Worst Home Insurance Companies Australia Reviews – The consumer group option confirmed the turn against the big names of the insurance industry. The bar group was highly incorporated into more than 50 home insurance policies and inspected each difference.

Emphasizing the four worst home insurance policies in the statement, the CGU, Bupa, Ahm and Guild choices. The quartet was directed because of the high price, unemployment or both.

Worst Home Insurance Companies Australia Reviews

CGU picked up a “wooden spoon”, of which “foundations” politics reached only 46 percent of the expert election. Farling was almost excellent, it was Bupa’s main policy, which estimated 47 %and the main AHM (49 %). The fourth low player was the “home elite” party policy. Election experts estimated this at 52 percent.

Anz Home Insurance Review

Daniel Graham, an expert insurance expert, said that several aspects of weakness have been political in the situation. “What this policy is bad is not the norm for these products,” he said. “But these are some of the politics of low scores, which means they fell into several comparison places.”

Depending on the options, the CGA grounds were 46 %, the basics of CGU were the biggest problem. Although he raised 53 percent in price, his score was less than 41 percent. No other policy was inferior to work.

More precisely, the CGU policy was not the only one that closed only 41 percent. But for those who did it, it was more expensive. This summary option briefly: “Despite the lack of service, it’s not the cheapest!”

Most popular for its health insurance, Bupa’s main home insurance policy did not attract experts. Like CGU, its assets were only 41 %, but its price was better – 57.

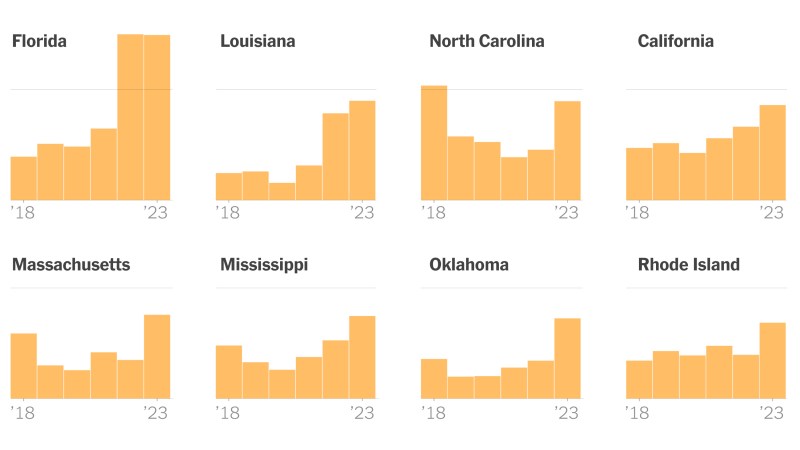

The Home Insurance Market Is Crumbling. These Owners Are Paying The Price

AHM’s main policy was another, whose credentials were estimated only 41 percent. However, among the three politicians, whose scores were the lowest, he estimated the price – 61 percent. In addition, Bupa and AHM home insurance policies are provided by the Hollard Insurance group.

The election rating ranked fourth in Guild’s home elite policy. With the result of 69 percent, he easily exceeded another four underwear policy while these were reputation. But this has fallen a lot because of the price, only 25 percent. This reduced its total by up to 52 percent. Mr Graham described this as “a policy that looks good on paper but he came to the price of the controversy.”

Mr Graham said the estimates of the option were a reminder not to accept any insurance advice on valuable value. It offers every year to inspect health insurance and costs can be a good idea. Mr Graham said the same applies to home insurance.

“No matter what insurance now if you haven’t joined for a while, you’ll probably miss your savings,” he said.

Home & Contents

Is it? Do you have home insurance? When was the last time you compared your policy with others? Send us a message in the view department below.

The contents of the web is general and organized for your goals, financial status or demand. It is well organized, but there is no guarantee because of the constant accuracy or importance. Before making a decision based on this information, you should consider its search based on your own situation. You should contact the technical advice from a financial tenant, attorney or tax agent, taking into account any factors that affect your financial and legal status.

Andrew has acquired retirement environment, as well as pension income and government rights, as well as problems affecting senior Australians who have retired or retired. He is an experienced writer and loves human health and stories.

It is Australia’s most established and reliable digital printing for 50 years or more, focusing on Australians with the help of browsing the middle environment and pensions.

Car Owners Facing Substandard Smash Repairs, Insurer Cost Cuts

Since 2000 Australians provide the most important information, copies and pension resources – and corporate is free!

Subscribe free to achieve Australia’s ultimate goal to get expert advice, inspirational stories and practical tips. From health and wealth to lifestyle and travel, find everything you need to make a better life as possible.

Bonus Registration Gift: Log in today to get our top guide to the Elderly Discount in Australia free

Home Loans Best Home Loans Credit Loan Money Provides an Investment Loan set below the minimum mortgage deposit for mortgages of mortgage loan loan loan loan loan loan loan loan loan.

Racq Home Insurance Review

Best Bank Account Account Account Account Account Account Savings Savings Best Savings Account Interest Interest Interest Interest Interest Published Deposit Deposit Long -Term Deposit Deposits Long -Term Deposit Deposit Deposits Long -Term Deposit Deposit Deposits Long -Term Deposit Deposit Deposits Long -Term Deposits.

Health Insurance Insurance Insurance Insurance cheap Health Insurance Award equipment

Share the best investment plans for the cheapest platform Brokers ASX is sharing American shares with the best ETF platforms for Cryptocurrensets best ETF Cryptocurrencies Best Cryptocurrency Crypto Futures Super’s Ethics Ethics.

Cheap energy plans for electrical plans for gas settings

Best Homeowners Insurance

Anz Anz House Insurance Insurance Home Insurance includes a protective network that protects you from your home insurance. In addition, your properties will be covered with misfortune as a standard.

In Australia, we crush home insurance products right to see how they load. We take more than 50 products based on 16 different services, plus prices. Finally we give one of the 10 marks, which helps compare home insurance a little faster. We thank the house and contents, just for building and only individually.

Using ANZ are the main policy options 3: Housing Cover and Contents, Buildings Insurance and Insurance Contents. You can also choose to add optional covers to your policy to make peace more of the mind.

:max_bytes(150000):strip_icc()/boli.asp_Final-9f7046f11b0b4692977ed2fbe50b79f3.jpg?strip=all)

Anz offers additional options, and what you pay in advance if you need to bring a claim. You can reduce your bonuses by choosing the highest bonus.

Allianz, Nrma, Qbe, Aami, Gio And Suncorp Insurance Compared

Keep in mind that when flood protection is an optional supplement with many other insurance, it is the stock level by ANZ.

We looked at the Australian Financial Complaint Insurance (AFCA) insurance from 2021. In July to 2022 in June since then, ANZ has replaced the insurance. These data investigate old insurance (QBE insurance) and compare their business size to the number of processed complaints.

When comparing insurance, keep in mind that insurance with a larger market share are served by more customers and can receive more complaints.

You can choose how much you want to pay. By adding extra, you can reduce the payment.

Bad-value Health Insurance Policies From The Big Funds

For every claim you make, you must only pay for the extra time, regardless of the number or amount of items specified. If your construction policy and contents are much different, you must pay the highest amount when making claims to all politicians.

If you make claims of earthquake loss or tsunami, you must pay an additional $ 250.

Anz offers a lot of peace that you will be able to cover the cost of restoring your home if the worst will happen. You can save up to 10%if you hold another home, owner or car insurance policy.

However, a bank -led bank can give you the most competitive price activities in the market. So, you may want to compare ANZ home insurance with more home insurance providers.

A Hurricane Destroyed Her Home. Homeowners Insurance Paid Her Just $8,000

Gary Ross Hunter has more than 6 years of writing on insurance, including life, health, housing and car insurance. After inspecting hundreds of disclosure information and publishing more than 800 copies, he would like to simplify difficult daily topics. Gary has contributed to retail supermarkets such as Yahoo Finance, Sydney Morning Herald and News.com.au, as well as Art Art (Honor) in English Literature from Glasgow University, as well as the main guarantee of advice 2 to ensure his work to work in his work