Property And Casualty Insurance Company Ranking – 25 major property and case insurance companies in the USA, according to the National Association of insurance commisseders (Naic) in 2024, there are 25 major and larger leave insurance companies in the USA. These companies often have premiums written in billions of US dollars. It insurance and insurance insurance (also that P 100 insurance) are kinds of insurance that help protect your own property. Reset and casual insurance (P & 100) provides coverage for physical properties such as homes, cars and other objects. These insurance and include liability coverage, which helps you protect yourself if you are right really responsible for accident, which causes injuries to another person or damage to the property.

All data was usually the database of the National Assurance commissarities (Naic) in 2024. Functionally, the National Assurance Insurance (Naic), in 1871 instead of insurance, experience, data and analysis for insurance commiters to be ordered in. industry and protect consumers.

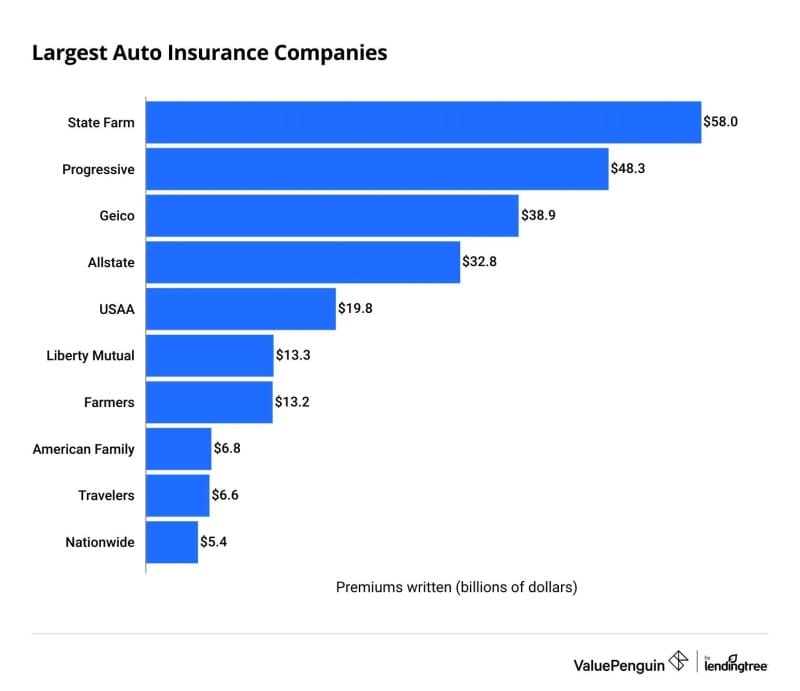

Property And Casualty Insurance Company Ranking

Many people in the United States (USA) are based on insurance companies to mitigate the unpredictable fear associated with a business or victim. Statistically: By 2023, the most direct Premium written by all U.S. Forum insurance companies at $ 960 million, $ 527 million. In the meantime, the total number of direct won in the United States Market reached 919, $ 859 million.

Property And Casualty Insurance Market Size Report 2025 And Share Analysis

And these are the orders of 25 things and leave insurance companies (P & C) in the United States in 2023. All data were obtained a public quota data Report published in National Commissioners d’insurance in 2024. This range d’insurance in 2024. This range d’insurance in 2024. This range d’insurance in 2024. This range d’insurance in 2024. This range d’insurance in 2024. This range d’insurance in 2024. This range d’insurance in 2024. This range d’insurance in 2024. This range d’insurance in 2024. This range d’insurance in 2024. This range d’insurance in 2024. This range d’insurance in 2024. This range d’insurance in 2024. This range d’insurance in direct document is in the possession of the bases (P & C).

State farm insurance is one of the largest insurance companies and leave (P & C) based on Bloomington, Illinois, USA. Historically, George J. Mectherle built this corporation in June 1922. George is a farmer who is widely considered as one of the most powerful figures in insurance business. With the development of his business, the state of the country uses more than 57,000 people. In terms of financial industry of financial intuition in the United States, the State Firme insurance is a.m Financial A. ++ grades. Best®, AA1 of Moody’s® and AA of Standard & Poor. The report of the National Association of Insurance Commissioners (Naic) by 2023, in a state firmly insurance obtained from the Premium written about 88.6 Billion and Direct Premium obtained about 88.6 billion of dollars.

Progressive group of insurance companies started in insurance business in 1937. In addition, the founders of progressive insurance companies were Joseph Louis and Jack Green. Financially, in 2022, along with a business development, progressive insurance revenue involved $ 49.5 billion, in the meantime, net income arrived $ 721 million. In addition to the 2023, the sum of good progressives are $ 59.7 billion. In addition to the Real Estate Industry (P & 100), progressive insurance company obtained a direct premium written by $ 62.7 billion and direct premium obtained about $ 59.8 billion.

Berk ‘Hathaway is a title corporation works in a variety of industries, including insurance. Historically, Berkshire Hathaway was created in 1839 by Oliverans Chlace, but developed by Warren Buffett with aid Charlie Mungic. According to the annual report of the 2022, this corporation had $ 948 billion in assets and $ 322 billion in revenue. Berk, Hathaway has several subsidiary insurance companies in insurance business, including in the National Company Company, government employees insurance company (GEICO), general matter and others.

Earnix And Exavalu Partner To Revolutionise Property & Casualty Insurance Pricing

Statistically, Berkshire Hathaway is still one of the largest insurance companies in the property and Casualties Industries (P & 100). According to the National Association of Insurance Commestaries (Naic) by 2023, Berk ‘Hathaway Won Direct Premium of $ 58.6 Billion, and Direct Premium of $ 57.2 in 2023.

Allstate Corporation is a North -AMERICAN insurance company and become one of the largest insurance companies in real estate and accident insurance industry in the United States (USA). Historically, allstate was launched in April 17, 1931 as holding, its business is mainly with allstate insurance company and other subsidiaries. Financially, in 2023, allstate’s financial performance reflects strength and challenges of energy. Total assets were recorded at $ 103 billion, with total burial reached $ 85 billion, which indicates a stable and length of financial structure. According to the market share report of the National Association of Insurance Commisseders (Naic), the direct premium document is allstate insurance reached $ 50 billion and direct premium obtained 48.1 Billion dollars.

Freedom’s mutual insurance is still one of the largest properties and losses (P & C) in the USA. Operationally, freedom of mutual insurance still headquartered in Berkeley, Boston, Massachusetts. Due to the insurance development, freedom mutual insurance company has occupied more than 50,000 people at 29 countries. Financially in 2023, according to the annual report, freedom mutual maintained solid financial basis with total assets estimated to $ 165 billion and total loads, ranking $ 140 million. According to the National Association of Insurance Commissarios (Naic) by 2023, freedom of mutual insurance obtained by a straight written premium of $ 44.4 billion.

Passengers’ insurance companies / passenger companies were founded in 2004 with merger between S. Company. Paul, Inc. and passengers. One with Business Development, travelers have more than 30, employees and 13, 500 lorem agents and runners in the United States, Canada, United Kingdom and Ireland. According to the annual report by 2022, passengers insurance has good about 115, $ 717 million. In the meanwhile, the passenger insurance toll was $ 36, $ 884 million with a net revenue of 2, $ 842 million. The report of the National Association of Insurance Commissationers (Naic), in the direction of the passengers reached $ 38.5 billion.

Dxc Insurance Software

United Services Automobile Association (USA) is one of the largest property and casualties insurance companies (P & 100) in the United States. USA is headquartered in San Antonio, Texas, the United States. Until 2022, this company occupied 37,000 people. Financially, according to the 2022 results, essa return reached $ 36 million. In addition, the balance annual report in U.s goods around 204, 5 million. In addition to 2023 in the USA obtained the correct written premium of around $ 31.9 billion.

Chubb is one of the U.S. World Property and World Damage (P & 100) in operations in 54 countries. Operationally, Chubb has executive offices in Zurich, New York, London, Paris and other areas, and uses about 40,000 people around the world. When the financial industry, Chubb has financial energy from a standard & poor and a ++ a.m. Best. Financially, the report of the National Association of Insurance Commisseders (Naic), Chubb obtained the correct written premium of $ 31.1 billion.

Insurance farmers are one of the largest and most important property insurance companies (P & C) in the United States. Historically, in the way of this crowd began in 1928 with Mars, John C. Tyler and Thomas E. Feav. One of the Business Development, the farmers insurance company can attend more than 10 million homes with more than 19 million individual policies in 50 US states. In addition, farmers insurance has 48, 000 exclusive and legal agents and 21,000 employees. According to the report of the National Association of Insurance Commissationers (Naic) by 2023, the farmer’s insurance obtained from a straight written premium about $ 27.2 billion.

Nationwide mutual insurance company is one of the largest thing and case insurance companies (P & C) in the United States (USA). This insurance company was founded in 1920 to make a mutual farm office and after the 1955, name has changed the National Him. To date, this company is headquartered in the national square, Columbus, Ohio, in the USA, the National Level is some financial ratings, included in Am Best, A1 of Moody’s and a + Standard & poor. The report of the National Association of Insurance Commissationers (Naic), Nationally won the correct written premium about $ 19.7 billion.

Universal Property & Casualty Insurance Company Customer Ratings

As one of the largest insurance companies (P & 100) in the USA, Zurich Insurance Group LTD still has primary job in the Turicum. Historically, this company was founded in 1872 in the name of Versicherung, Verein (insurance). During the business development at the time until the time, this insurance company has occupied about 56 miles and provides a large insurance products more than 210 countries. Financially, the financial conditions in the balance sheet in 2023, the company has the total assets about $ 361 billion with total loads of $ 335 million. A 2023 Business Performance, the Company obtained Revenue of $ 56 million and net income around $ 4.7 billion. The report of the National Association of Insurance Commestaries (Naic), Zuric Insurance obtained by a straight written premium of around $ 18.4 billion.

American Family Insurance started his business in October 3, 1927. Offer this company has primary duty in Madison, Wisconsin, USA. According to the National Association of Insurance Commestariis (Naic), American Family Insurance obtained the correct written premium of $ 16.6 billion. Financially from 2019-total assets