Irs Refund Hotline – It simplifies the accounting of your small businesses, combining intuitive software that automates a occupied and professional professional and professional. Less stress for you, more time to expand your business.

Accounting Accounting Accounting for Accounting On -Line Accounting for Small Entrepreneurs. Accounting services for small businesses, because they transcend tax files and small consulting, filing and annual income tax consultancy

Irs Refund Hotline

Don’t you know where to start or which accounting service meets your needs? We are just a connection. Our team is ready to know your business and drive to the right solution.

The Irs Phone Number And How To Call

Our intuitive software has strong tools and functions designed to help you simplify your financial management and make informed business decisions.

Communication messages effortlessly with your team, at any time for your financial documents for your financial documents, quickly connect all your financial accounts to access all your financial accounts, speed up your books, reduce errors and save. A detailed classification of transactions, promoted by intelligent automation, reporting immediate policies. Type or download the updated center demonstration or balance at the updated center all the time, get reminders to be in your tasks and economic terms

Magic occurs when our intuitive software and the real man come together. Reserve a demonstration today to see how your company is today.

Get free guides, articles, tools and calculators to help you browse the economical side of your business. Play with practical knowledge and advice.

Your Tax Refund Information Guide

Library sites, libraries and noted recordings, libraries and free models, specialized and calculators control and accounting tools to support your taxes to small businesses and evaluate your list of financial resources on commercial taxes, subtractions, IRS forms and support for taxes .

Learn how to build, read and use financial statements for your business so you can have more informed decisions. Used models and financial indices are offered.

Learn more, our mission and staff dedicated behind their economic success. We are committed to helping you angrily.

To find out what we do, how we get there, and why we are our hearts directly in the stories of Itcustomer. The latest news, updates and events between partners are collaborating with partners who help climb other small companies. See which list is

Help Please! What I Need To Do?

“Working saved me so many times. I made decisions for the business, I wouldn’t be well, because they didn’t do it according to the numbers.”

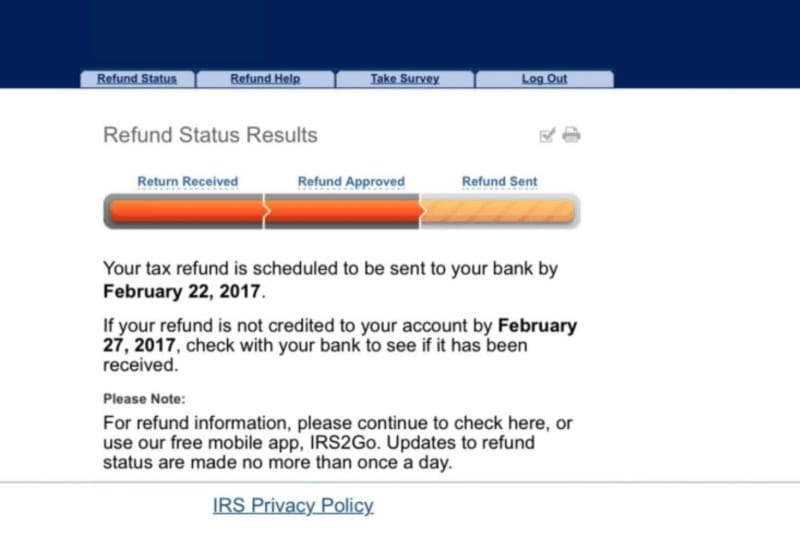

If you sign your return, check the return status 24 hours before the file.

If you presented the return of the paper, your statement should last about four weeks to appear in the IRS system.

When the IRS receives its tax return and processing, where the refund will show one in three situations: “accept” “” acceptance “” returned “and” returned “.

How To Check Your Irs Refund Status In 5 Minutes

This means that IRS sued and accepted its return. It usually occurs in about three weeks after the IRS indicates after receiving your return.

When IRS processes your return, when money is saved to your bank account, you will see it as money:

If you do not receive the reimbursement of the above page, IRS suggests contact your bank first to ensure that there is no problem with your account.

This means that IRS has sent its financial institution to its financial institution in the direct deposit or sent a check. (Where is my refund? It must indicate payment date.)

Went From Irs Needing To Verify My Identity Last Week To This…

Remember that your bank can take anywhere else to save money on your account. If you have asked for paper check, you can take several weeks to get to E -mail.

IRS will also use this page to find out the value of your reimbursements reduced for some reason, because the money was due to IRS for the previous return, for example.

No. The IRS updates the system once a day, usually at night, so it is not necessary where it returns? once a day.

Also remember that IRS receives my refund? The tool is offline every Monday every half -from 15:00 to 3:00, east time.

What Is A Cp21b Irs Notice?

Today, the return of 9 e-file received less than 21 days after receiving IRS.

It may be a spectacular statistics, but it is not promising. IRS will not send you a difficult term.

If you have sent your tax statement smoothly, and even if it takes 21 days to get a refund in previous years. Be patient and remember that you never receive your return date.

If you send a physical tax recognition in the email, the return should arrive within six weeks from the day IRS receives its return. (But again, the same rules on patients.)

How To Get Your Tax Refund Faster In 2024

No, it’s not. IRS Phone representatives can only investigate their return status after email entry or return their article after six weeks after shipping.

Don’t worry about calling IRS for your return status so far, where is my refund? The tool instructs you to call the IRS.

For more than 21 days (or six months, if you sent your return), call IRS without the IRS without the Toll-829 (800) 829 1954.

Modified returns can last three weeks to display, and processing can last 20 weeks or more if you should change your return.

Irs Tax Refund Tracker 2024: Discover The Typical Day Of The Week For Tax Refund Payments

You are able to follow the status of the modified tax return (and reimbursement) “Where did my return change?” Tool:

“Where is my return?” Tool, the modified return will go through three phases during processing:

Adapted means that IRS adapted to your account. (Adaptation will not result in changes in return, balance or tax.)

The end means that IRS will process your return and send all information connected to your processing.

Your Friendly Tax Preparation

If you sent the IRS, you have changed return for more than three weeks and did not appear in the system, call the free IRS +1 (866) 464 464 464 464.

Make sure your social security number or taxpayer identification number, a situation and accurate return available when you send the situation.

This post should only be used for informative information and does not include legal, commercial or fiscal consulting. Each person should consult their own lawyers, business consultants or tax consultant on the subjects mentioned in this post. It is not responsible for the information obtained here according to the information received.

Tax Tips 1096: If you present a simple guide 1099, you will also need to send the 1096 form. Here is more →

Filing For Irs Refund 2025: How Accurate Is Tracking Tax Refund Status With The Irs.gov Where’s My Refund Tool

Tipps Tipper’s tax season is not stressed when you make your books in the tax season. Here is what it seems. Learn more →

Taxes ignore taxes for small businesses. Being blinded by a large tax account can interrupt your cash flow. Saving throughout the year means maintaining confidence and operation soft. Learn more →

Get the common dose of healed drivers and teaching resources to help you make proper decisions to expand your business. No spam. Register at any time.

If you try to reach IRS, you know it’s not easy. A blogger found a way to cross automated demand to reach a real person.

Taxpayers Waiting On A 2023 Tax Refund Should Know Two Key Facts To Avoid Confusion. First, Calling The Irs Usually Won’t Provide More Information; Instead, Use The Online “where’s My Refund” Tool

Editor’s Note: Although this trick has worked in the first round of stimulus checks, several people reported in January in the second round of IRS payments say IRS is busy online.

Many people said they tried to use the IRS stimulus follower, but that doesn’t give them an answer. Some people reported that the automatic phone was useful, that is, unless this system is invaded.

A way to blog is a way to talk to a real life person, but you should ask for an automated system as it has no option to give an operator.

5 King Work Work, even if it doesn’t mean you’ll like the answer you get. Here is what you need