What Is Rti In Car Insurance – You have to realize that you buy a car, the price starts fall as soon as you remove it from the gallery. The percentage of the depreciation may appear slightly at first, but will increase each year.

This is an important aspect of talking to your car insurance. Advisors will cover your vehicle under idv (premium insurance), i.e. , Current market value is now from car. So, even if your car will be stolen or too damaged to be paid, you will be paid with the amount of cancellation and not the price purchased.

What Is Rti In Car Insurance

For example, Safe Buy Honda New Honda District for Rs 14 lakhs. The car value begins to reduce the moment he removes the gallery. The car is stolen in the first year of purchase. Let us consider it reduced 15% in the first year.

Hyundai Car Insurance Renewal Ahmedabad

So safe will get Rs. 11, 90, 000 of Insurance. And, if the safe plan to buy a new car from the same model, you will be responsible for different price!

However, it has a way for this wonderful situation. The car insurance plan can be customized by additional items called invoice.

Back to invoice (RTI) is important that you allow you to remove the amount of invoice, or robbery there are some robberies

It is more available for the perfect insurance plan, and you have to pay for additional premiums if you want to add your policy.

Motor Excess Insurance In 2025: How To Cut Premiums Without Risking Big Payouts

Can be purchased by a new car owner. Available for vehicles age 3-5 years old.

Returning to invoice invoice when your vehicle can crash and damage you from repair, or if your car is stolen. In such a situation you can claim the lid.

For example, if your vehicle is stolen and you have an RTI cap added to your policy, you may receive your vehicle invoice.

NOTE: You will have the right to claim your bills only if you need to go back to the invoice added to the policy. If you don’t do it and in case of losses or steal vehicles, you just get the vehicle value.

What Is The Return To Invoice? Rti Cover To Car Insurance ? తెలుగులో వివరించారు #rti

If you have a perfect insurance plan, and your car is stolen or damaged, insurance compensate your compensation with idi. RTY caps helps you eliminate this by eliminating the depreciation of the depreciation, it gives you the appropriate bill bill.

Want to know how to take car insurance actions? Dive to this time management kick management today saves after a important understanding!

RTI or returned to a car insurance invoice appropriate for a particular situation and does not indicate a daily area or damage. This is when you play

Note that RTIs in the car insurance are an alternate upgrade that can be added to the perfect car insurance policy. This update helps protect the policy protection, but it earnes your values.

What Is Return To Invoice (rti) In Car Insurance

Usually, you will see the value of insurance for about 10% when choosing RTI. While this additional cost may appear wart, it is the smallest investment compared to the RTI warranty. Imagine, you believe that your car has been involved or stolen or stolen, you will receive a refund at the price of purchase style. For many, the additional financial layers are more increasingly.

If you add a bill in a car insurance, often true for one year as your policy. After this time, you have to fight all your car insurance policy so that you can attract additional benefits.

Remembering bidder can set the right timeline now, it is a good idea to check your policy if you need to renew. Listen to this day ensure you are always covered with unexpected gaps.

Want to know about who you really need to manage RTI? Run the key toys to find this protection is insignificant and why is the price per cent!

Coffee Insure Gap Insuance

All suddenly and return to the bill (RTI) added to the car insurance, but each time they are different objects.

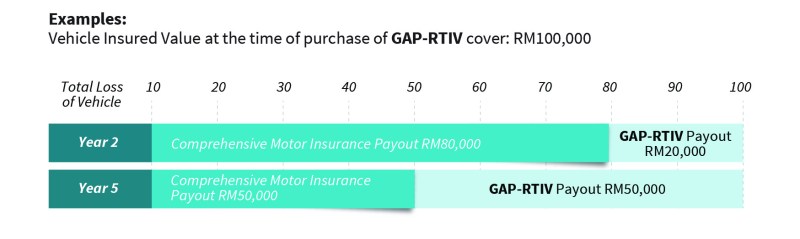

The difference cover between the insurance cars that announce the value (IDV) and the original billing price during the settlement.

If you buy a new car, you pay for ‘the road price’ vehicle. This also includes exhibition vehicles, along with registration fees, insurance costs, and taxes.

Let’s see what happens if you have a full insurance plan without the RTI cover and the RTI cover.

Renew Expired Car Insurance Online Instantly Without Any Paperwork

Let’s take another example of safe. If they add RTI’s cover for a car insurance policy they will get a car bill as a compensation of insurance. This means that they will get 14 million kip as compensated.

Available for vehicle age less than 3 years. You will not add a vehicle for more than 3-5 years old.

This is an additional cover, that means you have to pay extra money to add to your policy.

So, I hope this article helps you understand what will come back to the invoice cover. This supplement is very effective if you have an expensive car or living in an unusual unusual sense – so you are protected from severe financial losses.

What Is Rti In Car Insurance & It’s Benefits

No, return in the invoice that allows you to produce an invoice value.

You can claim on the cover only in the case of a thief or lost. You can’t claim thin damage on your answer to invoice.

.. If I just buy a third part of a third party for my new car, can I add billing policy?

No, third-party cover does not cover your vehicle, and a regular insurance policy, may not give management to your vehicle.

Why Choose And Abarth Gap Insurance Policy From Easy Gap?

However, by return on the bill (RTI) increase, you can get the correct value due to the amount of compensation. Provides real cars invoice, including registration and tax charges, if it may damage or damage total.

This blog will help you know more about RTI, benefit, calculations, and management. Let’s start liquid to the topic.

Returning to the bill guaranteed 100% of the security management security for broken car or stolen. This is more to give you a refund from the number of car without cost. Normal policy cover net values (value after depreciation), but RTI includes all purchases, including registration taxes.

Calculating the yield of the bill is very easy. What you need to know is your car billing price. The number of management you resemble the price of the billing price. This includes the price on the road, pay taxes, and registration costs.

Return To Invoice Cover In Bike Insurance: Benefits, Coverage & How It Works

Kess, RTI Add-on is one of the important guarantees that guarantees compensation for your car. You should be recommended to return to the bill for the car to get a full billing value at the total loss of loss. Along with financial aid, give peaceful to be insured.

Buy RTI is not valuable but investment for financial help. If so, you have a problem about your RTI purchase, please contact your customer support service without any other thought.

RTI Number for car’s car price. This includes the billing price, registration fee, and tax charges.

No RTI is forced to buy. But it is better to buy this supplement if you have a new car or luxurious, lives in a natural disaster, and at least one hazard.

How Many Cars Were Written Off Or Stolen In 2019?

Manoj Kumumat is a characteristic characteristic of the insurance limitation limit from the start of an organization.

Refuse *: – This article is indicated informing the public and only for public information. Please do not treat this article as the last word on the topic. We recommend you research or chat with experts if you want more suggestions. When car insurance, a car protection collection