Old Car Insurance Malaysia – You want to buy car insurance? Before buying, it is best to first understand different types of car insurance policy. This is to make sure that you will receive enough insurance insurance.

There are three types of car insurance policy in Malaysia in Malaysia. Let’s look at all kinds of politics and its composition.

Old Car Insurance Malaysia

The first is comprehensive insurance, which is also known as the first-pound insurance. This policy offers more extensive policy coverage.

Relocation Announcement: Our New Headquarters And Contact Number

Comprehensive insurance protects political cars in case of a car accident, fire and theft. This policy also provides a third party coverage.

Comprehensive insurance is usually required for new cars 10 and below. For more than 15 years of insurance companies for cars, most insurance companies will offer to cover third parties, fire and theft (TPFT), which we will explain next.

Third -Party insurance, fire and theft protect the third party damage and loss where you are guilty. It also allows the flow of policy vehicles in case of fire and theft. This policy does not contain other circumstances in political conditions, such as a car accident.

This type insurance is usually cheaper than comprehensive insurance and is more convenient for old and infrequent vehicles.

Fyi. What, How To Claim Against Car Insurance .

Third -Party insurance is the most important policy. In Malaysia, it is necessary to have at least a third -party insurance for the Malaysian public roads legally.

The “third parties” mentioned in this policy is involved in the accident with your car, where you are guilty.

This policy only presents only the third party third party and their property caused by your car.

This policy provides a very limited coverage, as it can only be used for third-part requirements. If your vehicle causes any damage, you need to provide repair costs yourself.

How To Get Cheaper Car Insurance

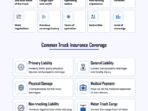

For your reference reference, below is a summary of the differences between the three types of vehicle insurance.

To help you choose the type of car insurance right below to take into account the three main parties.

It is important to choose the right insurance based on your car’s era. This is avoiding or unnecessary insurance (your car insurance)

For example, if your car is old, let’s say for more than 15 years, you may want to buy third parties, fire and thefts. This is because the estimated price of damage to your vehicle can be cheaper and acceptable.

Aig Malaysia Won’t Insure Any Tesla Models & Some Toyotas

On the other hand, if your car is new, the comprehensive insurance coverage is recommended as it can provide full coverage for your car.

If you often use your car, it is recommended to get more comprehensive car insurance as it can provide more coverage.

For example, for a 10-year car, which is often used, comprehensive insurance is a better option, as politics includes a car accident.

For vehicles over the age of 10, but more than RM10, but market value, you are very encouraged to receive a comprehensive coverage to cover your car properly. Comprehensive insurance can avoid owners to pay high renovation costs when their cars crash.

All You Need To Know About De-tariffication Of Motor Insurance [infographic]

Most insurance companies provide three types of insurance. Before buying any policy, consider policy coverage, the age of your car, the use of the car and the amount of coverage to provide appropriate protection.

To help you compare the policy offered by various insurance companies in Malaysia, just use where you can reach up to 15 car insurance. Compare quotes and easily update your car insurance fully online.

Malaysia is one of the largest web pages in Malaysia, which offers more than 10 brand policies. Get your free insurance offer today. What do MYVI and Mercedes have to do with? Answer: Two vehicles need a valid car insurance on the road.

New or second, local or imported if you have a car, you need to have a valid car insurance so you can drive it on the road. It’s like that.

Malaysian Motor Detariffication

Anyone who tells you or is unaware or just doesn’t pay attention to his surroundings around him.

Also, if you don’t have a valid car and road tax insurance (these two come handed, you can’t buy or renew another person) if you are marked by the police.

According to the Road Transport Law, it is mandatory for all car insurance and road tax for all car owners in Malaysia, both must be updated annually.

But aside, it is also important to have enough car insurance coverage for your car, so if something bad is (be a collision, you can estimate repair costs or replacement.

How Is Car Insurance Premium Calculated?

Based on the study of the Malaysian Institute for Road Safety Research, more than 400,000,000 traffic accidents were registered in 2020, almost 5 of which were fatal.

This is enough reason to buy the abundance of proper and insurance policy to cover you and your car when you are on the road.

There are three types of motor insurance in the Malaysian market, each is unique to you and / or your car to cover your car.

Third -Party cover is usually the cheapest car insurance caps and car insurance in Malaysia.

Malaysia Vs Vietnam Afc Asian Cup 2027 Qualifiers: Lrt Bukit Jalil Operating Hours Unchanged

Imagine this. It was a rainy night and you run home late at work. The road was fat and suddenly, your car slips into the loop and collides with another driver. Fortunately, you have fled the liking, but the same cannot be said about your collision.

To avoid huge amounts of money to pay hospital accounts without mentioning vehicles. You need at least a third person for car insurance.

Just as his name is, the third party insurance policy includes demands against you for death of bodily injuries or even other (third parties). It also includes any damage or damage to their car or property damage.

For the most part of the third party fire and theft are just like the third-part cover, except for this policy, allows you to request a request if your car is stolen or stolen.

How To Transfer Your No Claim Discount (ncd) Before Selling Your Car

Please note that this type of cover refers to damage / damage, casual fire and theft, but not the loss / damage in itself.

This car insurance policy offers a wider range of coverage than earlier car insurance.

In addition to providing cover for all of the above, it also includes damage to your own car.

Comprehensive car insurance is recommended if you can’t replace your car just like that, using savings to buy a new car or use a second car.

Car Insurance Guide In Malaysia: What You Need To Know

The moment you rely on your car, for example, to travel, and the previously mentioned scenarios are not used, you will have a comprehensive coverage that will provide your car replacement value (current market value).

The correct number of car management is not a missile science. Insurers aim to facilitate your life and determine the optimal insured amount based on the market value of your car.

With the details of the year in July 2017, additional factors are appropriate to determine your bonus. However, the insured ideal amount really returns to market value only from your car.

Simply put, insurance companies can bring out the technical data of your car from the database, such as production, engine size, model type, horsepower, etc.

What Is Betterment In Car Insurance?

It’s just ahead, if you bought a new RM100, a new car, then your insured amount ideally should be equal to the same number.

As the initial price has decreased over the years, and your car increases, the insured amount can be reduced each year according to the lower value and market price of your car.

Theoretically, you can decide to get a lower money insured than the market value of your car. For example, if the market value of your car is RM22 a few years later, you only decide to buy only insured RM20, only.

You may be able to save a few dollars, but in the end you can decide to make one RM22, 000 for full quantity, as the premium difference can be relatively small.

Rm55 Million For East-west Highway Upgrade

Although tempting directly to dive the best car insurance transactions immediately,