Irs Refund Issues – Copyright © 2025, Los Angeles Times | Conditions for servicing a privacy policy notification do not sell and do not share my personal information

IRS employee Donna Orton, the center, holds a sign protested by the government last week in the federal building of James V. Hansen in Ogden, Utah.

Irs Refund Issues

Reporting from Washington would already be a difficult year to complete your federal tax returns after significant changes in the 2018 tax.

Track Your Unemployment Tax Refund: Irs Unemployment Compensation Update & Guide

Then, the political dispute over the border wall of the United States and Mexico sent most of the home workers of the house last month.

9:30 h.

Now that the government is partially closed, when the tax registration season is approaching January 28, it is increasing whether employees of skeletal IRS employees can cope with the workload.

The Trump administration said on Tuesday that she would call about 36, 100 additional IRS employees back to work – without payment – for tax processing.

Irs Unemployment Tax Refund: Taxpayers Frustrated By Tracking Issues, Slow Pace Of Payments

But even if the suspension is completed soon, and the agency will return to complete personnel, the damage to this tax season may have already occurred from a shorter time to study IRS employees, which makes it difficult to hire seasonal workers to help return and delay the receipt of the decisive management of IRS for tax trains.

“This was the biggest change in tax reform over 30 years. There will be many, many millions of questions that they ask. You have a shutdown. You have fewer employees, ”said Tony Rirdon, National President of the National Union of Financial Workers, representing IRS workers.

IRS has already experienced difficulties with the processing of about 150 million annual individual tax returns, since in recent years the agency has been influenced by personnel reduction and political disputes.

Last year’s deadline for applying an application to the IRS electronic system has occurred, which allows the Americans to present their return on the Internet. The problem reserved millions of Americans to observe the midnight and forced IRS to provide IRS without fines, extension for the day.

Irs Starts New Tax Rule For Digital Income

“The statement season is busy, compressed and difficult for everyone,” says Edward Karl, vice -president of taxation of the American CPA Institute. “It will be a particularly difficult year.”

IRS is one of the approximately a quarter of federal agencies, whose financing expired on December 22, after President Trump and Congress Democrats could not agree with budget loans from the border funding of Trump in the amount of $ 5.7 billion. USA. Trump repeatedly promised during his presidential campaign that Mexico would pay behind the wall.

About 70,000 IRS employees – approximately 88% of the labor force – were repaid, according to the original plan of unforeseen situations IRS. The issuance of tax compensation is not one of the tasks of the agency, which will be solved during the exception that is limited by law, which are “necessary for the security of human life or protecting state property,” the report said in the report in the report of unforeseen situations on November 29.

The report states that only 9, 946 employees of the agency, or about 12%, were freed from braking and necessary for work.

Who Else Has This Issue?

But the protest on the influence of tax delays forced the Trump administration to announce last week that it is changing the course. Management and budget management referring to the law, which, according to him, created permanent budget loans to pay tax reimbursement, and IRS announced that he would “remember a significant part of his labor” back to work.

“We strive to ensure that taxpayers receive their compensation, regardless of the suspension of the government,” said Chuck Retg Commissioner IRS last week.

The processing plan to exclude the contingent published on Tuesday increased the number of employees freed from stopping to 46, 052 or about 57% of the IRS labor.

To process the restoration of recovery, Rarden judged, IRS had to recall about half of his employees. They will have to work without payment until they exclude the exception.

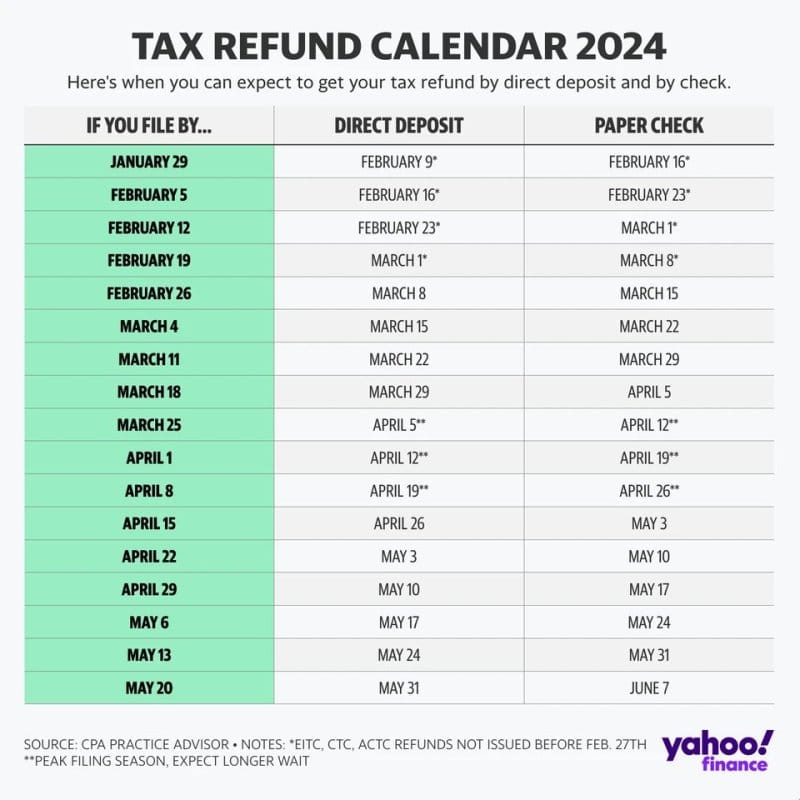

Tax Refund Schedule 2024: How Long It Takes To Get Your Tax Refund

“People are not happy, as you can imagine, for the potential to return to work without paying,” he said. Despite the fact that you are fenced is quite difficult, the return of work requires spending money on work related to work without receiving a salary.

“What is needed to get to work: fuel, care for children?” he said. “All these things cost money – money that you may not get.”

Last week, the trade union filed a case that stated that the coercion of federal officers to work without payment violated the Constitution and that the Trump administration uses a number of definitions of large public services that require work without payment.

Rirdon said that he understands why some of his trade union members working for the US Customs and Border Protection Agency are considered large employees, despite the suspension. But the processing of tax compensation “does not in any way protects life and property,” he said.

Common Reasons For Tax Refund Delays

IRS will begin to accept tax return on January 28. Last year, the shipment window opened on January 29. By February 3, about 18.3 million declarations were presented, and most of them were processed. IRS released 6.2 million people in the first week.

In general, IRS released about 112 million people in 2017. The average recovery is 2 US dollars, 895 US dollars, according to IRS.

People who expect recovery are inclined to serve early, while those who should pay taxes are usually waiting until the April term.

According to Mark W. Everson, who led the agency from 2003 to 2007, tax processing season always works to work in IRS.

Finance File Taxes

“This is always a challenge,” he said. “You start with an agency that has already been injured in recent years of low financing. He has no adequate resources for people or system resources. “

This year, IRS should deal with the basic amendments to the law on the tax reform of the Republicans, which entered at the end of 2017, which requires additional training and analysis, said Everson, who now works as Deputy Chairman of the Special Tax Services by Alliantground.

According to him, while tax legislation simplifies taxes on “millions of people”, there were also many changes in the rules of deduction and income of business.

“For those who continue to describe themselves and who own the business, this did not simplify at all. He probably made things more complicated for the majority, ”Everson said.

Where’s My Refund? How To Track Your Tax Refund Using Irs Website, App

Tax coaches are waiting for the final leadership of IRS according to some changes in the tax legislation of 2017, and the suspension may delay or prevent this information on time. This can lead to a larger number of extension requests this year.

“The first priority at this time of the year is the processing of income,” says Eric Toder, a former IRS employee, who is currently a conversation between the Center for Tax Policy, Non -Aparticheart Cerebral Provery. “I suppose to establish an additional guide, it will take a backpack for him. People just have to understand this. “

Taxpayers who call in IRS can also encounter problems, depending on how these services are provided if the stop continues.

In 2017, IRS received almost 96 million phone calls, according to an independent national defender of IRS national taxpayers. About 77% answered, and the lawyer announced 90% of customer satisfaction.

The Irs Has Stated That If You Claimed The Earned Income Tax Credit (eitc) Or The Additional Child Tax Credit (actc), You Can Expect To See A Direct Deposit Date On The “where’s My Refund” Tool

A wide shot brings you news, tests and understanding about everything – from streaming wars to production – and what everything means for the future.

Jim Potzsonger covered the business and economic problems of Los Angeles Times’ Washington, D.C., Desk. He joined The Times in 2006 and won the newspaper editor prize in 2009 to cover the financial crisis. He has been working in the capital of the country since 1998 and is the winner of the National National Press Press in Washington. A graduate of the North -West University previously worked at the rank of Mercury News, Newsday and St. Petersburg Times. He left time in 2019

9:30 p. Submission? “This is a common question that touched taxpayers when they pressed this final shipment button. Knowing when this tax refund comes to your account is similar to the presence of a crystal ball for your finances. This can affect everything, from the budget for upcoming expenses to strategic repayment of the debt or achieving this goal of savings.

Waiting can feel painful, but there is good news! There is a way to restore your recovery faster and easier than when lib: an electronic representation of direct deposition. Electronic filing optimizes the entire process of the tax return, saving your time and powerlessness. But a real change in the game is a direct deposit. It guarantees that your restoration is directly on your bank account, which eliminates the need to wait for a check on paper, which can be lost or postponed by mail.

Tax Refund 2023

But the burning question remains: how exactly will you wait? This blog will be your only store for a temporary line of taxes. We worsen average conditions for processing electronic tax returns with a direct deposit. We will also introduce you to “Wast My’s My’s My’s My’s My’s My’s Tool Tool, a convenient online resource that allows you to track your status