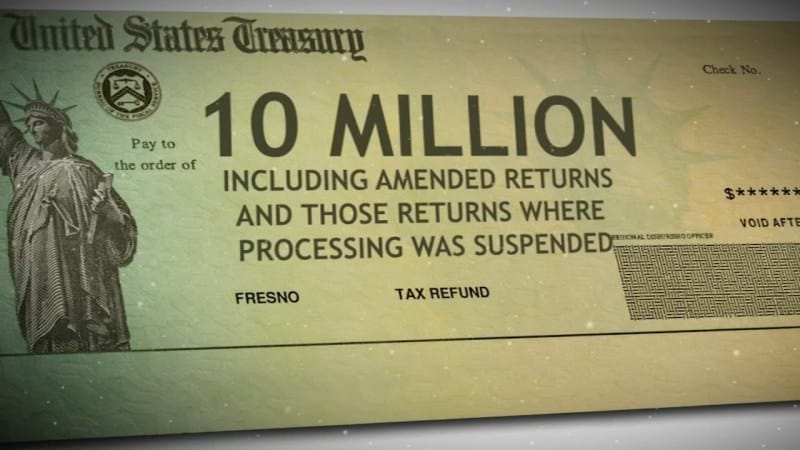

The IRS has successfully delivered stimuli to about 80 million consumers per direct deposit. The National Consumer Law Center said “hundreds of thousands” were sent to demands.

The most affected by the payment of the closed account are those who paid tax statements of tax tax return last year or paid tax statements. NCLC says some banks that make an error in an error do not return to the IRS, but they are checking them with a legitimate recipient. As a result, many consumers will soon be able to receive checks from the tax reader bank.

Irs Is Sending Out Automatic Stimulus Payments. Who Is Getting Them?

H&R Block says there is no charge for loading the expired bank card or loading stimulating payment to the current client account. In addition, according to the company’s Facebook page, those who stimulated the emerald debit card will receive $ 10 credits. IRS published the first, second and third control of stimuli for Covid relief. Know more about the second stimulus control and the third stimulus test.

It wasn’t too late if I didn’t get the third stimulus check. You must send a tax return from 2021 to April 18, 2025. Electronically, the 2021 tax return cannot be sent and should be sent to IRS.

Find a nearby free tax return site or visit Getyourrefund.org from January 31, 2025 to prepare and print the return to claim the third stimulus this year.

Economic impact: It is a main clause of Corona virus aid, called “stimuli check” or “recovery reduction” with the community, and is a legal bill that Congress has approved to reduce Covid-19 financial burden. Individuals and their families. Payment is the development of temporary credits for 2020 (tax sent in 2021).

Identify Stimulus Payments Using The Irs Transcripts

1. Revenue Limit: The marriage sent to a maximum of $ 150, 000 000 or AGI when sent to a single income (AGI) up to $ 75,000

Up to $ 112, 500 AGI will be paid in its entirety. If this income limit is exceeded, the amount of payment is reduced by 5 % for additional income for additional revenue of $ 136, $ 500 for single adults, $ 136, 500 for furniture and $ 136, $ 500 and $ 500 for couples married for couples married.

2. Age requirements: No age requirement for irritation tests, but no one can be.

). Is a joint marriage sent and a spouse has a SSN and a person has a personal taxpayer identification card (

Where’s My Money? Millions Still Waiting For 2021 Tax Refunds

You can pay. (Children with itins are not eligible for payment.) If a spouse is an active member of the army, the two spouses may have a stimulus, even if one spouse has a SSN and another spouse has a itin.

The Covid Relief Law, passed in December 2020, reviewed this requirement. Previously, to receive a check, a valid SSN was required. If you are married together, the two spouses had to go to SSN. If a spouse had a itin, the two spouses were inadequate to stimulate the inspection. In the case of married military couples, SSN spouses can still be stimulated, but other spouses are not other spouses with itin.

If you or your spouse do not have an SSN, you can claim the first stimulus by deducting the recovery reduction tax for the 2020 tax return. You must send a 2020 tax return until May 17, 2024.

Eligible taxpayers are financially influenced by $ 1, 200 or $ 400 for married couples. A maximum of $ 500 is offered for each qualified child under the age of 17.

How To Get Your Stimulus Payments When You File Your Tax Return

You will receive additional $ 500 per qualified child. Qualified children should live with you for over half a year of age and have social security numbers and be associated with you as dependents. These are the same qualifications as the child tax deduction.

If you are late for child support or tax or student loans, you can see the reduction or removal of irritation checks depending on the amount of debt. The Office of Financial Services will send a warning if this happens.

If you are in debt or there is a student loan debt, payment will not stop. You will receive the full amount.

If you use a direct deposit and you owe a bank rate with a view to the bank, the bank can deduce it from the payment.

Vat Refund Di Kala Pandemi

. Payments are not considered income for the coming month and month and no resources are considered for 12 months.

Will receive a check regardless of your job status. The check does not affect the unemployment rating.

If you send information to the Non -Children’s Portal 2019 or 2018 or 2020 IRS, nothing needs to be done. The IRS must automatically pay. Recipient Social Security

All the first stimuli inspections were issued until December 31, 2020. If the stimulus control is missing or do not get a full amount of qualifications, you may insist on the first stimulus as follows.