Irs Refund Issued Meaning – Go to the IRS R / IRS R / IRS Get help in paying your taxes from other experts and taxpayers. In front of the curve of the press and update. Find answers to your questions quickly and easily. Save time and money by learning from others who were there before. Subscribe today and start fearing that less tax compensation! Network Member • Tashasakura

Get Updates of Transcript 2/14 TC570-HC971 – 4464 degrees Celsius and your tax declaration and it is processed. 3 / 1-Called IRS 2/2 is told that it is still revised and can take up to 120 days – the IRS 4/23, which is in tax law. Reach on Monday Congress office for the update not sent by the former employer of my delayed employer.

Irs Refund Issued Meaning

Is anonymous so your username is what you’re going to go here. Choose wisely – because when you get the name, you can’t change it.

No, That’s Not The Irs Texting About A Tax Refund Or Rebate. It’s A Scam.

Email with links to reset your password is sent to the email address linked to your account payout to the amount paid to the federal or state government . While the taxpayers tend to review the refund as a bonus or trip, it always represents what is important that the taxpayer has done to the government. It is often possible to avoid your tax return so you can keep the extra money in your pocket, all payrolls and avoid payments when you leave your tax back.

It can be excited to get a lot of tax refunds. You can expect to get a refund if you spend too much of your taxes a year. This is generally occurs when the tax is withdrawn from your salary every time you get paid by your employer.

The payout is the opposite of tax bills that refer to the tax owed by the taxpayer. When it comes to tax bills, you owe taxes on governments more than you paid in the year. You usually have a tax bill if your employer does not hold enough tax from your salary.

In order to avoid your W-4 properly and update it if you have important life changes, such as marriage, divorce, new adoption or child case.

Why Is My Tax Refund Delayed?

The taxpayer is generally better to not pay too much tax because money is better. For example, you can adjust your withholding tax (or an estimate quarter tax if you have a job) and invest extra money in your pension account (IRA), 401 (K) or even interesting savings accounts. In this way, money works for you instead of the federal government.

Most tax relief is repayable, which means the tax credit can reduce the taxpayer’s responsibility on $ 0. The remaining amount of the tax credit paid is withhold by the taxpayer. For this reason, this type of tax credit is sometimes called trash tax credit.

However, the tax credit can be completely paid, which means the taxpayer is entitled to the entire credit amount regardless of their income or tax liability. If the tax credit reduction to the tax debt to below $ 0, taxpayers receive a refund.

The child’s tax credit accounted for $ 2000 for the eligible taxpayers. The removable part is $ 1 700 for 2024 and 2025.

This Mean I Was Accepted Right?

EITCH Gives income earners of income and family and low-income families and families. Credit is 7 ,,830,220 and $ 2024, 046 2025 Credit amount that the taxpayer receives depending on the archive and the number of children they have. For example, the taxpayer eligible for the right to no longer have $ 632 for the tax year of 2024 and $ 649.

US Charge Credit (AOTC) is a taxable tax credit that can be available in the taxpayer to pay for high-education costs. If the taxpayer reduces their tax liability for the total of $ 0 before using the entire $ 2 tax deduction, the remainder is limited to the remaining $ 1,000.

Low and medium-income families can qualify for the monthly premiums (PTC), which reduces the monthly premiums for the health plan offered through the change in federal and state health benefits. Taxpayers are available all, some or no PTC first (ie advance). If you pay less PTC taxes, they qualify for them will get a difference that is a tax returned when tax returns.

The tax refund is usually issued both the check and sent with the United States. Email or directly deposit into the taxpayer’s bank account. On the other hand, the taxpayer can use compensation to buy American series to cut or make it accused of previous debit cards. The fastest way to get a refund is to the email to pay your taxes and select the deposit directly.

Anyone From Missouri Try To File Their State And Won’t Let Them Finish It? The 1040 Form Was Suppose To Be Ready Yesterday, Now It Says “ready Soon”.

Most refunds are issued in a couple of weeks after his taxpayer. However, there may be some cases where the refund takes a long time.

For example, taxpayers claim that EITC will receive its refund on February 27. This is because the law requires the IRS to adhere to the repayment of these debts until March due to many years of fraudulent applications.

The refund is always good, but it’s better to avoid paying too much by completing the correctly in W-4 or the tax calculation you estimate. You get closer to zero, the more money you will have last year.

Of course, not everyone who agrees. Some believe that the tax refund is a replacement of a replacement plan and look forward to paying a payment.

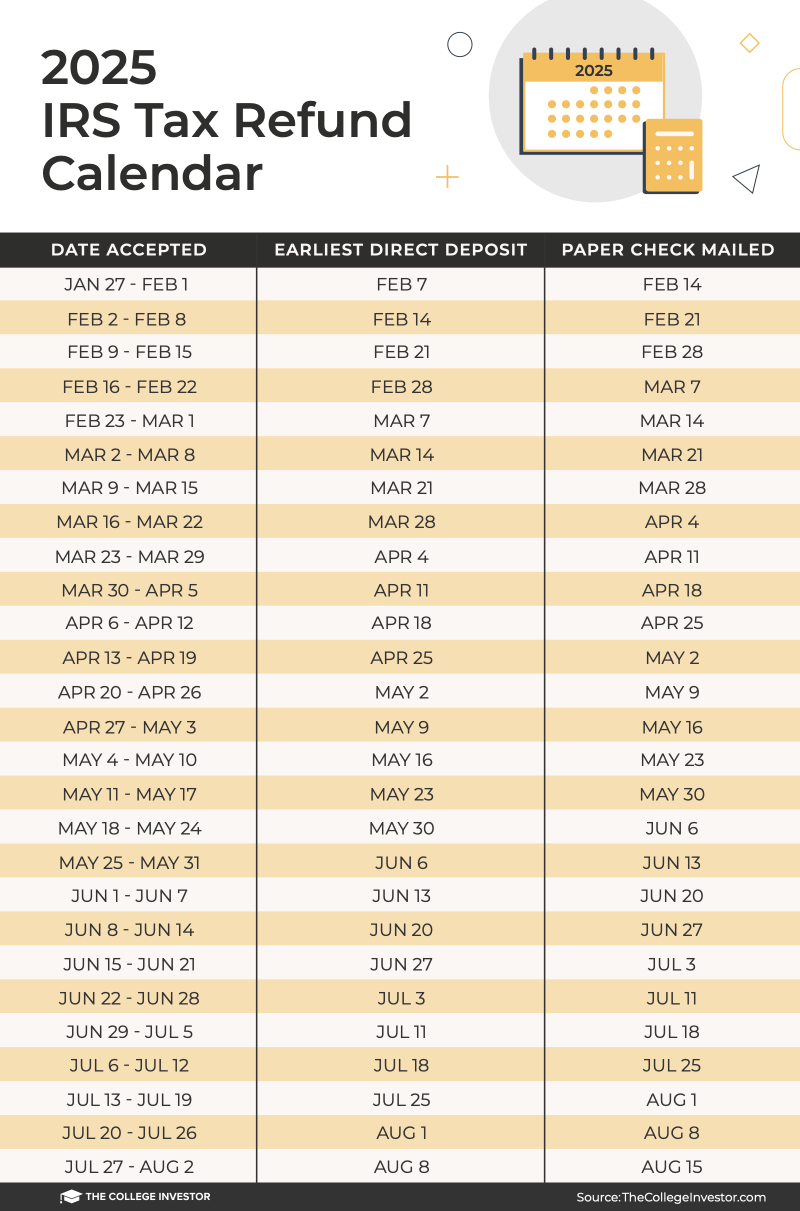

Tax Refund Schedule: Here’s When You’ll Get Your 2024 Refund

Internal Revenue Service (IRS) claims to be out “Most debts in less than 21 days of the Calendar day”. If you claim that the tax credit on the income tax receiving or child tax credit adds your repayment will not arrive until early March.

You will get a refund if you have paid too much of the tax last year. This may occur if your employer has too much from your payroll (based on your employment on your W-4. If you have a self-employment, you can get a refund if you pay the tax Quarterly you estimate. Tax credit, taxable, such as EITC can also lead to refund.

Where can you use IRS ‘Where is my refund? Tools for checking the status of the most recently submitted tax returns in the last two years. Can you start checking where refunds? 24 hours after the IRS received your electronic tax return or 4 weeks after you have sent a tax message on paper.

The tax refund is the amount of money that the government restrains paid taxpayers more than they owe taxes. Basically it is a good idea to calculate the tax that you owe the river correctly as possible so you don’t pay throughout the year. This way you can save your additional money and put it your best, whether it gets back and build your debt or repayment.

The Elastic Statute Of Limitations On Claims For Refund

Require the author to use the main source to support their work. These include white books, government data, government data, original reporting and interview with industry professionals. We also refer to the original research from other well-known printers. You can find out more about the standards we follow up to produce accurate and impartial content in our editorial policies.

The offer shown in this table is from a compensatory partnership. This remedy can affect how and where the list appears. Does not include all the offerings available on the market.