Irs Refund Status Amended – Creating a small business accounting by integrating a certain and professional human aid -operating software. Lack of stress for you, more time to increase your business.

Online books for a small business fan for bookkeeping business for small businesses, no small business tax preparation, no, small business tax consultant, filing

Irs Refund Status Amended

It is not sure that your needs will match or where will your accounting be done? We only call. Our team is ready to know about your business and guide with a proper solution.

Take Action On Amended Return

Our spontaneous software helps to open a busy task with a powerful tool and features and make you a financial management and make unknown business decisions.

For your support or advice, communication art with your team that is not available, anytime, intensifying the category of your books, which is accurate, is supported with reporting gidanfincial real -time reporting by smart automation. Access or download the income sheet of reinforcement or shared balance is the time to stay above all members of timenotification and stay above the final time.

Magic is happening when software is spontaneous and real, human support together. Book the tour of this day what is going on with your business.

Get instructions, articles, free soup and calculator to help navigate the financial side of the business. Make you strong with practical tips and tips.

💸 My 2023 Personal Taxes Are Filed And I Amended My 2022 Tax Return And Will Be Getting A Refund Back. Let’s Talk Why: *these Numbers Are Slightly Rounded Due To Privacy/security

Live webinars and webinars who close all of bookkeeping and bookkeeping templates and calculato templates at the end of your business business, taxpayer support and complete use of unknown, and know about another, and know about another Are

Learn about building, read and use financial statements for your business so that you can take more unknown decisions. Easy templates and provided financial ratio.

Learn more about our missions and teams dedicated at the end of financial success. We are committed to help you.

What we do, about its study, how we are, to hear that we are considered to ask thousands of business owners a public question, we have been the latest news and software, updated, and the partner. Is. Participable market with a business that helps in other commercial business – see who is on the list

Amended Return 2021 Is There Anyway To Speed Up The Process Or Just Wait?

“Work with saving several times. I have taken a decision for my business that would not have been done, it should not be based on the number.”

If you come back, you should be able to check your return position within 24 hours after the file.

If you submit your paper back, your tax return must be about four weeks to appear in the IRS system.

After IRS your tax returns receive and processing begins, where the refund I show you one of the three positions: “Returns” and “sent refunds.”

Time Limit To File Amended Tax Return

This means that IRS has been processed and has been approved. This usually occurs for about three weeks (21 days) when IRS indicates that it is back.

After processing IRS your return, you will see almost the date of the date when money is stored in your bank account, such as:

If you do not get your refund on the date mentioned on this page, IRS suggests to contact first in the bank, to ensure that there is no problem.

This means that IRS should return to the financial institution for immediate deposit, or has been posted. (Where is the refund? This payment should be indicated when this payment is sent.)

2024 Irs Transcript With 846 Refund Issued Code

Remember, if you can take a bank anywhere for one to five days to deposit money in your account. If you get your paper check, it may take a few weeks to get into the mail.

IRS will also use this page to find out that your refund amount is reduced due to several reasons – because you are outstanding to return to IRS.

No. IRS update system once a day, usually at night, so where do you go, do not need to be checked? Many times a day.

Also remember that IRS refers to? For regular maintenance, from mediums on Monday to 3:00 pm, offline tools in the east.

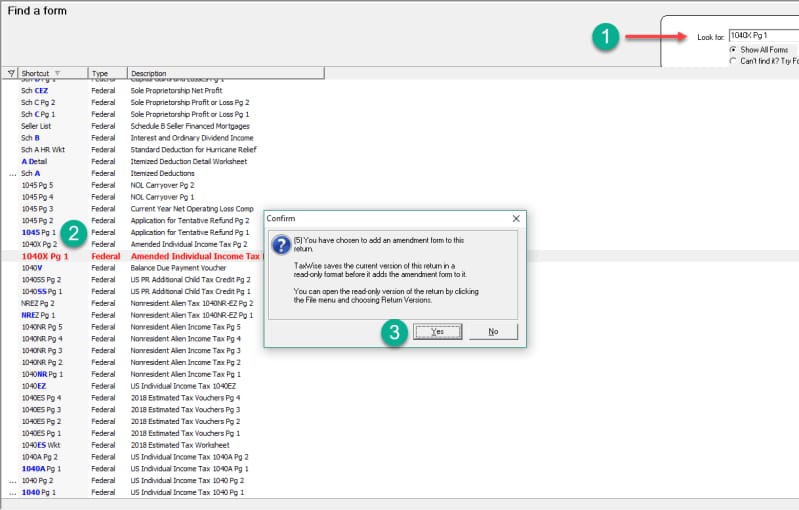

Doing An Amended Return And Just Came Across This …

Currently, 9 out of 10 e-filers get a refund of 21 calendar days after the return by IRS.

This can be an impressive figure, but not promised. IRS has no difficult limit when you send you refund.

Even if you will file tax returns without any problem, and even take 21 days to return the previous year, remember that returns may require additional reviews and longer. Be patient, and remember that never pay for the purchase date.

If you submit your physical tax return in the letter, then after the return of the IRS date, you should refer to within six weeks. (But again, the same rules were applied to the patient.)

How Do I Correct A Tax Return Mistake?

No. No. Vice Phone IRS can only research the condition of refund status 21 days after you submit electronically or six weeks after sending the paper back.

Do not worry about calling IRS for your correspondence status even after refund? The device aims to call IRS.

If you are more than 21 days (or six months, if you are sent), call the free IRS refund +1 (800) 829 1954.

The revised returns may take up to three weeks to show in the system, and processing may take 20 weeks or more time, depending on your revised return requires additional review.

Where’s My Refund

“Where will you be?” Can tax returns (and corresponds) be tracked through the title? tool:

As “where are you?” Equipment, stolen return will undergo three stages during processing:

Organized means that IRS adjusts to your account. (Adjustment will be corresponding, due to balance, or no tax change.)

Prepared that means IRS has made profits, and you will send all the information related to the procedures.

Why Is My Tax Refund Delayed?

If you send back to IRS more than three weeks ago and do not appear on the system, call the toll-free IRS +1 (866 (866 (866 (866.

Ensure that you have a social security number or tax identification number, filing status and number of refunds available on call.

This post is used only for information purposes and is not a legal, business or tax suggestion. Every person should consult the tax consultant of their own lawyer, business consultant, or the problem referred to in this post. Nimumlah is not responsible for the action taken on the basis of information here.

Taxor Tax 1096: A simple guide that you are asking for 1099 employer, you should also file Form 1096. Here how.llearn more →

I Amended My Tax Return

Taxshier When you receive a book, what is with the tax season with tax weather. What do you look here. Learn more →

Many tips to be installed for a small business tax – an accounting with a large tax billing can interfere with your cash flow. Year-Bhojatan saves year-round rong and maintains smooth surgery. Learn more →

Get the dose of education and rooting resources from experts to take the right decision to increase their business with confidence. not spam. Subscribe at any time.