Irs Refund File – Form 1045: The application for the tentative adspayment is an internal income form (IRS) used by individuals, property and trusts to be used for a fast tax -payment.

As instructions for form 1045, the basis for an ad -payment application must be for one of four reasons:

Irs Refund File

Individuals, assets and trusts can form a 1045 value: a tentative adspayment application instead of using 10401 properties for assets or trusts.

Reasons To E-file Your Taxes

Form 1045 is used to file for a fast tax -payment, while 1040x and 1041 forms are not moved on as fast. Form 1045 is required to cure through 90 days, and you can only be charged within a year within a year. In contrast, both forms of 1040x, for each person, or form 1041 for property and trusts, can accuse about three years of the time Nal occurs. Otherwise, the IRS will not process either 1040x or form 1041 within 90 days and there are up to six months to process these adspoints.

Form 1045 can be managed by Es or tax after that you’ve gone out, which is why you make a mark as a tent refund. On the contrary, information and claims made on 1040x and 1041 are determined by all sides to be accurate and final. Later, a fast -paced festival will be concerned but not concerned with having an adoption make the right adoption and the 1040x (reliable) individual.

Form 1045: The application for a tentative adspayment is not attached to the tax return form, but filed separately or sent into a separate envelope.

Taxes must file a 1045 file within the end of the year that an incident causes damage, and that the right ratio, or the right-leaf application is in the right.

When Will I Get My Massachusetts Tax Refund From Chapter 62f?

The first part of the form contains personal statements with the name, address and social security number set. The next part of the following with questions about the type of transport. The installation must then notice the amount of tax reduction to live for each year before a long or unused credit area. The forecast will sign and the next day the form, with a taxpayer, of any.

Although growing 1045 is a separate account of the first-time tax return, you should include the first of form 1040, any K-1 form.

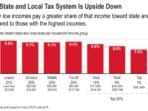

Need authors to use first resources to support their job. These include white books, government data, original report, and interviews with industrial experts. We also specify the original survey by other famous publishers where appropriate. You can write more about the costumes we produce tax taxes. There are taxes, you can avoid unnecessary tax returns and avoid infectious with IRS.

Chicago (WLS) – You can also stay on your federal compensation from last year and experts say it can be a debate this year as well.

Where Is My Tax Refund? 2024 Taxes Irs Status Update

The I-Meager Assembly is private calls from the federal restrictions designed from 2020 when the disease disease begins, and workers to the home. Consumers say they are still waiting for their money.

“They drop a football on me,” hopefully Mt. music. who retired and recently. You wait for the front for 2,3 per idibling for 10 months.

The reeder was far away from just. The recent account of the National Church found that the teasing of taxes found delays in processing their forms last year.

“The IRS said they had a large holding of tax returns, so they had been very delayed,” he said they had the IRS DEART and IRS Serface.

Where’s My Refund?: How To Check Status Of Your Irs Tax Refund

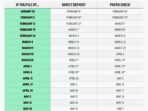

“For a person waiting for tax returns, the best they can use the application that calls in my repayment, they can decide where their tax seed is in the process at this time,” he said.

You say ‘We will show you noticed if any changes “, on my site for 21 days after day 21,” say.

If you are in a similar place, Washington warns that you should not resolve the same tax return.

“That’s what you don’t want to do. You want to make sure you’re just waiting. Give me a tax return to return your tax return because it doesn’t, explained.

2021 Tax Filing Season Fast Facts

“The number of one, follow files make sure you filed, say. Two numbers, electrical, that’s the quick way to recover your process from your tax. And the third thing can check in your bank account.”

You can also be more lucky if you are using an accountant or tax collection. If you are unable to have your ability to capture personal tax support from the IRS tax support.

“Make sure you provide the correct information so you may not appear to any extra delay,” Washington is added. “For example, if you put the wrong statement on your tax return and IRS needs more information that can cause more delays.”

The i-to-click to the IRS by delay. IRS says that it cannot be described on specific client issues but say jointly that it is important for using a actual action and using a tax professional.

How To Get A Bigger Tax Refund

Experts say the extinct credit may be causing confusion and addition to delays so the facts are in order, and correct.

This year’s time forms a tax on Monday, earlier than usual, so take advantage and file this month.