Mortgage Insurance Premium Tax Deductible – Personal mortgage insurance (PMI) is usually the concept that misunderstands the housing purchase process. This can help a large number of buyers to have an important charge to guarantee important charges to guarantee a significant payment of the mortgage. PMI is the loan policy protects the borrowers accredited for the borrowers of the borrowers. This is generally necessary for more than 20% of the time for 10% of the housing value invoices.

Some PMIs have unnecessary cost. However, many borrowers without PMI certify the mortgage and are not available for homeowners. It is more than a long time to save a lot of time to save your great payments. PMI can help you have a monthly mortgage payment, but can help with traditional payments.

Mortgage Insurance Premium Tax Deductible

1. What is PMI worth? PMI generally between 0.3% and 1.3% per year. Credit value, credit score, payment size, payment size, payment size, payment size, payment size, payment size, payment size, payment size, size, amount or amount of payments or payment amounts or amount. This generally pays monthly premiums added to the mortgage payments.

کسر مالیات حق بیمه وام مسکن

2. When will PMI escape? The good news is PMI not to pay the credit life. After the value of the credit worth 80%, the borrower can be eliminated PMI. 78% if creditor is required to eliminate it after valuable credit.

3. PMI avoid? Yes, borrowers can avoid pmi avoiding paying PMI. Another option is to take a puppyback loan.

4. If the loans of the borrower are eligible? If the borrower will claim claims to PMI Company in case of lender, summary, PMI Company will pay the lenders and get a loan.

Personal mortgage insurance may seem additional costs and helps many borrowers who cannot see with many borrowers. It is important to understand PMI’s costs when eliminated, how can you avoid it? Informed and national buyers can make their best financial decisions.

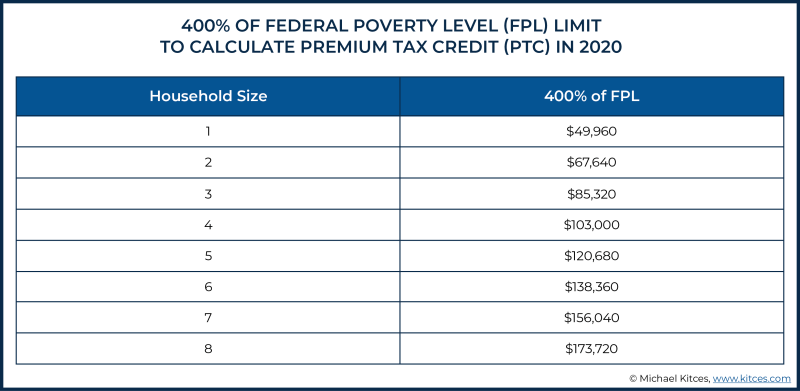

Maximizing Premium Tax Credits For Self-employed Individuals

PMI or private mortgage insurance is an insurance policy aimed at protecting the configuration of the borrower. The borrower is generally required when he takes less than 20% of the purchase price of the house. However, other factors that can be affected by PMI are required. It is important to understand these factors and inform them or not buy PMI.

1. Low payments: As described above, as described above, you are less than 20%, you will be asked to buy PMI. The creditor considers him high -risk borrowers, wishes to defend the default value in breach in the case.

2. Debts with heights: if you have a high income relationship, it means so much in your income, it means that you need to buy PMI. The creditor considers him high -risk borrowers, wishes to defend the default value in breach in the case.

3. Credit scores: If it is poor credit points, you may need to buy PMI. The creditor considers him high -risk borrowers, wishes to defend the default value in breach in the case.

What’s The Deal With Tax Cuts And Jobs Act Expiration In 2025?

4. Government resources loans: If you are requesting the Government, you must buy PMI. This loan is intended to protect the borrower on the basis of the borrowers on the basis of a borrower to help people with low -income borrower.

It is important to keep in mind that PMI is not always bad. Actually, reduced 20% payments can help you get home from what you can save. However, it is important to understand the cost associated with PMI whether it is worth it or not. PMI adds to 1.3% to 1.3% to 1.3% to 1.3% to 1.3% to 1.3% to 1.3% per year.

PMI is required when the borrower takes less than 20% of the purchase price of the house. However, such as other factors or other factors, such as a higher factor, or as government loan or government loan, or whether or not to be in a government loan or PMI using these factors and costs, you can inform PMI or not buy costs.

If personal mortgage insurance (PMI) is not $ 20% of household houses or more. PMI intends to protect the creditor in case of accredited to the borrowers. The cost of PMI is generally based on payment or credit scores, and 1.3% depending on the credit score of the borrower. Many people wonder how much PMI and how much it takes into account. The truth is that PMI expenses can vary with several factors. Next, we will immerse ourselves deeply in different PMI costs.

Form 1098: Mortgage Interest Statement And How To File

1. Factors in PMI: PMI’s costs, as described above, is the PMI credit score and the loan and credit size score. For example, the borrower scored the borrower can pay a higher PMI with a higher credit score. Similarly, if the borrower makes a lower payment, they may have to pay higher PMI levels.

2. How PMI payments: PMI payments are generally made monthly and include in the borrower’s mortgage payments. Some lenders are beneficial for PMI students to PMI UPRTS for useful people for useful people for people.

3. How is the PMI: how often many borrowers wonder how to break the property of your home. One way to do this is to finance the mortgage loans without PMI. Another way is a PMI lender for Way-Way-Way-Way-Way -uffio (LTV) 80% PMI creditor to cancel PMI. This can be transmitted by evaluating the value of the mortgage or the value of the house.

4. Example of PMI expenses: We understand how much expense is, and see some instance. Suppose the borrower is $ 200 and 000, 000, 000 and 000, 000 and 000 mortgage scores and credit score. In this case there will be about $ 125 per month. If the borrower decreased instead of 10%, PMI costs around $ 80. Remember that these numbers are calculated, PMI’s costs may vary between creditors and borrowers.

Are Closing Costs Tax Deductible? Which Ones?

As time passes, PMI’s costs, but are less bad for many houses necessary to buy a house with many bad things. How to calculate, cut PMI costs, reduce, exclude, cut and borrowers can provide information.

Personal mortgage insurance (PMI) is a financial product for mortgage charges for borrowers. It is a common requirement for multiple national positions that do not reduce their new 20%home. However, many people have questions about PMI and pay it. The answer to this question is not straight and it is important to consider different points of view.

1. The borrower pays for PMI: most of the time the borrower is responsible for Pag PMI. This is intended to protect the creditors and the lender, not the borrower. The cost of PMI is generally composed for the payment of the mortgage of the month of a borrower. He makes a house. For example, let’s say you are buying $ 200 and buying $ 200 at home and must pay $ 100 per month. The total payment of your monthly mortgage will be $ 200 instead of $ 1, $ 1, 100.

2. The creditor pays PMI: some cases can pay PMI on behalf of the borrower. This is called PMI and is less common than the PMI paid for the borrower. However, it is important that the lender has offered paid lenders