Irs Refund Information – Ed Znurnerfer should discuss issues related to “delayed retirement”, which have been addressed to some questions. Contains links to the comments of groups offering federal employees

Chris Covalik tells how to manage your options by prevention. Includes a review of various groups of federal employees, which includes a review for different groups of federal employees, who know about the safety of your numbers, understanding the effects of early government and “Preliminary informed” measures …

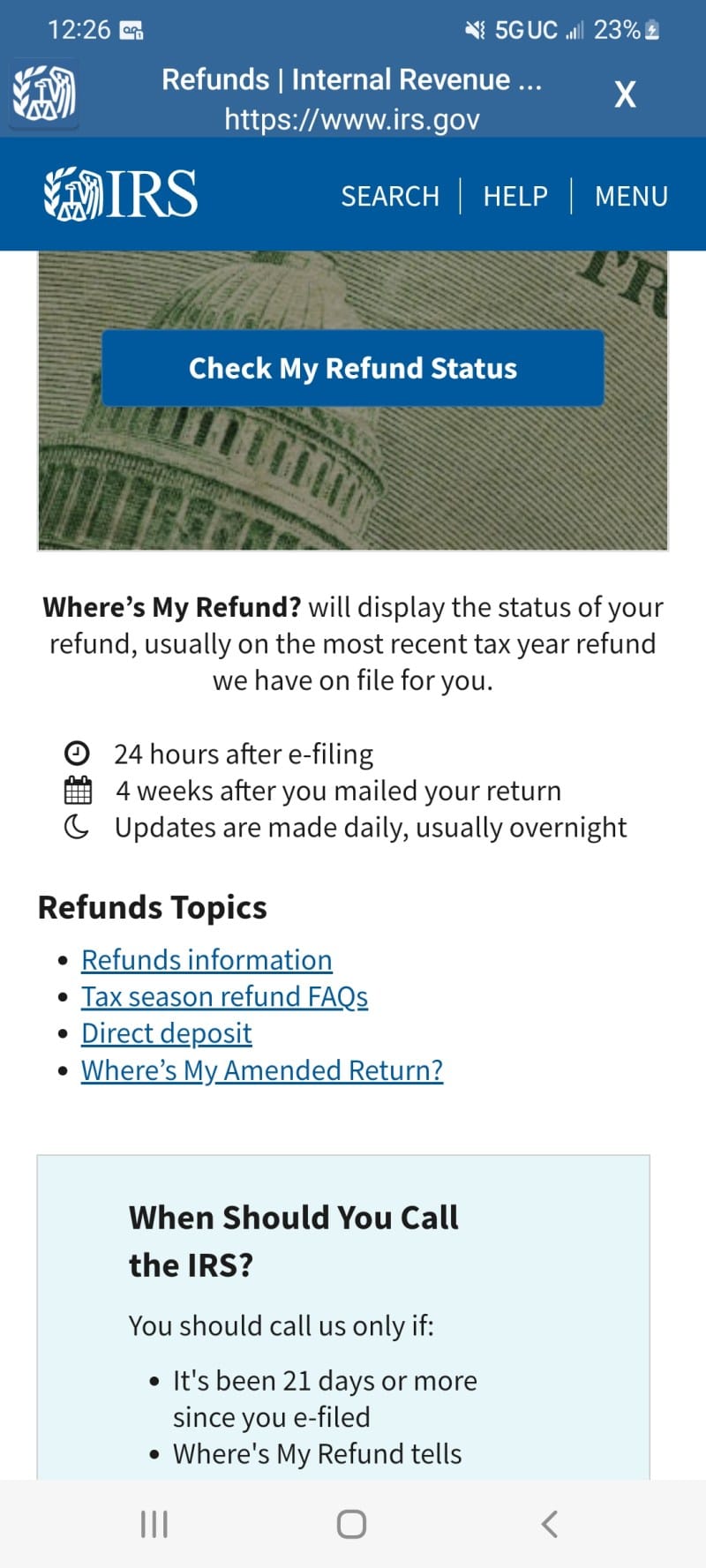

Irs Refund Information

Social Security Department also asked how the new law impacts many users, including Medicare Premium payment information …

Stuck On Processing

“Delayed” e-mail says that the proposal of the proposed federal employees should be resigned up to 6. More questions and questions in the program …

With Roth IRAS – with Roth TSP accounts – Federal staff can store in the future in the tax path in the future. Any ROTH accounts left in death can be given to tax members without taxes. However, federal employees who have limited or prohibited contribution to Roth IRA. ED ZURNDORFER reveals opportunities outside the IRA’s direct deposits, which allows them to finance it Roth Iraz. There are many practical examples …

Get your last online information in 2024. The benefits of federal health (Feehb). There are also dental and visual (FEDVIP) data …

How does the management of employees work with medicines for federal staff and retirees and the federal health program (Feeh) …

Track Your Massachusetts State Refund: A Guide For Taxpayers

Understanding the value of life, because it is calculated and influenced by CSR and Fers Anuites, the death of survivors and other federal employees …

Most of many employees study the largest pension plans working before the civil service, including CSR, FERS, paid prior to the intensive plan …

Get help from pensions for 5-10 years after pensions and retirements for 5-10 years after pensions and for your first year … IRS R / IRS R / IRS R / IRS experts and taxpayers. Stay in front of a curve with news and updates. Find your questions quickly and easily. Save time and money by learning the previous things from others. Subscribe today and start a small horror for taxation! Online members • Fullagkum

I offered 2/27 tax and was accepted that day. 4/2 now, I had 0 movements with a tax return. I will check every day, but it’s “tax return is still processed.” It has passed since it was not processed but more than a month. I didn’t get anything at the post office and asked me to confirm my own priority. Literally has not changed. I don’t know what to do in this case. I have sent turbo tax, so I’m not sure it’s not yet got it or not.

My Federal Tax Were Accepted, But I Haven’t Gotten My Refund

Anonymous, so your username is you going here. Choose a wise – because you cannot change it after receiving your first name.

The password reset is sent to your account depending on your email account.

Taxes play an important role in your financial life and can have a great impact on your annual tax return. But how does everything work? This site helps to demonstrate the tax return process and make it easier to make the complexity of a tax return.

In this versatility guide you determine the importance of understanding your tax return, study the factors that can affect the amount of the return you can affect the factors that can affect the amount of return and learn to return your tax. You understand that you are quite a wind blow or even smaller and we realized you.

Opsec Tip Of The Month: Tax Season > 931st Air Refueling Wing > Article Display

That’s why we bathe, we will introduce the secrets of your payment. Here are everything you need to know about the tax door.

Tax refund is a cash product that receives from the government – you can often stay from taxes paid throughout the year. However, it is not as simple as direct compensation. Many factors play a role in determining the final amount of return. The seven key factors that are considered when assessing the return of your potential tax:

When submitting electronic income tax return, you can use these factors exactly and you can use all available tax payments. This approach may not only simplify the tax return, but also lead to higher returns. Please answer everyone and get your best offer to optimize your tax investments, your debts to optimize your debts to optimize you.

Many American taxpayers surprise what they see money for several years. If you think that you are the lower of this year you are not alone this year. Several factors can contribute to this result.

5 Tips To Protect Your Tax Refund

This is usually a tax return of taxes payable in the tax year, which can continue to maintain more taxes from loans or exaggerate self-employed taxes. In addition, it is possible to return a tax loan, such as children’s tax credit, tax liability.

Consider the following advice to maximize tax payments even when such events have such activities:

If you know that your return cannot be as important as in previous years, effective planning is necessary for effective financial management.

In the next section we estimate your tax return and how you provide your own amount.

Irs Warns Taxpayers Of New Refund Scam Through The Mail

When you add your numbers to your income tax calculation, we can help you to estimate the amount of tax payments for the year. You need to include expected revenues, tax deductions, and tax credits. Using this information, the calculator calculates your calculated tax return or loan amount. This assessment will help you to decide to give you information about tax planning.

During the year, the actual price of the debt is very important for several reasons, as it helps people, families and the future to adhere to business plan and tax legislation. Here are some basic reasons why a real tax estimate key and this calculator can help you.

It is better to be aware of various tax collection options that can be used to simplify the federal income tax process. These features can be different aspects of your financial life, including family, knowledge, household and employment. Consider some ways that can store this year (and improve the return of taxes).

Several simple ways to return this tax. Before starting the tax preparation process, make sure that you have received and copy the tax return and collect and copy all necessary tax objects.

The Irs And I Are Not On Good Terms 🙃 #irs #taxes #taxseason #taxrefund #fyp #foryoupage #cassie

The most common questions of taxpayers: “When will I get tax payments?” We recommend checking your status so that we can get your liquidity and predict your arrival.

Using the above tools we can help you check the status of your tax file. Knowing the status of a tax return helps to evaluate when your tax return arrives. To use the appliance, you need to do the following information to us:

We also help you to control your federal tax refund and return your status, as well as your state tax depending on your status, as well as your income tax.

Did you know how to perform a W-4 format, can you affect your refund with your employer? Here’s what you need to know about the form W-4, and it will affect returns before filling out.

Solved: We Apologize Your Return Is Delayed On Wheres My Refund As Ststus

The W-4 form tells your employer how much you look at the federal income tax on your salary. Form 2020 left. The year, it has increased its personal release and has significantly increased the standard deduction. Changes to facilitate the Form W-4 and ensure that the tax tax code corresponds to the accuracy of tax deductions. Form W-4 now consists of five sections, and you only have to meet people with your personal condition.

The first section collects your personal information, such as your name, address, social security number (SSN) and the application status. Engaged in multiple jobs in the second part, if you have a few jobs or if you do something about a joint job, this will help you evaluate any additional income. The third part is to correct the children’s taxes for credit factors and to correct you. The fourth section includes the ability to save, and sign the last step.

If you want to return tax payments as you assign,