Largest Insurance Company Usa – According to the National Insurance Commission (NAIC) in 2024, there are 25 major property and accident insurance companies in the United States. These companies usually write premiums with billions of US dollars. Property insurance and accident insurance (also known as B&C insurance) are types of insurance that help you and your property. Property and accident (B&C), such as housing, automobiles and other items provide protection for physical property. This insurance includes accountability that can help you protect you if you are legally responsible for an accident that may be injured or damage their property.

All data were usually obtained from the National Insurance Commission (NAIC) database in 2024. Functionally, the National Insurance Commissaries Association (NAIC), established in 1871, provides insurance companies to effectively regulate and protect consumers.

Largest Insurance Company Usa

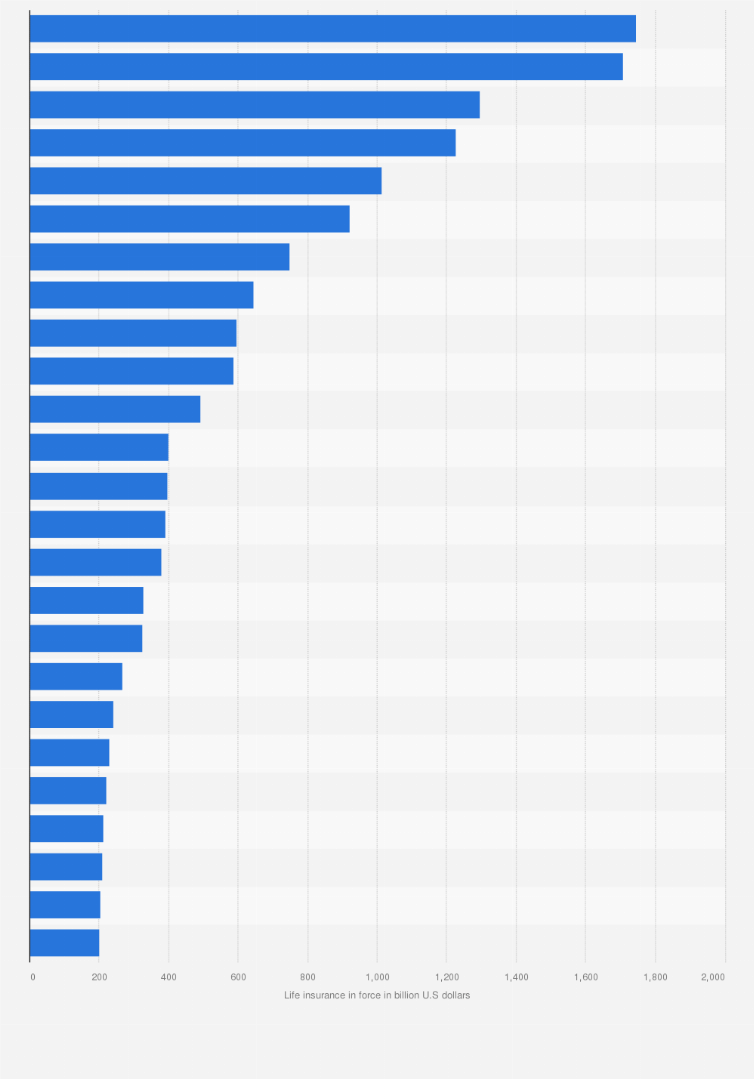

Many people in the United States (USA) rely on insurance companies to mitigate unpredictable risks associated with property and accidents. According to statistics, until 2023, the total direct premium written by all insurance companies in the United States market was $ 960, $ 527 million. Meanwhile, the total direct premium won in the US market reached 919 and 859 million.

Insurance Consulting — Crescent Wealth Advisory

Until 2023, there are 25 major property and accident insurance teams in the United States. All data were obtained from the Published Market Share data report by the National Insurance Commission until 2024. This ranking is organized on the basis of direct premium (B&C) written in property and accident (B&C).

The United States Illinois is one of the largest property and accident (B&C) insurance companies based on Bloomington. Historically, George J. Macherley built the company in June 1922. George is a retired farmer and is widely considered one of the most powerful people in insurance business. The state farm uses more than 57,000 people with the growth of his business. As for the financial forecasts from financial instincts in the United States, I am in the state farm insurance. Best®, AA1 and AA Standard and Moody’s® Arts. Based on the report of the National Insurance Commissaries Association (NAIC) in 2023, the State Farm Insurance won $ 93.7 billion and direct premium $ 88.6 billion.

Progressive Insurance Company Group started in 1937 in the insurance business. In addition, the founders of progressive insurance companies are Joseph Louis and Jack Green. Financially, until 2022, with business growth, progressive insurance revenue was about 5 49.5 billion, while the net revenue reached $ 721 million. In addition, until 2023, progressive assets were $ 59.7 billion. Moreover.

Berkshire Hathaway is a holding company operating in various sectors, including insurance. Historically, Berkshire Hathaway was created by Oliver Chase in 1839, but it was created by Warren Buffett with the help of Charlie Mungar. According to the 2022 report, the company earned $ 948 billion and $ 322 billion. Berkshire Hathaway has various sub -insurance companies in the insurance business, including the National Institute of Compensation, the State Employees Insurance Company (GEICO), General Re and others.

Discrimination Concerns At State Farm

According to statistics, Berkshire Hathaway is still one of the largest insurance companies in property and accident (B&C) industries. According to the National Insurance Commissioners Association (NAIC) in 2023, Berkshire Hathaway won $ 58.6 billion in 2023 and a direct premium.

Allstate Corporation has become one of the largest insurance companies in the US (USA) property and accident insurance industry. Historically, Alestate was launched on April 17, 1931 as a holding company and is mainly carried out by Allstate Insurance Company and other subsidiaries. Financially, in 2023, Alstate’s financial performance reflected both strong and difficulties in the sector. Total assets were recorded for USD $ 103 billion, while total debts reached $ 85 billion, which refers to a standard but foreign financial framework. According to the Insurance Commission (NAIC) market stock report, direct premium written on Alstate Insurance won $ 50 billion and direct premium 48.1 billion dollars.

Liberty Mutual insurance is still one of the largest assets and accidents in the United States (B&C). The business is located in Berkeley Street, Massachusetts, Boston, the center of Liberty Mutual Insural. Liberty Mutual Insurans rented more than 50,000 people in 29 countries because of its growth in insurance. Financially, until 2023, according to its annual report, Liberty Mutual provided a solid financial confidence with a total assets, $ 165 billion and total loans of $ 140 billion. According to the National Insurance Commissaries Association (NAIC) in 2023, Liberty Mutual Insurance received a direct premium written around $ 44.4 billion.

.jpg?strip=all)

Passenger insurance companies/ passenger companies in 2004 Paul Company, Inc. And it was founded with passengers. With business development, more than 30,000 employees and 13, 500 independent representatives and brokers are located in the USA, Canada, England and Ireland. According to his annual report in 2022, travelers insurance assets were about $ 115, $ 717 million. In the meantime, passenger insurance income is 36, 884 million dollars, which comes about 2, 842 million dollars. Based on the National Insurance Commission (NAIC) report, the direct premium of the passengers reached USD 38.5 billion.

The Largest Brokerage Firms In 2025

United Services Automobile Association (USA) is one of the largest assets and accidents (B&C) in the USA (USA). The headquarters of the USAA are located in San Antonio, Texas. Until 2022, the company rented 37,000 people. Financially, USSA’s income by 2022 reached $ 36 billion. In addition, USAA’s assets were around 204 and 005 million dollars based on the presence of the annual report. In addition, until 2023, the US received a direct premium written around 31.9 billion dollars.

The Subb is one of the insurance companies of the world’s goods and accidents operating in 54 countries in the United States. Sub Surich contains administrative offices in New York, London, Paris and elsewhere and uses approximately 40,000 people worldwide. In terms of financial estimates, AA’s sub -standard and financial forecasts from art and am. The best. Financially, the National Insurance Commission’s National Insurance Commission (NAIC) report received a direct premium written around 31.1 billion dollars.

Farmer insurance is one of the largest assets and accidents in the USA (B&C). Historically, the company’s journey was in 1928. It was started with the initiative of Tyler and Thomas E. Levi. With Business Development, the Farmer Insurance Company can serve more than 10 million families with more than 19 million individual policies in 50 US states. In addition, there are 48, 000 exclusive and independent representatives and 21,000 employees in Tiller Insurance. According to the National Insurance Commission (NAIC) report in 2023, Farmer Insurance received a written direct premium up to 27.2 billion dollars.

Mutual insurance company throughout the country is one of the largest assets and accidents (B&C) in the USA (USA). The insurance company was mutually established in the 1920s, and in 1955, the name was transformed into a country -wide insurance. So far, the company is a country -wide plaza, Columbus, Ohio, the United States. Based on the National Insurance Commission (NAIC) report, a country’s premium is written around 19.7 billion dollars.

What Is A Fortune 500 Company? How Companies Are Ranked

Surich Insurance Group Limited is still one of the largest assets and accidents in the United States (B&C). Historically, the company was founded in 1872 under the name Verseces-Warin (Insurance Associations). Occasionally, with occasional business growth, the insurance company worked about 56 thousand people and offers a wide range of insurance products in more than 210 countries. Financially, based on the financial conditions of the balance sheet until 2023, the company’s total assets are $ 361 billion and total loans are $ 335 billion. Until 2023, the company won 56 billion dollars and net revenue and $ 4.7 billion. In the National Insurance Commission’s report, Zurich’s insurance received a direct premium written around $ 18.4 billion.

American Family Insurance started its business on 3 October 1927. Functionally, this company has the primary office of the US Wisconsin Matison. According to the Insurance Commission (NAIC), the American family insurance received a direct premium written up to $ 16.6 billion. Total assets as of 2019 financially