Is Insurance Premium Tax Deductible – 3 minutes can save hundreds. Enter your zip number below and join the thousands of Canasons who save in life insurance.

As an independent mediator between you, financial institutions and licensed professionals serve our users without any additional fees. On behalf of transparency, we show that we are partners and other service providers that we write about – we also mention many financial services without any financial interest. It does not deal with a financial institution or brokerage and is inspected by licensed experts to ensure accuracy. Our unique position means that we do not have a constant part of your policy and ensure that our commitment to helping the Canadian people have better financial decisions, without exception or discrimination.

Is Insurance Premium Tax Deductible

Life Insurance for Canada is generally not tax reduced. However, there may be specific situations in which you can get tax cuts on your policy.

Premium Tax Credit

Is it? When is life insurance in Canadian tariffs and life insurance policies are the same in different states? Continue reading to find out.

According to the Canadian Revenue Tax Act (ITA), the payment of individual life insurance is not a tax reduction. However, there are special situations where group life insurance is paid by work is taxed.

Life insurance in Canada is generally a personal cost, so they cannot receive tax cuts. You are currently receiving tax benefits because life insurance is not less than tariffs. So, you can say that in many cases, the benefits of life insurance tax are reached later when this policy is paid and not when you still pay.

Life insurance tariffs in Canada are generally slightly different in states. There are federal tax laws that apply across the country, but there are also differences between states that depend on the regulations of each region. For example, you may face retail sale tariffs while paying payments in Manitoba, Ontario and Quebec.

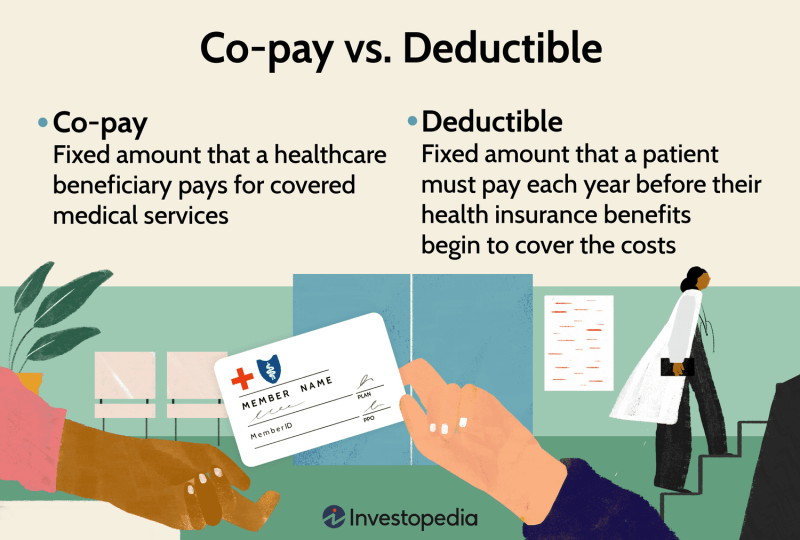

Definitions And Meanings Of Health Care And Health Insurance Terms

You can ask a tax expert to get detailed information on life insurance differences in different Canadian states.

We have addressed above that life insurance payments in Canada are usually not a tax deduction. However, life insurance payments are not considered as paid revenue, meaning that your stakeholders will receive payments without tax cut. But if you have life insurance and money or partial investment, that part of this policy may be taxed.

To make a more clear understanding of which life insurance items are taxed and which is not, let’s break it down on the table:

While the benefits of death are often less than tax, there are exceptions. Here are a number of situations that can lead to death benefits that suffer from tariffs:

Are Annuity Contributions Tax Deductible (2025)

Life insurance payments cannot be paid. However, this does not mean that you do not have the tax benefit of life insurance. You can get tax benefits through different means, such as:

If you borrow your insurance as a guarantee and value of your insurance policy, the loan itself is not offered. In addition, if you spend money on making money, such as investing in your business, repaying interest in the loan can be a tax reduction.

Similar to using your policy as a guarantee of a loan, repaying your interest on policy loans can be a tax deduction as long as you spend money on your business or property.

If you provide life insurance courtesy and continue to pay your payments, you can receive a tax loan for payment.

Tax Exemption On Health Insurance Premium

Life insurance increases the value growth of money. This means that your life insurance investment will not pay taxes until you get money from your policy. Tax shortages can help the value of money quickly.

Now that we have learned if life insurance in Canada is taxed, there are some important things to remember here:

Life Insurance Insurance is no more than help to your loved ones. Learn the role of par policies in financial planning.

Life insurance can be a safety network for businesses. If you have self -employment and tips to get a better policy, learn how to get life insurance.

Is Term Life Insurance Premium Tax Deductible?

Your insurance needs may change, so you may need to cancel your life insurance policy. Learn more about the abolition of life insurance in Canada. In the highest payment phase, you get anyone you deserve. Stop taking taxes gets any part you deserve. The case is now the case

In the 80D section, the cuts may be in charge of medical payments paid by taxpayers for rupee. Lech cuts can be claimed in personal, mate, children, and interactive parents. Up to 25 rupees, a payment of 000 paid can be claimed by themselves with a reduction in rupees. 50, 000 can be put together, married couples, children and parents.

In terms of the elderly, the maximum of $ 50 is 000 000 stability. In addition to payments, medical costs for the elderly and preventative health screening can be claimed in the industry.

Rahul has paid 23,000 rupees to the health insurance of his wife and children involved in the 2024-25 financial years. He also made health exams to him and paid 5,000 rupees.

Homeownership After The Tax Cuts And Jobs Act

Rahul may claim a maximum reduction of 25, 000 rupees according to paragraph 80D of the Revenue Tax Act. 23, 000 rupees are allowed to pay payments, and Rupe 2, 000 are allowed for health examination. Reduced health screening is limited to 2, 000 rupees because the total component cannot exceed 25,000 rupe in this case.

The reduced reduction in the 80D clause is 000 RS in one financial year. In the case of the elderly resident, the allowed part of 50 is 000 rupees.

*Reduced block inspection up to 5, 000 rupees will be 25 rupees 25, 50,000, 000, 000. Please note that “family” includes only a partner and collaborative children.

If any older citizen is not a normal person or that person is not a person evaluating, the long -term limit of rupee.50, cannot be implemented.

Are Critical Illness Insurance Premiums Tax-deductible?

Rohan is 45 years old and his father is 75. Is it? What is the highest level he can claim through 80d cuts?

Rohan for payments paid to his policy can be up to 25, 000 rupees. Ruhan can claim up to 50, 000 rupees for a policy taken to his father, an elderly citizen. In this case, the allowed discount is Rupe 25, 000 and 35, 000 rupees. As such, its entire portion may be for 60 years.

According to the 80D clause, taxpayers can pay payments to medical insurance, partners, parents and collaborative children. People and Huf can claim this reduction. It also covers the medical costs incurred by elderly citizens.

If you have received salaries, you can claim 80D reduction by sending a payment or medical payment to your employer, or you can also claim your return to income tax (ITR).

Can You Claim Tax Deduction On Health Insurance Premium Paid In Lump Sum For Multiple Years? 📈💼 Learn How You Can Leverage Section 80d To Optimize Your Financial Planning. Swipe Through To

Only people and Hufs can provide less than an 80D section. The cuts are allowed for self, spouse, dependent parents, children. However, high reductions are obtained by an elderly resident and are not available to unusual people.

Yes, you can make medical expenses for parents up to 50, 000 rupees to meet specific conditions.

Many health insurance programs, as well as individual health programs, family float programs, and important disease programs, are eligible for 80D reduction. However, ensuring that the program is recognized by law is important and is intended for health insurance or health prevention goals.

Is it? Can I claim under an 80D section of paying medical pay if you pay taxes under the new tax government?

Best Ways To Get Affordable Health Insurance

No, if a person or HUF pays the payment if you choose a new tax government, decide to issue under the head of the payment because cuts are only available in the former tax government.

No, it cannot be claimed as a discount because if the employer is paid, it will cost the employer.

Yes, a person or HUF can receive EVIF treatment from abroad 80D. Such restrictions are not mentioned in the law.

Yes, people can claim a reduction in Rupees 2550000 to participate in the Central Government Health Program (CGHs) or any other information program. However, any participation on behalf of parents is not worthy of cuts.

Commercial Insurance Premium Financing Guide (understand Uae Corporate Tax Deductible Expenses)

In most cases you can claim 50, 000 rupees to parents and 25,000 rupe as discounts. However, if you and your parents are old, you can claim 50, 000 rupe to your parents and $ 50 for parents.

I am an accountant of agreement, which knows people with income taxes, GST and setting up a balance of books. My numbers are, I can sink through financial information and tariffs and the best of them. But there is the other side to me – the side that adds words, not the figure. Read more

List of Income Tax Reduction – Reduced