Tax Refund Bangkok – Are you going to go to Bangkok to shop? Or to travel another in Thailand? Not to say this, most of the potential of the ability and the programs in Thailand has 7% taxes (VAT). I will share the way you can save some money by receiving Vat taxpayers in Bangkok or Thailand in most. Read to know if you have the right to get this refund and, if so, what you need to get it.

To get VAT taxes in Thailand, you must be a tourist that leaves the Thailand from the International Airport. To

Tax Refund Bangkok

If you are a large number of airlines, carrying a Thai Passing / Technician in Thailand or in Thailand for more than 6 months older.

Cara Mengklaim Vat Tax Refund Buat Kamu Yang Berbelanja Di Thailand

Not all goods purchased in Thai can benefit from the tax return. Reinstance only for goods purchased from the shops that indicate “VAT returns to tourists” signature. Or you can easily with the team for sale. The store or large stores (such as Apple) most eligible to receive.

Even in stores, you should buy at least 2,000 THB (VAT (VAT) in a date or a labeled All purchases require more than 5,000 THB to receive tax returns. However, we managed to get the money back up to 3 , 040 THB.

Later, the material should be taken out of Thailand within 60 days of purchasing and without drinking in Thailand.

After purchasing, sending a passport and request a tax return (P.P.10) from the seller or by the team. It will complete the form with it and provide media-tax payments to pay for the form. Check the P.P.10 macule for guaranteed:

👀 รีวิวทำ Tax Refund 💸 ที่สนามบินอินชอน เกาหลีใต้ ✈️

Do not leave the file after, you will need to disclose two forms and tax bills when you ask for a refund to the airport.

For purchases in the monitoring room, organize with the service clients work. Get the tail and have a passport and tax / receipt when you are. Please read the information in the previous section

When I wait for employees to improve my complaint in Central Warehouse, I learned that I can get money back to the refund immediately. He said to me that there is a service to the tax return of VAT of the place. I ask how much and you have said 7%. This is very little to me 100 THB pay back. Better to make money now in current information we need to run the flight or a long tail of the airport.

In any case, to get rapidly, I should have queue to another counter (receiving a new opponent for this). I also need to expand the visa / MasterCard Card that is not expired for 6 months. My payment refunds from 100 THB is deducted from my credit card. This amount will be repaid after my income appeal is made at the airport. This is to make sure the travelers are receiving their form

🤑 How I Got $$$ Via Tax Refund In Thailand!

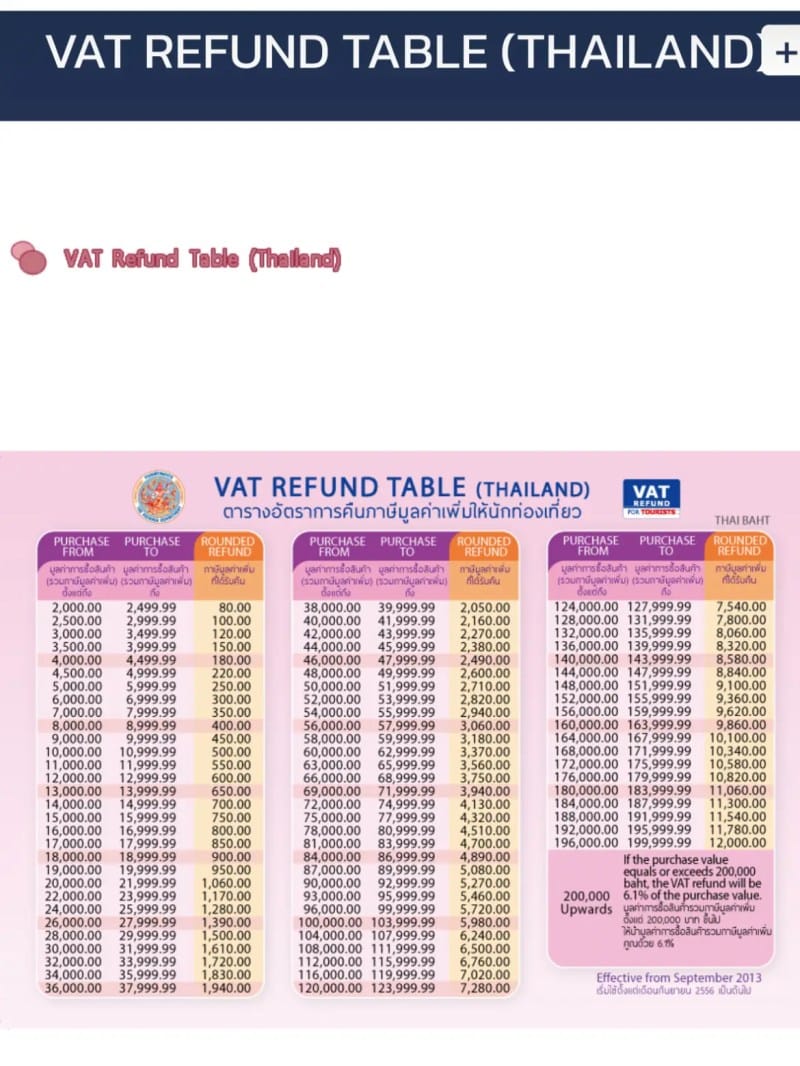

The staff said to me that after cutting out the program, I will be only 60 th jewelry. I was stressful, not the Service Services is only 7%? Then I can see with the hindsight that the woman who worked for me in the past is 7% taxes and not 7% service commission. Izzz. High -level recharge and I am 40 THB. So it is not worth it even … here’s the table of taxes (orange side) for your use:

After receiving VAT tax, you and the product you need to start at Thailand within 14 days of litigation. So if you don’t leave early, don’t use the middle service. You can confirm with employees who can improve money recovery.

You have to go to the airport before becoming VAT taxes. Use the time to spend time for the queue for the tax return before and after the release of immigration.

Go once after the permission of the release of the entrance as we, you can imagine the one you buy a person under 5, 000 THB.

Ternyata Utk Bisa Refund Vat Di Bangkok (teruntuk Akumulasi Belanja Diatas 20.000 Baht), Perlu Ke Front Desk Sebelum Check In Counter Di Bandara Utk Dapatkan Stamp Nota Iphonenya. Alhasil, Ga Dapat Tax

Step 1: Before the plane-in, it exposes your product, first tax return and P.P.10 modules for the examination. You should get P.P.10’s structure by the officer.

Step 2: After entering the entry, to VAT the refund for the office trip.

Luxury the tool is an item between 10, 000 THB or more. Be sure to avoid packing them in a test-in baggage. They control the product, especially if your luxury luxury.

Step 3: After the entrance field, to Vat’s refunds to the tourist office to apply for tax return. Fila and presented the first time shipping and p.p.10 modules. You must indicate more expensive items in this institution.

Conditions For Applying For A Vat Refund

For me to buy between 3, 040 THB, I get payment at 120 THB, which is up to 4%. This message indicates the refund that you will receive:

I hope you can save some money with this step. Have fun shopping! If I lost something above, let me know in the comments below. I love listening to you. 🙂

Are you looking for any other information on, home and baby? Register my list and make sure you follow me on Instagram, Facebook and YouTube! If you like what you read here, it is also continuous with a small support. 🙂

Disclaimer: Jogostyle and Christina don’t feel the responsibility (in the promotional or any damage to the website.bazkok, 1622 of Thailand is the famous purchase for purchases for travelers worldwide, it is the vative money back to the product they will be when traveling.

‼️get Your Tax Refunds! #gentlewoman #bag #thailand #bangkok #taxrefund #tips #travel #how

In order to qualify for the refund, item should be purchased from the “VAT to tourists” signature and baht (VAT) a day hill. All costs of each purchase should be at least 5,000 baht someone around.

Item must be removed from thailand from the tourist in the country 60 days from the date of the international, chigruet, U-Tapao, Krabi and Samui.

In the repository of VAT is carried out in the city, the departure of Thailand shall be within 14 days of this day.

When buying goods, the tourists must send his passport and ask the market to give the VAT’s Code Conditions must be treated in the form.

Tourists In The Interior Of Bangkok Airport At The Tax Refund Counter Editorial Photography

* In case of customers, these must be sealed with the words “without food during Thailand”.

The product will, of total costs should be 5,000 baht or more, should be sent together with the tax credit for testing before reviewing.

Such a luxury (the jewelry, the ornes, bag, bag, bags, etc. from the price is 50,000 Baht or more from the article, these should be obtained by the VAT to repay the tourist office after the immigration entry.

To Vat’s refunds to the tourist office, if a refund is not over 30,000 baht with insurance for refund, payment ( Tasi Baht).

How To Get A Vat Refund In Thailand. Tax Free Shopping In Bangkok

Returns can guarantee from the post office of the Department of Thailand or by Tourist Office.

The Division of International Public Relationship With the traditional and Online News follows Thailand as a tourist throughout the world.

Thailand is successful with flowers from December 2022-building 2023 Thailand successed in December 2023-President 2023

Tat expression “NFT BUKAWAW 1X amazing Thai field special” Nft Buokaw 1X amazing Thai Vat Rimburse at the airport. This year’s financial institutions from VAT must pay more than the increase of travel tour. (Image of data)

Airport Tax Refund Malindo Air

Tourism tax return has been up to date from the Thailand to reopen the moon, according to the director of Lavaron financial financial financial financial.

Lavaron said the Number of Foreign Visitors Climbed to After the Reopearing, reflected by a Great Certeize in the total-rimbedness (VAT). In 2022, VAT Refound to more than 423, the tourists with the value of 1.2 billion baht.

From January to May 2022, 55, 700 payments for 204 million baht. However, repay by June