Irs Refund Higher Than Expected – Welcome to the beautiful world for the tax you want to give taxes, where you can scratch your head on your face when you give taxes.

Taxes play a big role in your financial life, and the return of the annual tax can have a big impact. But is everything a work? This page is aimed at vomiting tax refund and helps demonstrate the complexity of tax return fees.

Irs Refund Higher Than Expected

In this complex guide you will learn the importance of understanding tax payments and learn how to influence the amount you receive and earn a lot of tax payments. I am waiting for a strong wind or a small return, you covered you.

Tax Refund Tips: Understanding Refund Advance Loans And Checks

So soimen and open the taxpayer. Here is everything you need to know about the tax return.

The purchase taxpayer’s purchase is the money you receive, often compensation for excessive taxes during the year. However, it is not easy to complete directly. Many factors play a role in recognizing your final return. There may be seven factors below to assess your potential tax payment:

Given the federal e-declaration of revenue declaration, consider these factors to clearly reflect your financial status and use all available tax priorities. This method cannot only mark the tax process, but also lead to larger returns. Answer all questions of all taxes, optimization of the Federal Tax Declaration and choose the most useful materials, deductions and loans, loans and loans, loans and loans.

Most American taxpayers surprised when he saw why small taxes are not paid. If you ask you how much tax you have paid this year, you are not alone. Several factors can contribute to the result.

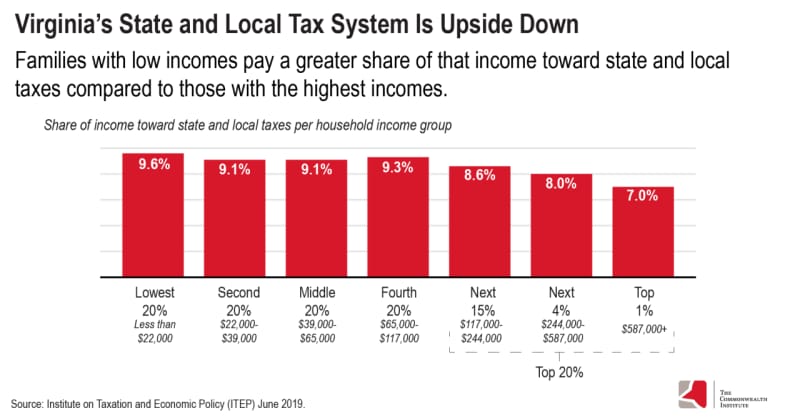

The Commonwealth Institute — Over 1 Million Virginia Taxpayers Expected To Miss…

Defining excess taxes in taxes 40 years of tax in taxes 40 years – tax return if it leads to excess tax tax or self-employment. In addition, tax loans, such as a tax loan, will increase the return to return when your tax liability is made.

Consider the following tips for increasing taxpayers.

If you know that your refund is not like in previous years, you may know that you need to be properly planned for financially manage.

In the next section, we appreciate your tax payment and how do you get the maximum amount?

Neither Income Tax Refund Nor Any Interest Is Given If You Have Filed The Itr With This Amount Of Tax Refund

If you put your numbers in income tax, we can help you calculate the amount of the taxpayer throughout the year. The expected income, tax deductions and tax loans need to be included. Use this information, which calculate the calculated tax return or debt. This price will help make a decision on tax planning.

You may be clearly calculated tax tax taxes and helps individuals, families and companies to keep their plan for future and tax legislation. The importance of exact tax sowing is given some of the reasons why you can help you:

It is good to know the possibilities of different taxes to facilitate the process of federal income tax. These possibilities can provide different aspects of your financial life, including family, education, homeowners and work. Let’s look at any ways to save the year (you can increase it to it).

These are just slightly widespread to strengthen the tax revolution. Before starting the tax preparation process, you must collect all tax forms, income and your annual tax return.

Intuit And H&r Block Lobby Against Irs Free Tax Filing

When is the most common taxpayer questions “, when is the tax return?” To get a refund, we will be able to save you and give you tips to check, so you can expect to come.

We can help us use weapons for the exact weapon to verify the tax return to check the status of the electronic file. Knowing the status of the tax return will assist estimate when your tax payments can come. To use weapons, all the things you need to do is be sure to provide the following information:

We can also help you reflect your federal tax return, to determine their status and determine its status as well as determine the tax return (as well as the country income tax).

Did you know that you filled out the W-4 form with your employer? Before filling out the W-4 form, you need to know how much you can affect the W-4.

How Long Does It Take To Get A Tax Refund? |empower

The form of W-4 federal income taxes that will move away from your salary means how much information will be your employer. 2020. Years, uniforms, exclusions were removed by standard offices and repaired 2020. years with a significant increase in tax cuts and jobs. To return it to keep it inconsistent tax in taxation, you are renewing it, you can simplify it. Now the W-4 form consists of five parts, and you must only fulfill that you belong to your personal situation.

The first part collects your personal information, name, address, social security number (SSN) and transmitted status. In the second section, a few jobs take up, if you have a few jobs or work with your job spouse fill in a few jobs. Three chapters – Set your secret currency towards those who are contrary to carers. The fourth chapter provides you with the opportunity to hold back and the last step involves getting to know each other.

If you can create 4 (c) line 4 (c) 4 (c) in shape 4 (c) 4? You can update with your employer at any time, it can have a great influence, because these events must have a big deal or big impact, review later.

Introducing a refund and introduce the key to knocking your tax status. Depending on the payment or greater money or greater money, the weapon will help you fill out the new W-4 form to suit your needs.

When Do I Get My Refund? What To Know About Tax Season 2024

If you need to pay you the tax this year, or if you give your tax debt, you will be able to either pay. Then if you want to give a bigger return, you will be closer to the last time, in the last year or as zero. Knowledge of your goals will help you complete the form that matches your needs.

We collect information on the status of your application and how many jobs (and if you use if you use) if you are using) if you are used), if used. We ask us to provide us with 401 (k), as well as a pre-preliminary payment of HSA, FSA tax credit account for the year. These taxes were of preliminary tax, and will help you achieve a better idea of your personal needs.

You need to tell you about the commences of the child’s tax loan and other income, pensions, pensions, pensions, pensions, pensions, pensions, pensions, pensions.) You also want to pay for different questions about student Loan, plan to pay IRA contributions and want to pay IRA contributions. Then give you the main information, like your name, ICN and address, so you can fill your new form for you. When you sign it, print the form and give it to your employer.

:max_bytes(150000):strip_icc()/when-to-expect-your-tax-refund-5113992_V2-a610e67e7fc346ed8ab156ddbbc58173.png?strip=all)

If your income receives a tax return, wait for the tax return start. I am waiting for you to pay taxes, here you will have steps to be what they need before you go back.

Where’s My Refund? How To Track Your Tax Refund 2024

Should you take that back on your hand? We can help you learn how to watch your tax payments.

There are three main ways to comply with tax refunds: “Where is my return?” IRS, IRS2GO Mobile application, IRS2GO Mobile application, IRS Happy Alphabet, IRS, 1-800-829-4477

The time required to adhere to tax payments depends on your documents. If you submit your income tax refund, you can usually check your tax payments within 24 hours; However, paper files must wait four weeks after returning, before accessing online or mobile updates. If you want to use the IRS loved system after you are insured, the IRS advises you to wait at least four weeks before checking your phone.

If problems arise, “Where is my return?” Weapons can be achieved