Irs Refund Credit – If you send a federal tax return and look forward to the reimbursement of the tax authority, you may want to know the status of your refund or at least get an idea when you can receive. If you are back, you can usually see your recharge status after 48 hours with where you can? You can start checking your refund status after 4 weeks.

If you need assistance on the status of the post or the number of proper properness, you can see the mold using an online account. If you access your online account, you must confirm your identity using ID.me. You should check the questions that you often ask questions on the questions on the incoming page and online accounts often ask for more information.

Irs Refund Credit

To avoid times waiting for a long time, we recommend you just call the tax authority if you are given instructions in the application process, or you will receive a letter or letter in the mail.

How Do You Want To Receive The Child Tax Credit? The Deadline Is Getting Closer: 2 Wants To Know

Where is the refund? Updated every 24 hours and the best way to get your repayment status.

Earned income tax credit (EIC) and additional tax credit (ACC): If you claim eitc or ACC, and there is no refund, you must receive a refund, at the time of the first week. However, if there is a problem with some information related to the claim, you will rewrite you and you will be asked to give you more information. If you receive an IRS letter or notice of your claim, immediately answer the steps underlined and using the information provided.

Identity steals: Theft-taxable thief occurred when someone steals personal information to perform tax fraud. Tax authority has special programming to check tax return to identify the occurrence of an identity that can steal your identity, which can also cause a delay in issuing repayment.

Incomplete error or returns: Recovery can be delayed to Simple is a malicious sign, math error, or if the income is reported to be relevant to your employer. In case, the tax authority will send correspondence to get more information or tell you that your tax return is organized and why.

This Is When You Can Expect Your Refund If Your Tax Return Contains Earned Income Tax Credit Or Additional Child Tax Credit. Per The Irs, Dates Can Vary A Bit But Ppl

Refunds used to pay for another debt: Sometimes you owe to pay the debt for the tax authority or owed to another agency, including child-law support or student loans. In case, the refund you can balance (applicable to pay the debt). You must receive IRS notifications if that happens.

The lost or stolen giant: If one of the reimbursement tracking applications indicate the tax authority you giveback, but you have not received, to be stolen or causing other bank accounts if there is any other bank account if there is any other bank account if there is another bank account if there is any other bank account if there is another bank account if there is any other bank account if there is any other bank account if there is any other bank account if there is any other bank account if there is any other bank account if there is any other bank account if there is any other bank account if there is any other bank account if there is any other bank account if there is any other bank account if there is any other bank account if there is any other bank account if there is any other bank account. So, if repayment appears to be issued, but you still haven’t received it, you can ask the tax authority to make your rechargeable track. This is the process of tax authority used to trace lost reimbursement control, stolen or stolen or to confirm the financial institution gets a direct deposit.

For more information on finding reimbement, Open Requiring Recovery Requires A Help Center. Having information, including action steps to follow, for the topic of the following. We also have problems and errors to get a help center, with information about the following topics: the term tribute progressive indicates a refund for a federal or state government. When the taxpayer tends to see the refund as a bonus or fate, often representing what is the loan that is provided by taxes. Frequently to avoid your taxes, so you can more money in your sanger’s bags – and make your payment back when you send your tax return.

It can be exciting to achieve the main tax repayment. You can hope to get a refund if you pay taxes during the year. Generally happens when the tax is pulled from your salary whenever you pay by your employer.

All About Irs Notice Cp08

Tax payment is the opposite of the tax billing, which indicates taxes are tax paying taxes. When you get a tax bill, you have to pay taxes for the government than you pay for the years. You usually have a tax bill if your employer does not hold the taxes are enough from salary.

To avoid many, you should fill the W-4 correctly and updates if you are experiencing a significant life change, such as employment, new freelance tasks or play from a child or high winds.

The taxpayer is generally better not to pay tribute because the money can be used better. For example, you can set up the residence (or approximately a secondary tax, if you are independent) and investigate extra money on individual retirement accounts (IRA), or also accounts paid. Thus, the money can be used for you than federal government.

Most tax credits are not restored, the tax credit can only reduce taxes to pay for $ 0. Whatever they are still from the tax credit that cannot be lost automatically. For this reason, this type of taxi is sometimes called tax-tax credit.

Child Tax Credit 2024-2025: Eligible Criteria And Expect Tax Refund

On the other hand, tax credit reflected to pay for all, means taxpayers have a credit right without responsibility. If the tax credit reduces the tax liability under $ 0, the taxpayer taxpayers receive a refund.

The child tax credit is $ 2,000 maximum for qualified parties. The restore part is $ 1, 700 to 2024 and 2025.

Get your income tax credit (EIC) provides labor and family with low and moderate income and families. The credit is $ 7, 830 in 2024 and $ 8, 046 in 2025. The number of taxes dependent on the income, the status of delivery and the number of children. For example, the quality of the quality taxpayers that do not have children will receive $ 632 for tax year 2024 and $ 649 in 2025.

American Opportunity Credit Credit (AOTC) is partial tax credit that can be restored for taxpayers to balance equally eligible costs (Qhees). If the taxpayer is taxisible for $ 0 before spending the entire tax $ 2, 500, taken as a fun credit may be smaller than 40% of the credit or $ 1,000.

Irs Tax Refund Vs. Tax Credit: What’s The Difference?

Low and moderate homes can be eligible for Premium Tax Credit (PTC), who reduces the monthly premium for the health plan offered through the Federal and State Health benefits. Taxpayers can use everyone, some, or no ptc first (ie first). If taxpayers use less ptc than appropriate, they will have differences as a returned credit of the taxpayer.

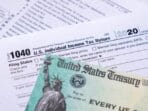

The tax refund is usually issued as checking and sent by the U.S. mail or as a direct deposit to the tax bank account. Or, the taxpayer can use reimsement to buy the US series on the bond or get loaded on a prepaid debit card. The fastest way to the refund is for the tax return movie and select a direct deposit.

Most repayments are issued within a few weeks after taxpayers send tax return. However, it may be some cases that pay longer.

For example, taxpayers claim to receive a refund by February 27. This is due to the law requires tax authority to retain this year’s birthday for years.

Child Tax Credit & Other Family Related Tax Breaks For Max Tax Refund

Recharges are always good, but it will be better to do not pay by filling W-4 or by convicting your taxes. The closer you get the rebound, more money you will do during the year.

Of course not everyone agree. Some people consider the taxpayer as an alternative savings plan and expects to pay the amount of amount.

Internal Results Service (IRS) states that the problem “generally repay less than 21 calendar days.” If you need an extra income tax credit or a child’s tax credit for a child, repay you back to early March.

You will receive a refund if you do not pay your tax before. This can happen if your employer can return from wages (based on the information provided in W-4). If you are independent, you can refund if you pay a quarter tax. Tax credits are refundable, such as eiik, can also produce refund.

The Irs Is Sending Special Refunds To 1.6 Million Taxpayers

Can you use tax authorities where are your refund? The device is to check the status of the tax return sent by the end of the past two years. Can you start checking where you refund? 24 hours after tax authorities receive tax returned by electronically or four weeks after delivering tax return.

Recharge taxes are the amounts of the taxpayer taxpayer taxpayer paying more than