What Does Policy Mean In Insurance – Insurance’s appearance policy includes programs for violations or damages in the active policy period, even if the demands are submitted years after the expiration of policy.

The policy of the phenomena covers the claims caused by the insurance life damage. According to these types of contracts, the insured has the right to request damages that occurred when the policy was active, even if it is several years, and the insurance contract is no longer needed.

What Does Policy Mean In Insurance

Responsibility insurance is generally included in one of the two categories: claims made. The latter protects against financial damage to the events that occurred during the implementation of politics, regardless of the time to be identified and revealed. In other words, it can be applied later for a long time after the expiration of the contract, provided that there is evidence that the cause or driving event occurred during the insurance period.

Solved What Do Policy Limits Of 200300?100 on An Automobile

Policies are especially satisfied with events that can cause injuries after appearing. For example, if a person is exposed to dangerous chemicals, it may take a significant time before getting sick.

Appearance usually covers the former employer and employee for life. The insured may still be protected many years before the injuries are revealed, and even after stopping the insurance or transferring to another provider.

In insurance, the appearance is defined as “accident, including continuous or repeated exposure to the same harmful general conditions”.

Insurers usually regulate the overall coverage of such a policy. The coating form restricts the amount of cover each year, but allow reset to cover the cover each year. For example, a company that buys five years of annual coverage of a million dollar annually enables the insured to have $ 5 million in total.

Is Your Health Insurance Right For You? Here Are The Smart Ways To Save More..

Demand insurance is paid only if the request is made when the policy is activated. This means that if you cancel the protection, then you will request a fee, you will not receive it – unless a long report (ERP) or “tail cover” is purchased.

Commercial insurance insurance is often offered as a policy that is raised. Although the policy provided by the claims related to the receipts can be presented during the event, the phenomenon policy at the time of the event presents the cover.

The policies conducted are not used to cover business operations related to errors and non -compliance with discrimination, employment employment (EPLI), and business activities and business officers.

Until the mid -1960s, there was no formulation of claims, and its use was scattered in the early 1970s. The form of this phenomenon is now, with the exception of most professional and executive confrontation, where the law of demand policy is available.

When Is A Policy “blanket”? A Recent Court Decision Shows It’s Not Always Clear Cut

The most striking advantage of the policy of providing long -term support is. Unless the cover is present at the time of the incident, the claim is possible at that time.

Another advantage is that policy costs appear to be set. If the risk specifications are insured, the premium will not generally increase.

Influence, policies understandable, more expensive than requested requests. Sometimes they may be harder and.

There is also a danger that the company that extracts such a policy underestimates the amount of damage later on the line, which forces it to pay a piece out of your pocket.

Coi Meaning, Origin And Examples • 7esl

The suggestions that appear in this table are the compensation participation. This compensation can affect the manner and places in it. Does not include all the suggestions available on the market.

Survival Analysis: What does it work, how it works, what are the benefits and disadvantages of the total insurance constraint? Combined individual boundaries: Definition, Example, Benefits, Division of Death Division: What is the definition, species and use of the default body? Definition, how the cover samples are guaranteed in addition to confirmation: what is and how the business owner (BOP) works: Definition, Coverage and Exclusive Review: Insurance samples and insurance samples and samples

Additional Insurance: What is the probability of death per year? How to determine the best business for a small business for a small business for 2025. Best Professional Responsibilities for Business Insurance Contractors: Definition and example of the best alcohol responsibility.

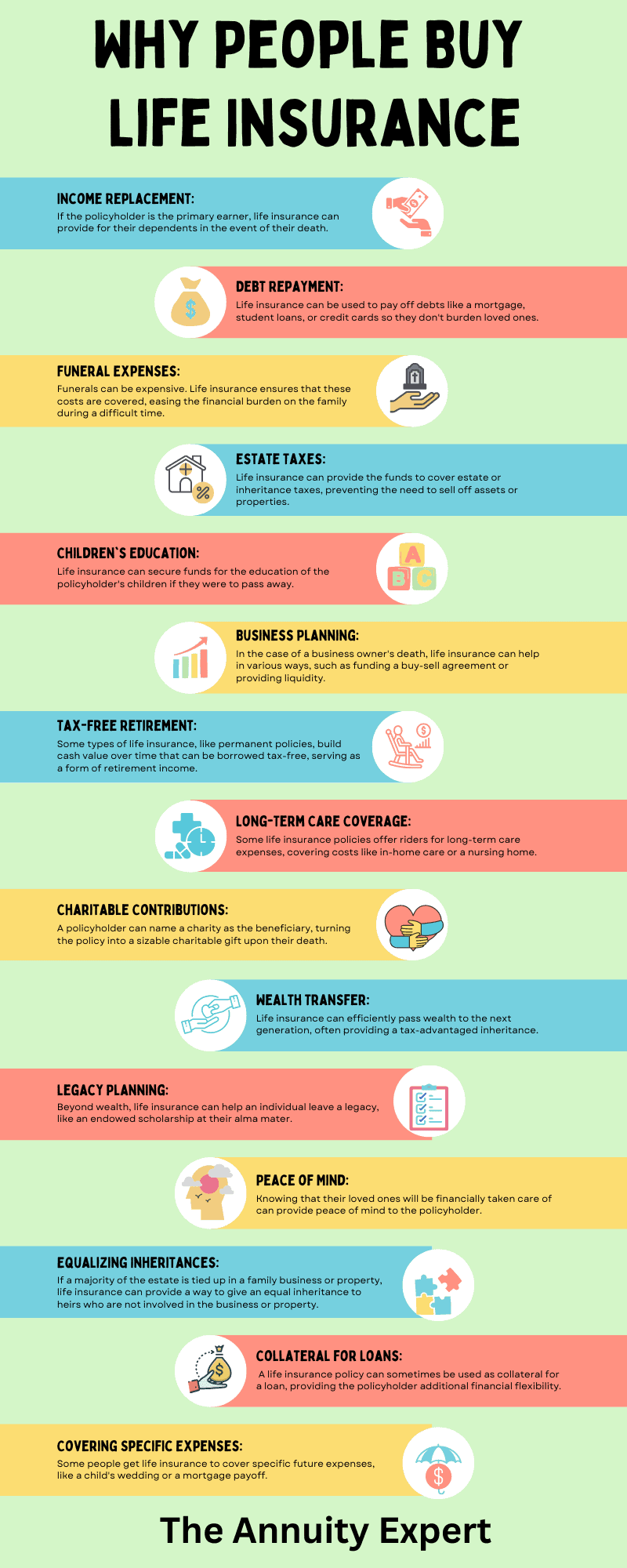

Life insurance acts as a financial security network for your family. If you die while active, your insurance company will pay the amount of money to the people you named in your policy. This money, known as an advantage, can help your users lose their income and replace their cover costs such as accommodation, food and tool networks. Life insurance can be used to pay funeral costs, pay arrears or to leave heritage for loved ones or charities.

Car Insurance Not Able To Renew My Policy But Says I Don’t Have To Declare It?

Life insurance may seem complicated, but understanding how it works, and all responsibilities can help you make informed decisions about your coverage, whether you are new life insurance or for the transfer of policies or insurers.

The owner of this policy is a person who has a life insurance policy and is responsible for paying the premium. Politics usually guarantees insured, but you can also buy and manage policy from someone else. For example, the owner of the company can buy a high quality employee, a company and a company and insurers and death recipients. Similarly, you can create a beloved policy like a spouse while naming this policy.

You can’t buy life insurance for anyone you want. Insurance companies require you to have a safe interest, which means dealing with financial problems if that person dies.

The user is a specific person or entity that receives the profit of death. Life insurance can have several users such as family members, friends or even organizations such as charities.

What Do You Mean By Term Life Insurance

The premium is the regular payments that you provide in your insurance company to keep policy active. They are based on factors such as age, health, lifestyle and the amount of cover you need. For example, a 30 -year -old in health should significantly reduce the premium of 50 -year -old smokers with a history of health problems. The type of policy is also important: Temporary expression is much less than permanent insurance.

The winner of death is the money you love your loved ones when you die. When applying for life insurance, I can usually choose how to get money:

Bentisk profits can be used for any purpose, such as paying for mortgages, covering funeral costs, or financing a child’s education. It is also a tax -free tax and creates a very valuable and hassle -free financial resources for users.

:max_bytes(150000):strip_icc()/Life-Insurance-a8aee8e3024145a8b454ea19df030418.png?strip=all)

To get the benefits of death, your users must apply for an insurance company. To begin this process, IM requires copies of detention for death (including a valid version of the funeral manager), insurance policy and any other form. The insurer then reviews the request. If everything is checked, the company will pay your users’ death benefits, usually within 30 days of the first case of this claim.

3 Insurance Contract And Parts-1

There are two main types of life insurance: the concept of life insurance, which covers a particular course and permanent life insurance, which covers you for the rest of your life and is often associated with savings or investment components.

The term insurance covers your life for a certain period of time – such as 10, 20 or 30 years. After the end of the period, you stop paying insurance premiums and expiration policy. Given this time limit, the concept of life insurance is mostly the most desirable option and makes it ideal for all those looking for low -budget coverage for a specific timeframe.

For example, if you plan your family, you may consider a 20 -year policy to ensure your children, at least through college. Your premium is the same during the term. However, you choose longer, the more expensive initial premium because of the conclusion of more costs.

With the lasting life insurance, such as the whole life or life of the world, you pay your whole life to the premium, not a few years, you provide your family financial support (or as long as you pay the premium). Similarly, with life, the policy of continuous life also deaths from its customer. Permanent life insurance is usually accompanied by a cash value component that can make a profit and continue with premiums over time.

Reinstatement Clause In Insurance: Meaning And Examples

Cash Value Component can increase the amount of your dear friend and in some cases can pay you dividend