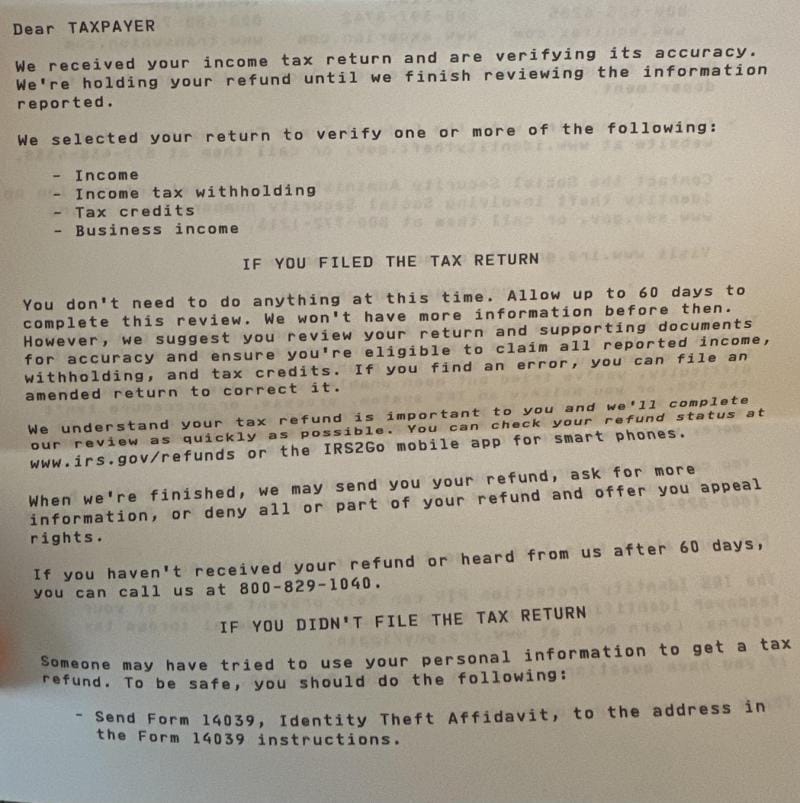

Irs Refund Due Letter – That threat lawyer IRS CP05 belongs to your mailbox Sparcaus. This letter did not impatiently refreshed the balance of the bank. Instead, it made your money to make money by announcing the review of IRS, which indicates that there may be potential tax issues, but the brake erupted.

Try not to imagine the taxes of audit and eternal loss. The IRS CP05 warning marks conventional verification, rather than criminal investigation and the promise of this guideline to quickly meet the requirements, solve the technology of taxation and release any taxes for taxes. Soon, when CP05 only represents a small speed bump instead of roadblocks, you will breathe again.

Irs Refund Due Letter

Continue reading to discover the secrets of simplified, to accurately provide information, accelerate the process and monitor the progress until all income tax and money are approved in full.

Irs Cp80 Notice

In the search for delayed tax reimbursement, wisdom must first accurately decode the content representing the IRS CP05 notification. In the center, the CP05 notification means that the IRS is reviewing specific tax declaration forms for key details in order to perform dual control of key details before handling related reimbursement.

Perhaps the amount of income is different from the salary of the employer’s report. Perhaps large or rare inferences have led to inspection. O required tax credits need to be verified before the flow of funds. In essence, the US State Taxation Administration hopes to quickly check some aspects of income tax (such as the source of income tax) before the reimbursement issue to ensure the correct amount of the issuance.

The letter CP05 is considered as a pit on the tax declaration table track, not the redirect of the main road. This is not a complete audit, and accuses the fraudulent behavior of the document in a forensic manner. This notice marks fast income or deducting confirmation to correct errors. Just like your mother, his answer to the task, not punishment, but clarifying.

With the US dollar of Penzoland tax, everyone wants to know: how long can the snails of the IRS can pay for CP05 to issue my money to last? The agency estimates that it is 60 days after notification. However, in thousands of cases, CP05 comments are usually much faster with simple confirmation.

Irs Notice Cp2566

We have witnessed the customer’s customer for only 2 weeks. However, some people lasted 60 painful days. If your comments think of short -term commercial breaks or TV series throughout the season, it will not be sure. In the evening, direct deposit notification is eager. Uncertainty test patience: If the IRS needs more information, everything you can do will be respected in time.

Is there a higher power that controls the country and even accelerate the IRS? Continue reading to understand who checked the clock in these waiting games and how to contact IRS to get updates.

The IRS (IRS) brought CP05 comments to the rhythm of bureaucrats, but taxpayers can use accelerated things to control the results. Don’t panic when you receive the letters CP05: no production operation comes from emotional collapse; on the contrary, focusing on understanding the meaning of notification or letter and how to solve any tax issues. EMPOSIGI, a gradual rational game plan:

Ask “How fast?” As for the process of the IRS, it rarely produces satisfactory answers. However, taxpayers using active response can reduce the time from CP05 for several weeks or months to restore reimbursement faster.

Sample Irs/tax Bill Assessment Extension Letter

Now, CP05 dynamics has been decoded. What does it need to reach? Random opportunities have reduced some taxpayers, such as lightning. But for most applicants, IRS has continuously refunded the accuracy of your return due to the following reasons:

Finally, the path of free reimbursement means the curiosity of the IRS that meets the first review of the IRS for the first time. Subsequently, we introduced the method of final closure of the case in detail.

As the Purgatory CP05 expands unpredictable, is the taxpayer waiting for IRS? not necessarily. Although it is impossible to determine the order of time, the applicant can use strategies to accelerate income verification and freely reimburse for free as soon as possible.

Use technology to optimize the fastest possibility and funding issues. But then you will watch other potential notification types to ensure the answer.

Offer-in-compromise Scams Expected To Increase

Waiting for more than 60 days without reimbursement is a real pain. However, before giving up all the hope for the delicious tax, please contact the taxpayer’s lawyer service. The independent group hidden within the IRS provides one hand to the people who are stopped, waiting for reimbursement or other issues related to the IRS. Aid is free!

Therefore, if you pass the IRS CP05 notification 60 days since the arrival, but there is still no refund, the taxpayer’s lawyer service should be your next phone. When the organization provides shortcuts when the organization can warn the maze and so necessary moral support, there is no need to face the reimbursement waiting for the game alone. The frustrated refund tunnel at the end of the tunnel became brighter.

Finally, the IRS (IRS) took the CP05 cuffs from long -term tax reimbursement. Although the well -known freedom has conquered hard efforts, the three destiny aims to save how much money.

However, for most of the taxpayers who confirm some details, CP05 is only dissolved just to obtain all the freedom of reimbursement. We consolidated the course without comments on problems to avoid these courses.

Understanding Irs Cp21b Notice: Refund Adjustments And Next Steps.

Essence By recognizing the banner that leads to control, as a deviation of income and deduction or requirements for tax credit. If the comments need to be handled, please strengthen defense measures and quickly propose sealing support documents. Monitor the state online, and it is expected to delay with restraint.

Even program capabilities, sometimes CP05 cannot prevent CP05 from random collar as certain files. However, for those who laugh at themselves, remember most comments, and these comments quickly verify a comprehensive reimbursement version. Let this guide act as a roadmap. The route chart drove verified gloves on the close route until it finally recovered the joy of the happy fund.

In the face of a few people who expand the audit, they should immediately consult with tax professionals to plan a personalized anti -road. However, whether it is fighting alone or using the combat, wisdom claims that victory is conquered in these pages. It provides a distance of distance, so the preparation of the future taxation year has led the CP05 notification to destroy the refund celebration again! The CP21B notification is an important communication of IRS, informing the changes in the tax declaration form that affects the refund. The notice is usually sent after sending a revision or correction request to the tax declaration form, and an overview of the adjustment of IRS based on this request. It detailed how these changes affect tax liability and refund amount.

In the CP21B notification, you will find detailed information about the adjustment of the tax declaration form. This includes any correction of your income, points or deductions, and how these changes affect the overall tax refund. The notice provides a clear distribution of these adjustments to ensure that it includes the number of refunds revised after changes.

Landmark Tax Group

After receiving the CP21B notification, the first step should be carefully reviewed its accuracy to ensure that the adjustment of IRS is consistent with your records. If the information in the notice is correct and the changes in reimbursement can be understood, further measures are usually not required. However, if you do not agree to adjust or need to be clarified further, you must use the information provided in the notice to contact IRS. Facing any differences is critical to ensuring tax registration.

Generally, if the CP21B notification is consistent with changes, there is no need to answer. However, if you think there are errors and do not face errors, it may affect your future tax documents or misunderstandings involving your tax liability.

If you are not sure of changes made by the tax declaration form shown in the CP21B notification, or you need to help to understand its impact on the tax situation. We can help! Our expert team can provide you with valuable suggestions on behalf of you and represent your situation on behalf of you.

Understanding CP21B notification adjustment is important for accurate future tax documents. It can ensure that you know any changes that may affect your next return.

Strategic Tax Relief On X: “client Received An Irs Notice For Examination And $8k In Proposed Amount Due For Their 2016 Taxes. We Were Able To Get It Resolved And Cleared 💰💻🖥⌨️📲 #

IRS CP21B notification is a key file that can notify you to adjust the tax declaration form that affects the refund. Understanding and verification of these changes is essential for maintaining accurate tax registration and ensuring that the financial plan is maintained correctly. Many customers received letters from the IRS, and they explained that because their federal tax refund is sufficient because of the restoration credit repayment (RRC) contained in the 2020 tax declaration form.

Recycling credit repayment is the tax credit of people who have not yet obtained all the stimulus amounts. In the 2020 statement, we reported the amount received by each taxpayer in the previous two rounds of stimulus payment. Those who have not received the full amount of money have a differential discount credit limit. The credit is on the Federal 1040 line 30.

Our experience this year is that many RRC returns spent more time than usual to explain in detail. Many customers have been waiting for reimbursement for several months. This is because the IRS (IRS) is checking all the yields. They compared the records with the amount of credit that they already claimed. In some cases, the claimed credit is correct and refund. In other circumstances, they found that the amount requested did not match the stimulus of IRS