Tax Refund Journal Entry – How to register your tax survey (payment or refund) will depend on the passage of the tax test and the existence of your full year.

In the previous exercise, to determine the relevant account where the transaction should be assigned.

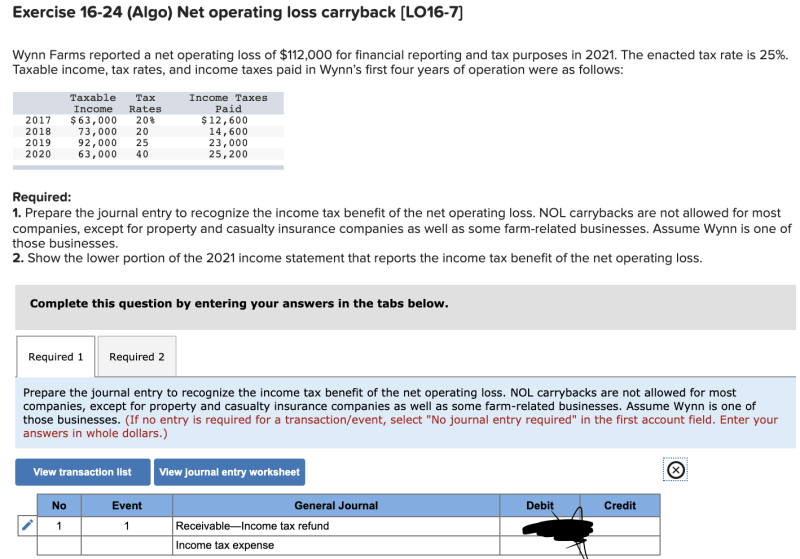

Tax Refund Journal Entry

Money: Only income was the test offer. There was no rhythm. Tax to pay, on June 30, 2019, were $ 6, $ 500.

Question 43 Chapter 4

On March 1, 2020, the highest financing has presented the tax on Compensation and Annual Payment of SMSF. You can handle income tax payment in one of the following ways:

If you have entered the bank data, you can assign a proper transaction to the “tax rate” through the budget process.

Does not allow income transactions or payment. Therefore, in these cases, you must make an entry in the newspaper.

You will then have the next revenue from the generator when the tax return is paid to the bank account:

Accounting: Customers + Vendors: Customers: Credit Notes

If you have rewarded taxes when you have launched then do not register the ATO ATO tax on deletion through the bank’s construction data or use the magazine. The following two roads are described.

If you have a bank account, you can assign appropriate transactions for the income tax return through the assignment of data or partial assets.

However, if you record ATO ATO ATO ATO ATO ATO ATO ATO to your migratory party, send an opinion from the newspaper: