Irs Refund Hotline Number – Grease to offer a variety of self-help tools to help Get Quick Answers to Tax questions.

An eligible for free Cup help? Did you get a notice or a letter or a question? Do you have a suggestion on how to improve the IRS? Read tax slow tax

Irs Refund Hotline Number

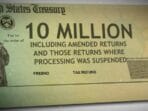

We understand that there are more adventure waiting for help from the IRS and 2023 and previous tax returns. The taxpayer advocates will take to help address this inventory return return from making a temporary change in case acceptance criteria to better serve taxpayers and businesses.

Free Tax Return Preparation For Qualifying Taxpayers

Read our latest FAQs in these changes and how we are advocating the taxpayer who need to be the most help.

Cup understands patience in this difficult tribute time with advocates can work carefully addressing your tax concerns.

The taxpayer advowson only have a high volume require help for the delay in tax return processing. As a result, you may try time while trying to connect with guilty or while waiting for the return call. We will ask your patience to get to two weeks before we will be able to return to call or respond to the request. We apologize for this delay and capture the steps to reduce the answer time to get better to serve you.

Financial problems also called economic harm. The economic harm includes some loss or damage from finance from any capacity.

Top 9 Irs Scams: How To Spot Them And Fight Back

Please note that this job has been established only to answer the questions from press (Media). Questions and questions against the public and businesses cannot be treated with this role.

Local taxpayer Advocates (LTA) will share tips to help you prevent filing filing and treat delays so you can submit your tax with confidence. Find out the event with you.

The cup of an independent organization of the IRS. Our work is that all the taxpayer is enough and what you know and understand rights.

By calling toll-free Cup number you will connect to the centralized consumption (201) team who is the first point in contact with the taxpayer Advocates Service. I will be your account to start your account and get help you need.

Chapter 62f Taxpayer Refunds

The taxpayer advowson only have a high volume require help for the delay in tax return processing. As a result, you may try time while trying to connect with guilty or while waiting for the return call. See if you are eligible to help. If you qualify, you can download and submit the form of 911.

There are more ways to ask the quarter of the cup. The easiest thing to download the 911 Mail and Fax to your local job. You should listen to a lawyer can assign you to your submission form 911.

Pocula to offer otherwise to complete the 911 form. These options are not to be quick to the process of your glass experience very high call volume time.

Depending on the tax problems, that can take a couple weeks to a couple months to solve your tax problem. Your account advocates and I’ll do all things possible to help you in your path to solving your problems. The defender will be in touch with you in the duration of your accident and last and delay in issues.

Property Tax Credit

Cups can help with Refund problems after IRS preaching the process timeline. If this date is made with a problem with a cup of job at the option you have.

Sign up to the latest tax relief data and tax law changes, blogs from national taxpayer Advocirum and the cocks., 2024

Need to talk to someone in the internal postage services? Start with 1-800-829-1040. The last four digits of the individual income tax form 1040. (See what you do.)

Of course they are more than the phone lines used if you don’t have an individual tax questions. Received a simple question about your tax transcript, out of the meeting at the tax payment deadline, or maybe a complaint about your business tax return? Whether you’ve got a complex or simple question, it’s often the best to go out and talk to a valid tax professional by contacting it. There is no shortage of online resources available for basic services, but sometimes you need more than chat service.

Employee Retention Credit

Customer Service representatives who can answer questions about individual tax return preparation, including situations when you have received notice of a tax problem. Fortunately, there are many ways to contact the agent, including the lines of the phone.

What is the best way to reach a real person in there? It means depends on what you need to talk.

Phone Line: A automated service at the hotline to connect you to the current person in a specific topic, offer them some numbers.

In-People: Especially handy with your paper tax returns, you can schedule and bring documents to the taxpayer office center and closest to you. You can also meet with some of the nonprofit or independent organizations that work closely with, including taxpayer advocates (cups), an independent organization that works as each taxpayer is not treated enough.

Irs Plans $80 Billion Overhaul: Plan To Crack Down On Closing Gap Of Uncollected Taxes

Email: Some Email Address are to: But I didn’t answer any personal questions and take the email correspondence. Sometimes they can follow with a representative way of email. The said: Only one public address: [Email Protected] to report any continuum phishing tax Email.

Love to contact the persistence of the mail, but when you responding back, you do not have enough to feel like writing a letter and waiting in response. Just because I prefer a snail mail, you mean to you. If you would like to call the account your problem for sending an email or writing letter, then you have more numbers to choose.

One of the special you need to depend on the type of inquiry. Make sure you are calling the appropriate phone number to tax question you have. For individual questions, tax tips, assist with tax return and general assistance call 1-800-829-1040

This is a great place to start. Available Monday by Friday 7.M. At 7 p.m. Your local time, this number to handle common questions, including solving tax debt and setting up payment plans. (If you are a Puerto gross rich in lines have hours of operation from 8 a.m. to 8 p.m.)

Submit A Request For Assistance

Some exceptions can be treated but operators here will be able to the right department.

By the busiest part of the tax time, January in April, average telephone service can be average 4 minutes or longer. Some phone service lines as long wait. Waiting service at times you get now on Monday and Tuesday. Also, call services can take longer than usual to two special days: President on the weekend and tax file deadline in April. After the tax period call service time to wait average 13 minutes or longer.

Drop your relevant tax data before calling. It just can’t keep the phone operator with searching your home in one tax form to forget.

By the way, if you live in Alaska and Hawaii, the customer service hours in Peace.Tax refund status 1-800-829-1954

Contacting The Irs: Phone Numbers, Email Addresses, And Offices

One of the most demanded phone numbers in tax Refund Hotline updates you in the state tax refunds and if the completed paper income when you can wait check to be. (Yeah, this is not just to check your refund status.)

Related: When will I get my Federal Tax Refund? Business Tax Returns, Employee tax forms and questions in W-2 Call 1-800-829-4933

Even available Monday by Friday 7.M. At 7 p.m. With local, this is a general phone line handles the business tax requests, work tax and tax law questions, including help with W-2 forms. And if you can also help to solve the tax debt, including your market and organization in any scratch plan requirements and payment options.

Related: Online payment agreement if the victim could be a victim of the publicians to suspect the call 1-800-908-4490

Tax Refund Solutions

For cruelty who believe are the victims of identity theft, the phone number is 1-800-908-4490. The schedules of this number are Monday in Friday, 8:00 PM by 8:00 PM your local place.

The exempt tax and control entity service reasons are what you need if you are calling the organization in one of these categories. Is open from 8 a.m. at 5 p.m. Local Hours, Monday in Friday.for Tax Format orders and materials, even if they do not know what you need