Motor Car Insurance Malaysia – Wenn Sie Weiter Klicken Oder Sich Anmelden, Stimmen Sie der Benutzervereinbarung, datenschutzrichtlinie undiskeie -Richtlinien von benutzervereinbarungen zu.

Der Markt für kfz-versicherungen in malaysia blüht aufgrund einer zunehmenden anzahl von fahrzeugen, einem sterenden einkommen, obligatorischen versicherungsvorschriften, der Liberalsirif , Der Adoption Für Digitale Versicherungen Und Der Umsatzerholung Nach Pandemischer Fahrzege auf.

Motor Car Insurance Malaysia

Der Markt Für Kfz -Versicherungen E vorschriften, Die Die Kfz -Versicherung Vorschreiben. In addition, the step -by -step liberalization of motor plates has led to insurance products and dangerous prices. Das Wachstum Der Digitalen VersicherungSeinrichtungen Und Die Erholung Der Fahrzeugverkäufe Nach der Pandemie Tragen Ebenfalls Zur Expansion des marktes bei. However, there are challenges like deep competition and fake claims.

Motor Insurance Premium Increase Effective Feb 15, 2014

The market for car insurance in Malaysia is listing the value creation services due to growing attention. Insurance provides additional services, such as B. Round aid for roads, repair and maintenance services for vehicles and personal insurance packages. These services improve consumer satisfaction and loyalty and offer competitive advantage of the crowded market. The integration of the digital platform for providing smooth service increases the attractiveness of this value.

Promoting Geo -Political Stress has a significant impact on the market for Malaysia’s FZ insurance market. Increasing uncertainty and risks increase insurance premiums and increase claims. Störungen der Globaln Lieferketten Wirken Sich auf Die Produkion undyfügbarkeit der fahhrzege aus undauresachen verzögerungen und höher kosten für reparaturen undaustausch. Darüber Hinaus Kann DIE WITISCHAFTLICE Instabilityät, DIE SICH AUS Geopolitischen Konflikten Ergibt, Die Versicherung Auswirken. Versicher Können aufgrund der notweendigkeit eines Erweiteten Risikomanagements und.MAßnahmen auch erhöhte betribskosten ausgeset sein sein. Insogesamt traggen diese faktoren zu einem Volatilener underedden Marktumfeld bei, in the dem Versicherer ihre strategien anpassen müssen, um die rentability with das kundentreuung aufreechtzuerulten.

Das segment für versicherungsmakler/broker iste derößte vertribskanal auf dem markt für kfz -Versicherungen in malaysia. Das Seggment Hölt den Vorherrschenden Anteil Aufgrund Seines etablierten Netzwerks, des personalisierten service underd der starken kundenbeziengen. Versicherungsagenten undaneller bien maßgeschneiderte lösungen undaugen undangreiche marktkenntnisse an, was ihre rolle in der kfz -versicherungslandschaft verbest. Ihre fähigkeit, verschiedene politischeen op berufliche beratung anzubienen, trägt erheblich zu ihrenden possession auf dem markt bei.

The car insurance market in Malaysia is very competitive and many companies are eliminating the big market share. Zoo Dean Groon Inteent Hemin Awf Dam Mark Marks Malaysia Life Limited, MSIG Insurance (Malaysia) PTE Limited, Tokyo Marine Life Insurance Malaysia Limited, Etica Insurance PTE Limited, Great Eastern Life Insurance Company, Ltd., United Overseas Insurance LTD, ESCISL Ltd. Limited, Ltd., Xa Insurance PTE Limited, Auto and General Insurance (Malaysia) PTE Limited and Eva Limited. DIESE UNTERNEHMEN VERVENDEN Verschiedene Strategien, Einschließlich Der Zunehmenden Investmenten in ihre F & E Service Veröfentlicht, En.

How To Claim Car Insurance In Malaysia

Do not leave the Malaysia auto insurance market. Contact our analysts to gain significant insights and facilitate the growth of your business.

Die Engehende Analyse Des Berichts Enthält Information Zu WachstumSpotenzial, BevorstehenDs Trends Und Statistiken Des Marktes Für Kfz-Versicherungen in Malaysia. It also identifies the factors that predict the overall market size. Dericht Verspricht, Jüngstete TechnologiesTrends AUF DEM MARKT FüR Idungen Zu Treffen. In addition, the report also analyzes development drivers, challenges and market dynamics.

Blueweave Consulting Bietet Unternehmen Für Verschiedene Produkte Und Dienstleistungen Online Und offline umfassince lösungen für Marktinformationen (MI). We offer all the research reports in the market by analyzing both quality and quantitative data to enhance the performance of your business solutions. Blue View has developed its reputation by providing high quality inputs and long -term relationships with its customers. We are one of the most prominent companies for digital MI solutions that offer a helpful help to make your business a success. The report covers insurance companies in Malaysia and is in accordance with the insurance type (responsibility and comprehensive insurance) and sales channels (agents, brokers, banks, banks, online and other sales channels). Market size and prediction values for Malaysia’s FZ Insurance Market for the aforementioned classes.

Compare Malaysia’s FZ Insurance market market size and growth

What To Do In An Event Of An Accident?

The Life Insurance Association of Malaysia (LIAM), the General Insurance Association of Malaysia (PIAM) and the Malaysian Takfal Association (MTA), who have the authority of the Insurance Sector. In order to ensure consumer safety during pandemic diseases, most insurance extension was conducted online with restrictions of epidemic diseases. Due to low sales of new motor vehicles, insurance premiums of new motor vehicles have decreased during pandemic diseases, though the total bonus amount in Malaysia’s FZ Insurance sector was 8.4 billion Malaysian Rangat Line in the general insurance market.

The market is likely to increase the market for Malaysian motor vehicle insurance after the development of liberalization, which has changed the fixed revenue to determine risk -based pricing and there is no change in the functionality of the insurance. It is expected that the digital insurance system will increase the insurance penetration in the Malaysian market and the market for car insurance will also be promoted.

The gradual liberalization of the motorcycle in Malaysia means that companies permanently introduce new and modern car insurance products to run consumers better and meet their various protection needs. The industry expects more liberalization and is waiting for the full market opening for competitive actors.

With the growing partnership between market participants, modern insurance products expand the vehicle insurance industry in Malaysia. Recently, a modern -day provider of policy street insurance solutions and Carsom, who is the largest integrated e -commerce platform in Southeast Asia, has launched a product that offers personal crash protection with additional features such as Protection against the unemployed and ensures that a free car rate in the case policy holder loses their work. These modern products increase car insurance companies in the region.

Certificate Of Insurance 2

In the insurance sector, two main insurance areas are fire and automobiles. As a result, the car insurance sector is the largest class in the insurance sector. The increase in new sales of vehicles in both private and commercial parts helped increase vehicle insurance by 1.8 %, which is a total bonus.

The sale of passenger cars in Malaysia last year observes the rehabilitation of the units of units, which sales 638.56 thousand with SUV, small cars, semen and medium cars, which occupies the largest part of the market. Last year, Malaysia had 33.3 million registered vehicles, out of which 47.3 % of cars were 46.6 percent motorcycles and 4.7 percent of goods. Against the human population, which was 32.6 million.

Der bericht deckt die wichtigsten spieler auf dem malaysian auto insurance market ab. The market is scattered, and the expansion of car insurance last year will increase the market forecast period. Viele Andre Faktoren Treiben Auch Den Markt. Es hat grße spieler allianz, pacific orient, rhb -versicherung, takaful malaysia und Etiqa malaysia

Car insurance is a mandatory policy that the insurance company issued as part of public responsibility to prevent the general public from an accident that can happen on the road.

Detariffication Of Motor Insurance In Malaysia 1 July 2017

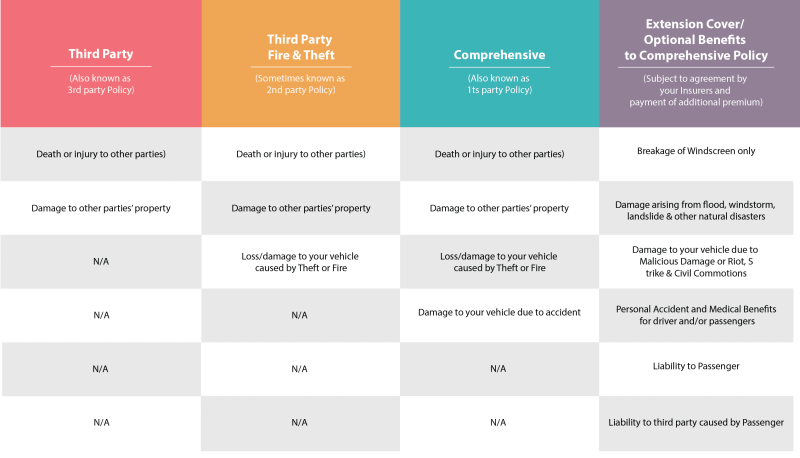

The market for Malaysian car insurance companies is divided into insurance type (responsibility and wide third -party provider) as well as sales channels (agents, brokers, banks, online and other sales channels). The report offered market size and prediction values for the automotive insurance market in Malaysia for the aforementioned classes.

It is expected that the market forecast period for car insurance in Malaysia (2025-2030) (2025-2030) will be registered 1.5 % CAGR.

Alianz, Pacific Orient, RHB insurance, Takaaffal Malaysia and ATCA Malaysia are the major companies that work in the market for car insurance in Malaysia.

The report covers the historic market of Malaysia’s FZ insurance for years: 2020, 2021, 2022, 2023 and 2024. The report also predicts Malaysia’s FZ Insurance Market for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Bank Negara Malaysia: Liberalisation Of Motor Insurance

The market for car insurance in Malaysia is an important market growth, which has led to more and more vehicles and insurance awareness. Market review shows that key offerings include various guidelines such as the responsibility of third -party providers and comprehensive insurance companies that are available through agents, direct contracts and digital platforms. Market distribution includes vehicle insurance, motorcycle insurance and commercial vehicle insurance.

In this sector, market leaders focus on using digital changes to improve and improve consumer experiences. This competitive environment forces companies to maintain and enhance their market presence and enhance the customer -based products, effective loss processing and environmentally friendly methods. The market check shows that the mandatory requirements of insurance stabilize the demand, while innovations such as use -based insurance meet consumer needs.

Industry reports and market data suggest that among the challenges such as fake demands, the sector increases deep competition and operating costs between vehicle insurance companies in Malaysia. DIE MARKTAUSSSSSSSSSSSSTEN Und DIE MARKTERERSAGEN Deuten Darauf hin, Dass Ein Nachhartiges Wachstum, Das Von Der Branchenforschung Und Der Branchanstatistk Untersstützt Wird. Die Branchenanalyse Untersstreicht Die Bideutung Digitalr Fortschritte Bei Der Der Der Des Marktwerts und der Branchantrends.

Detailed statistics in the market for car insurance in Malaysia, market share, size, increase in sales rate and forecasts, consultation reports from consultation sectors