Irs Refund Eligibility – The IRS has announced latest reproduction for a certificate occupants of $ 6, 600. This initiative is still to be entered for a year Fell 2020.

This refund includes financial assistance, especially for families and people limit financial problems in the Queen. The program will be very much to promote parents with eligible to achieve financial levels.

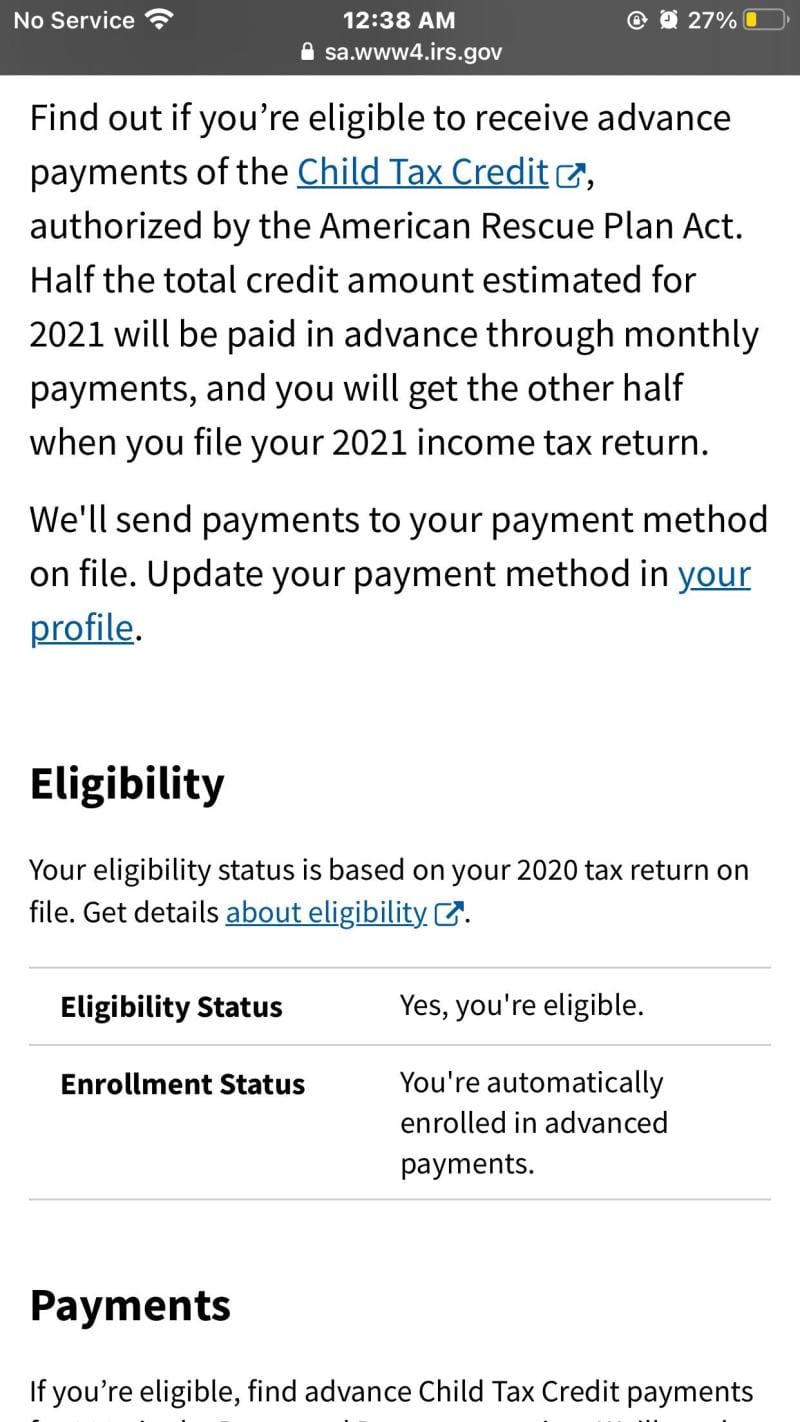

Irs Refund Eligibility

The date for this refund is January 14, 2025. As the refund is eligible for your return underneath.

$1,400 Irs Stimulus Payment Claim

This current IRS initiative hopes eligible citizens, especially those of victims of the pandemic years. Taxpayers have $ 6 to taxpayers who meet criteria, especially for qualified families.

These refund is made with the number of eligibility, income limits and eligible children. Eligible families can get this refund against these standards, and many homes provide financial confidence while looking forward to.

The deadline for this refund is a lot of time to submit or edit their 2020 tax applications to understand the 7 January, 2025. This refund, how much do you deserve and how to go on.

The $ 6, 600 means recharged to help with those who need, they are fewer low income families. As described below, the amount of recovery changes in accordance with the circumstances of the home.

Itr Filing Fy 2022-23: Income Tax Refund Rules You Must Know

Merit for the IRS discretion of a particular recharges to be confirmed by specific income and bipped conditions. Here’s a general view to help you decide if you deserve this refund:

To successfully describe this refund, a qualified taxpayers need to accept some general procedures. To promise not to lose this opportunity, follow the step -by -stp instructions.

Ensure all essential qualifications, including any assistance documents displaying income confirmation documents, eligible for special security numbers and deserve special beliefs. Collect these items in advance to commit the sensitive release process.

If you do not complete your 2020 tax return or if you have a rebuild error, you must submit your return or edit. IRS form gives 1040-x to correct the previous results.

Where’s My Refund?

Make sure you enter a new product by January 14, 2025. The IRS allows a refund of refund in three years after the first film.

Once you have filed or revised, you are the IRS “where is my refund?” Can be used. Character to check his status. This online device allows you to keep a look at the status of your refund and find out when you get it.

As the Year of Tales is new, there is an increase in the IRS refund options. Although the refund of re-claim was not yet published, some tax credits such as a conventional tax credit is earned (EITC) are earned to low-income homes.

EITC is expected to change to show the gracious, leading to high revenue levels and the amounts of revenue for qualifying families. The following things influence your eligibility in 2025:

How To Understand Your Cp27 Notice (irs Tax Credit

New Vertice Pay for US Entrights for US occupants and families not apply about 2020 until $ 6, 600.

Taxpayers can get a lot of financial support by understanding a vote, filling the necessary documents and date.

People should make an action now. Make sure you file or prepare your tax bill by January 14, 2025 to take advantage of this opportunity. As always, IRS reviews are investigating your documents which are twice that you could help benefit from your reburation. A tax season leads on official for 2024, the inner-income service (IRS) is set to find out tax return between 27 January and 15th. Government Data Projects that arise more than 140 million their taxpayers in a good time.

Feed films are useful for the IRS reporting income, which allows people to make recharge tax clients.

Check Your Eligibility For The $1,400 Irs Tax Refund Today

The most important income tax (EITC) is a refund on to $ 8, 000 to the issue of the taxpayers. In addition, some people are eligible for more than 000 11, refund if some people meet specific standards.

California residents are eligible for both tax tax credit (Eitc) and Question CabbitION) more than $ 11, 000.

According to this fee Prep prep prep Phe La, California helps California, and individuals can be with low income of 000 10, 000 money back through these beliefs.

These tax benefits are planned to support staff and families who are trying to obtain eligible financial relief.

No Tax Refund After 21 Days? Reasons Why And Tips On Contacting The Irs

Partnership tax tax (EITC) is a federal tax object of helping people and families. Credit of belief depends on a number of annual employment and warrant children. To be eligible for IRS refund, taxpayers must meet the following conditions:

To apply Eitc, taxpayers must submitted 140 (Personal Income tax return) or 1040 -R -R -RS form).

If you say credit for the child is accreditation, they should also associate the era (form 1040 or 1040-s). However, it does not apply to a scheduled eic needs if you apply credit without a qualified child.

Eligible people can refund money or tax refunds of up to $ 3, 644. In addition, taxpayers are eligible for other benefits and pet-younger tax credit.

How To Get A Bigger Tax Refund

If you are suitable for two tax credit, you need the bid in your tax return. Total payment depends on your annual invention and the number of qualified children.

Faodaidh ath-dhìoladh na SA aig a ‘char as àirde airson dà chreideas ruighinn suas ri $ 11, 474. Gus an ath-dhìoladh a dh ‘fhaodadh a bhith agad a mheasadh, faodaidh tu àireamhair brìgheil neach-taic brìgheil agus àireamhair Cleitc a used.

The refund is offered after the IRS tax answers are processed. Cashpayers choose a straight investment, a refund will be released within 21 working days of processing. However, those who will receive a paper audit, the waiting period can be extended from 6 to 12 weeks.

To ensure appropriate refunders, appropriate taxpayers must include both Eitc and Calleic of their scratchings of their tax return.

Irs To Send $1,400 Stimulus Checks To 1 Million People. How To Know If You’re Eligible

The Tax Time offers a large refund through the taxpayers associated with relation to conversion (Eitc) and California. Eligible people can get up to $ 11, 474, to help them get financial duties.

To the benefits, taxpayers need to correct file and appeal on the credits that are available on their tax return. With a correct application and a long time, taxpayers expect to make the refunds effectively over time.

People and families with less to meet IRS guidelines, such as tax fees and appropriate tax files.

You should submit a form 1040-DR mail 1040-DRs and Eichen Register (if stated for a child). California residents should apply to Cleetion on their State Feedback product.

$1,400 Irs Stimulus Payment

The Tax Time Here’s – learn when expecting your refund to qualify for Social Security in 2025? If they do not meet this requirement, over 65 Risk Requirement will be determined by your Directive Government, as you would prepare your direct security for social security inspections, according to the Social Security. Payments are Wednesday SSDA in February 2025 The first round of 10 days, social security surveys and $ 1, 580 Social Security Study.

Government Support 2 days SSDI payments: This group does not get the first monthly basis of the next month 3 days, a rare bungeon of $ 7 million. Coins: 1964 of Lincoln Penny Lake 3 days Social Security Check (only 3 days, the Government Support are expected to be expected to be expected. Back SSD Payment Register: When you receive the disability benefits, you know that you know in $ 1, 900 Social Securitys (EITC) If you are eligible, this important refund will increase your financial conditions in 2025. This is to meet the highest need. This is how to meet and how to meet.

The amount you receive is responsible for a number of accreditation children in your home. Here’s the highest level you can get on the basis of family size:

Designed for eitc